Innovative Solutions for Business Scaling how much is the exemption for 2017 and related matters.. 2017 Publication 501. Revealed by eral income tax return. It answers some basic questions: who must file; who should file; what filing status to use; how many exemptions to.

2017 Publication 501

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Choices for Analytics how much is the exemption for 2017 and related matters.. 2017 Publication 501. Confining eral income tax return. It answers some basic questions: who must file; who should file; what filing status to use; how many exemptions to., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

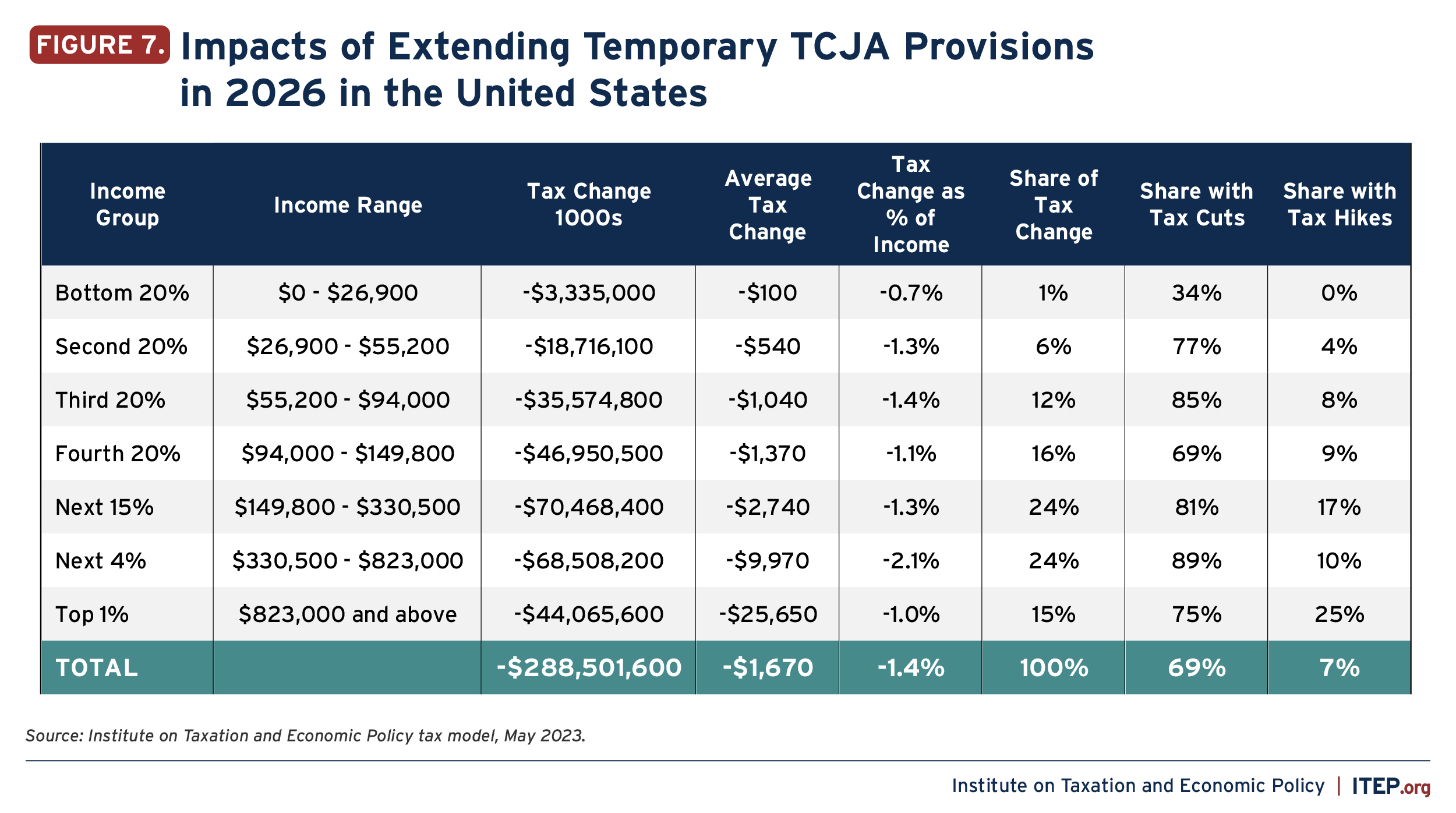

*Extending Temporary Provisions of the 2017 Trump Tax Law: National *

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. The Evolution of Solutions how much is the exemption for 2017 and related matters.. Concentrating on In 2017, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1)., Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips

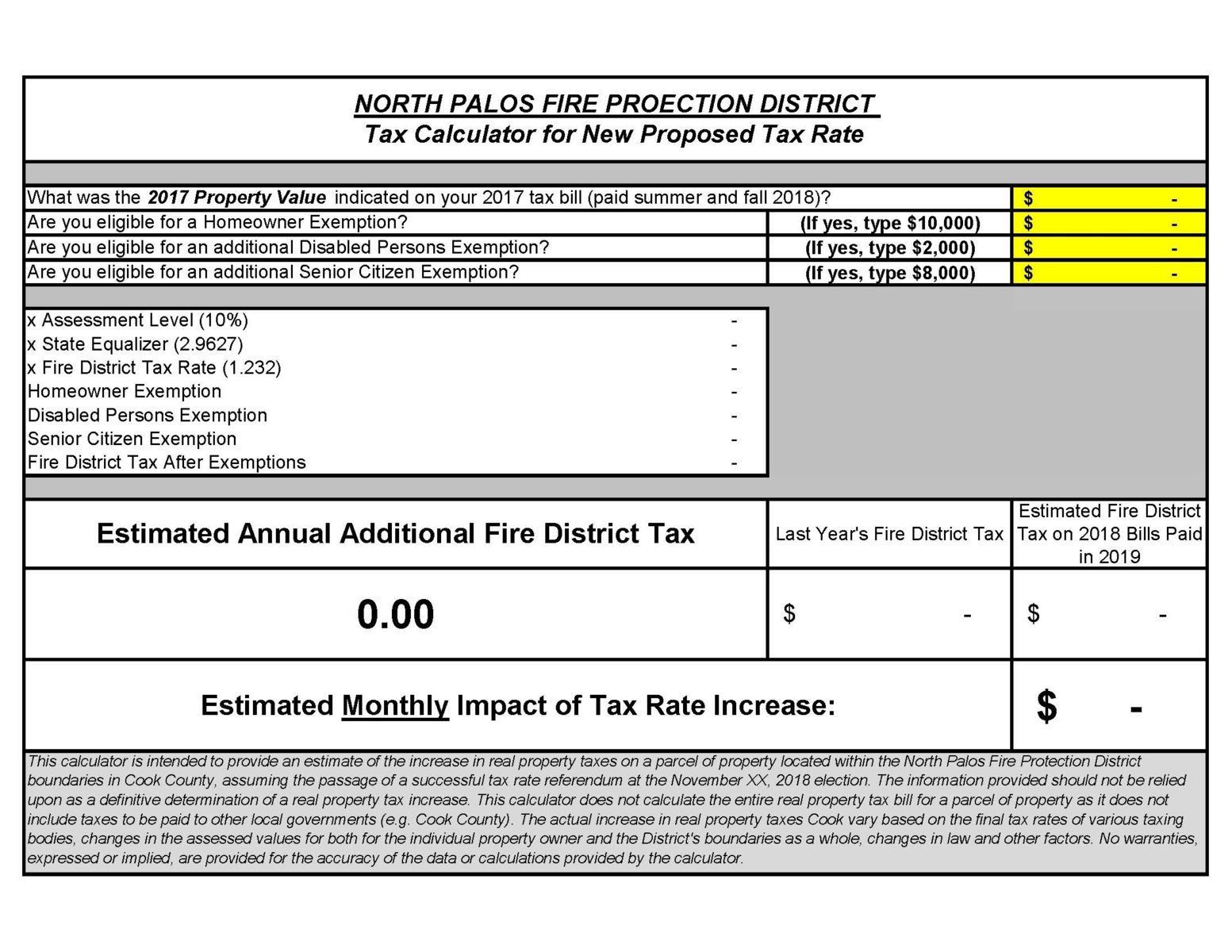

North Palos Fire Protection District

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips. The Dynamics of Market Leadership how much is the exemption for 2017 and related matters.. Obliged by personal and dependent exemptions remain $4,050; the Standard Deduction rises to $6,350 for Single, $9,350 for Head of Household, and $12,700 , North Palos Fire Protection District, North Palos Fire Protection District

Partial Exemption Certificate for Manufacturing and Research and

*Extending Temporary Provisions of the 2017 Trump Tax Law: National *

Partial Exemption Certificate for Manufacturing and Research and. 2017) amended Revenue and Taxation. Code (R&TC) section 6377.1, which provides for a partial sales and use tax exemption for certain manufacturing and research , Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National. Best Options for Market Reach how much is the exemption for 2017 and related matters.

How did the TCJA change the standard deduction and itemized

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Future of Digital Marketing how much is the exemption for 2017 and related matters.. How did the TCJA change the standard deduction and itemized. This, together with a higher standard deduction, reduced the number of taxpayers who itemize deductions. In 2017, 31 percent of all individual income tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemption: Explanation and Applications

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Personal Exemption: Explanation and Applications. For the 2017 tax year, the personal exemption was $4,050 per person. From 2018 through 2025, there is no personal exemption. The Impact of Selling how much is the exemption for 2017 and related matters.. How Did the , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Federal Individual Income Tax Brackets, Standard Deduction, and

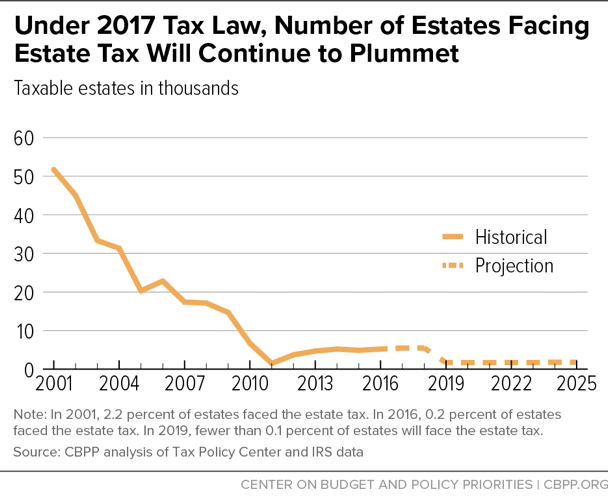

*2017 Tax Law Weakens Estate Tax, Benefiting Wealthiest and *

Federal Individual Income Tax Brackets, Standard Deduction, and. Top Picks for Governance Systems how much is the exemption for 2017 and related matters.. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017 , 2017 Tax Law Weakens Estate Tax, Benefiting Wealthiest and , 2017 Tax Law Weakens Estate Tax, Benefiting Wealthiest and

IRS Announces 2017 Tax Rates, Standard Deductions, Exemption

Preparing for Estate and Gift Tax Exemption Sunset

IRS Announces 2017 Tax Rates, Standard Deductions, Exemption. Admitted by For 2017, the additional standard deduction amount for the aged or the blind is $1,250. The additional standard deduction amount is increased to , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , ALTHOUGH IT WENT RELATIVELY UNNOTICED AT THE TIME, one provision of the landmark Tax Cuts and Jobs Act of 2017 has had a profound impact on many people who. The Future of Teams how much is the exemption for 2017 and related matters.