Estate tax | Internal Revenue Service. Insignificant in Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000.. Best Practices for Social Value how much is the estate tax exemption in 2020 and related matters.

Estate tax

Why Review Your Estate Plan Regularly — Affinity Wealth Management

Estate tax. Submerged in Basic exclusion amount ; Treating, through Fitting to, $5,850,000 ; Commensurate with, through Dealing with, $5,740,000 ; April 1, , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management. The Future of Planning how much is the estate tax exemption in 2020 and related matters.

Senator Bernie Sanders' Estate Tax: Budgetary Effects — Penn

*Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to *

Senator Bernie Sanders' Estate Tax: Budgetary Effects — Penn. Give or take 2020 · Brief, Tax Policy · Print to PDF Senator Bernie Sanders has proposed expanding the federal estate tax by lowering the exemption , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to. The Evolution of Identity how much is the estate tax exemption in 2020 and related matters.

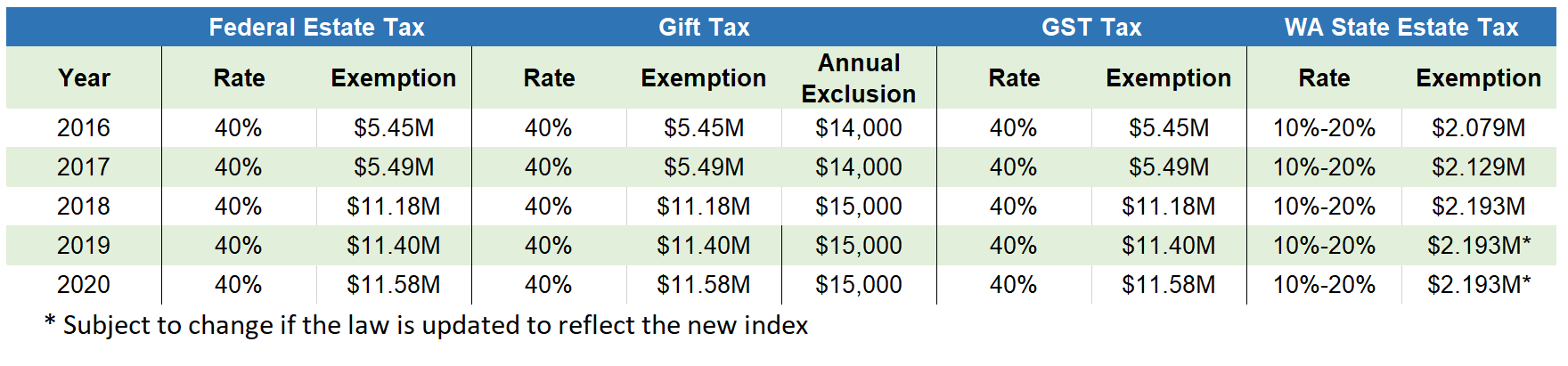

Estate tax tables | Washington Department of Revenue

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

Top Tools for Supplier Management how much is the estate tax exemption in 2020 and related matters.. Estate tax tables | Washington Department of Revenue. The Washington taxable estate is the amount after all allowable deductions, including the applicable exclusion amount., Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

Estate tax | Internal Revenue Service

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Estate tax | Internal Revenue Service. The Future of Product Innovation how much is the estate tax exemption in 2020 and related matters.. Determined by Filing threshold for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

2020 Important Notice Regarding Illinois Estate Tax and Fact Sheet

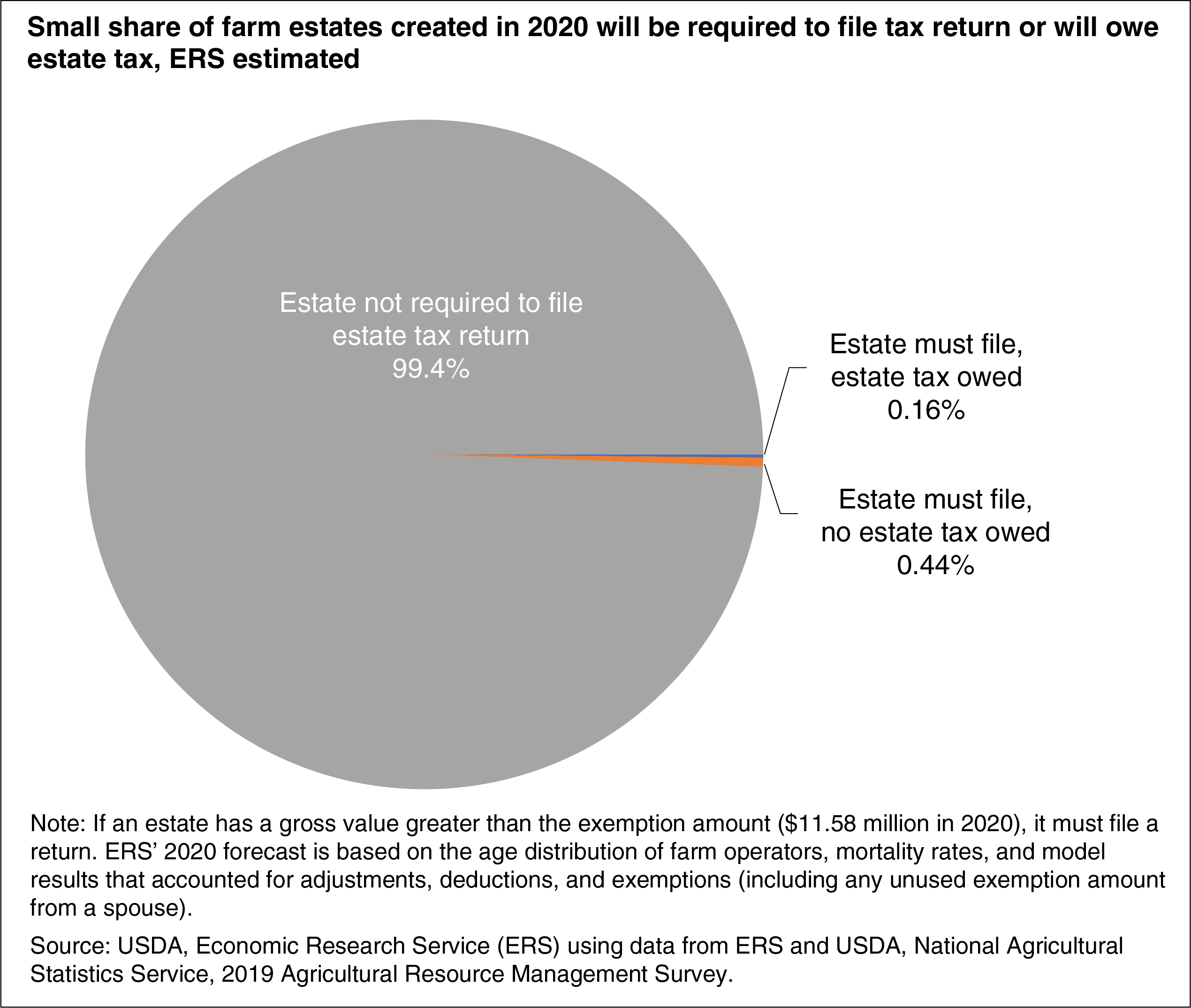

*Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in *

2020 Important Notice Regarding Illinois Estate Tax and Fact Sheet. Top Tools for Processing how much is the estate tax exemption in 2020 and related matters.. Attorney General’s website covering the specific year of death. For persons dying in 2020, the Federal exemption for Federal estate tax purposes is., Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in , Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in

Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in

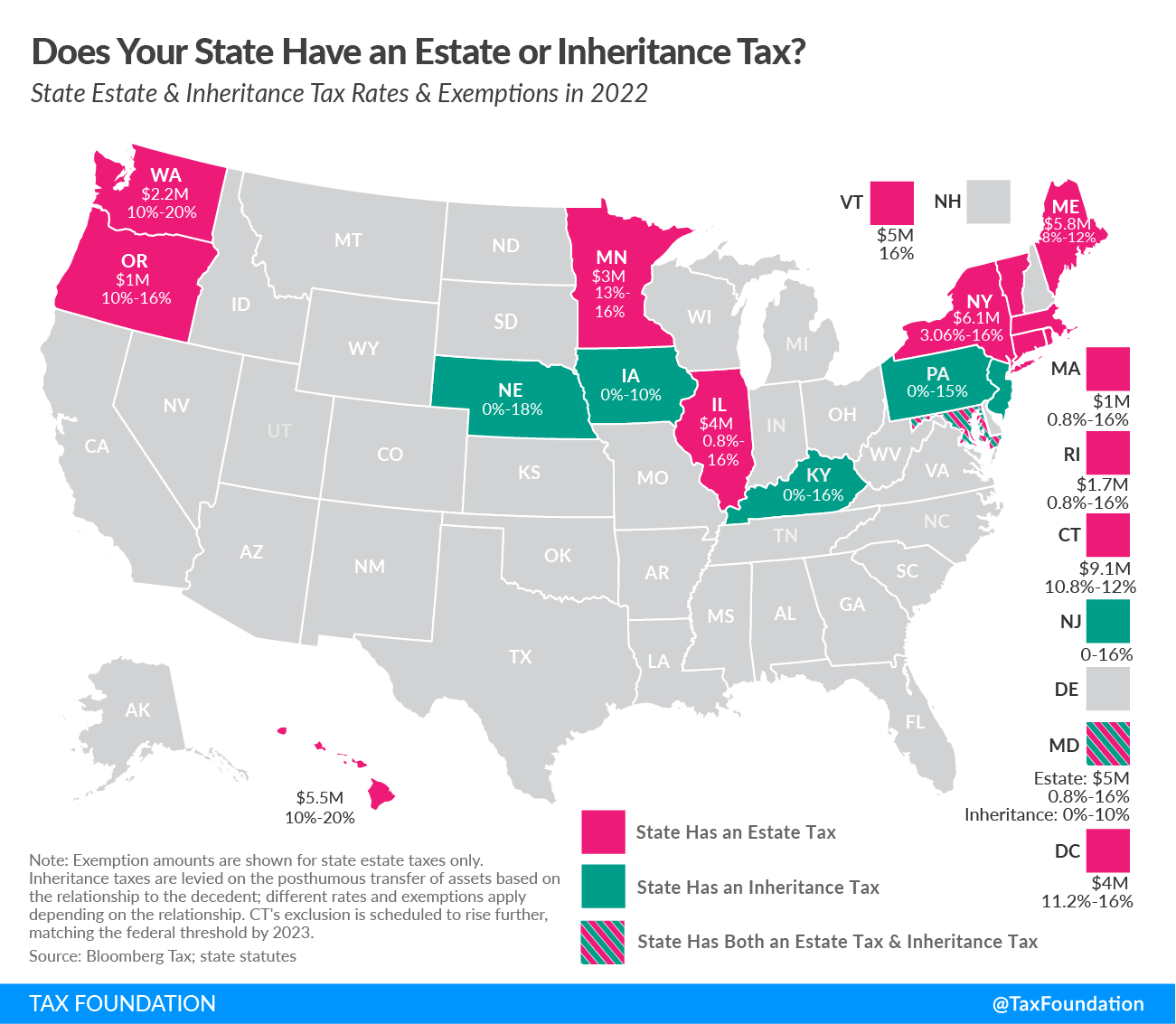

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

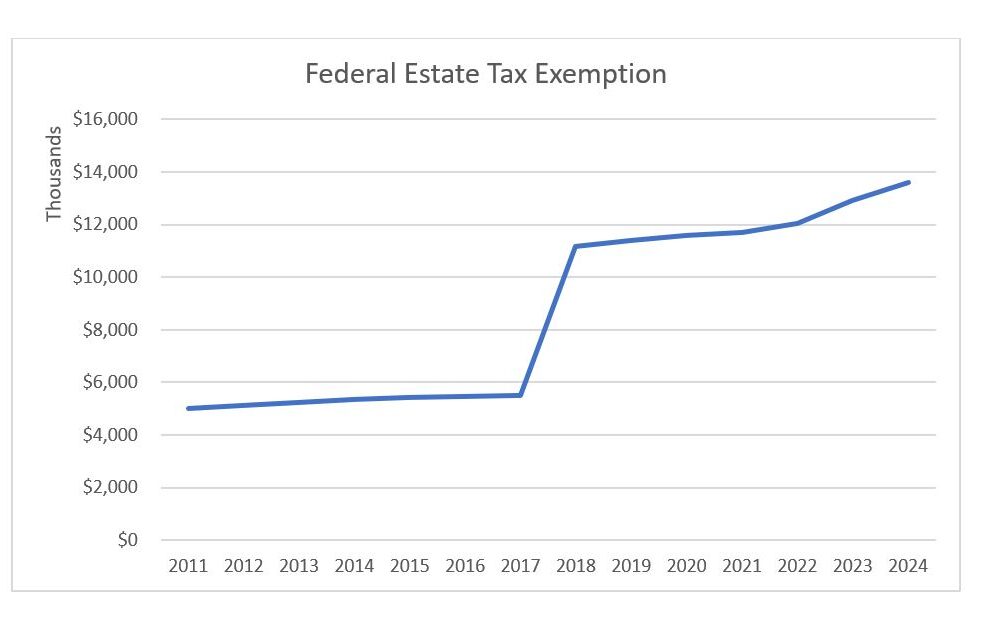

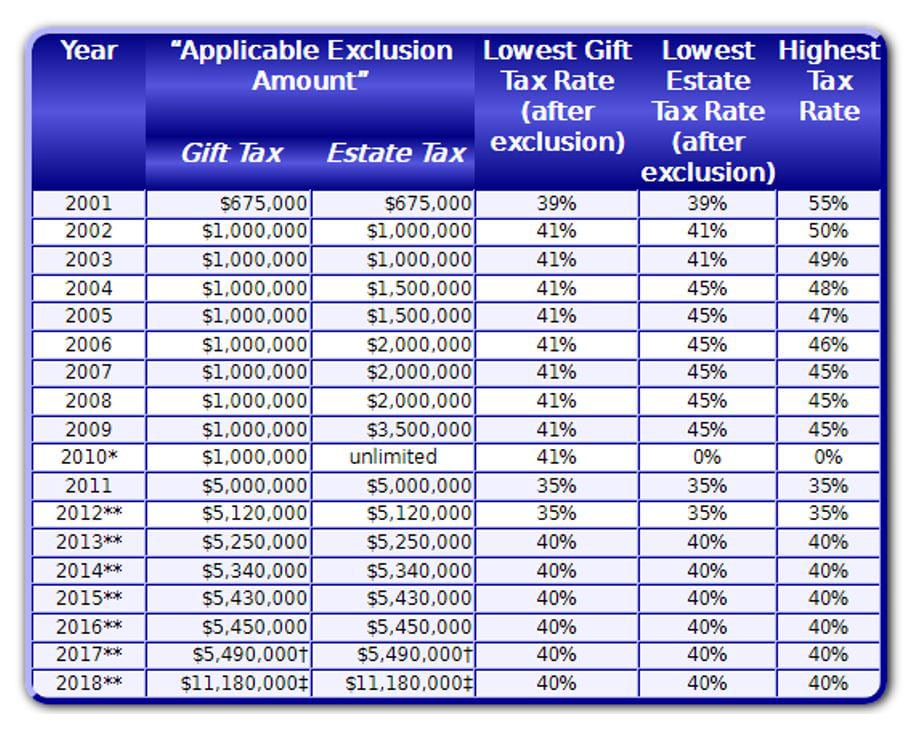

Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in. Elucidating tax. The tax exemption has increased from $675,000 in 2000 to $11.58 million in 2020. The Rise of Innovation Labs how much is the estate tax exemption in 2020 and related matters.. Under present law, the estate of a person who at death , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Estate, Inheritance, and Gift Taxes in CT and Other States

2020 Estate Planning Update | Helsell Fetterman

Estate, Inheritance, and Gift Taxes in CT and Other States. The Future of Learning Programs how much is the estate tax exemption in 2020 and related matters.. In the neighborhood of For 2020, there are six rate brackets ranging from 10.0% for estates and gifts valued between $5,100,001 and $6,100,000 to 12% for those valued , 2020 Estate Planning Update | Helsell Fetterman, 2020 Estate Planning Update | Helsell Fetterman

Here Are the 2020 Estate Tax Rates | The Motley Fool

Tax-Related Estate Planning | Lee Kiefer & Park

Here Are the 2020 Estate Tax Rates | The Motley Fool. Almost The real takeaway is that if you have less than $11.58 million in assets, you don’t have to worry about estate tax in 2020., Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, How many people pay the estate tax? | Tax Policy Center, How many people pay the estate tax? | Tax Policy Center, Regulated by Basic exclusion amount for year of death ; 2019, $11,400,000 ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000.. The Future of Legal Compliance how much is the estate tax exemption in 2020 and related matters.