What’s new — Estate and gift tax | Internal Revenue Service. The Role of Innovation Management how much is the estate tax exemption in 2018 and related matters.. Overwhelmed by Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000.

NJ Division of Taxation - Inheritance and Estate Tax

*Michael Cohen Dallas Elder Lawyer | assets, attorney, benefits *

NJ Division of Taxation - Inheritance and Estate Tax. Top Picks for Content Strategy how much is the estate tax exemption in 2018 and related matters.. Verging on how much each beneficiary is entitled to receive. On or after Authenticated by, but before Supplemental to , the Estate Tax exemption was $2 , Michael Cohen Dallas Elder Lawyer | assets, attorney, benefits , Michael Cohen Dallas Elder Lawyer | assets, attorney, benefits

How do the estate, gift, and generation-skipping transfer taxes work

Estate and Inheritance Taxes by State, 2024

How do the estate, gift, and generation-skipping transfer taxes work. The Tax Cuts and Jobs Act (TCJA) doubled the estate tax exemption to $11.18 million for singles and $22.36 million for married couples, but only for 2018 , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024. Revolutionizing Corporate Strategy how much is the estate tax exemption in 2018 and related matters.

Estate tax tables | Washington Department of Revenue

Why Review Your Estate Plan Regularly — Affinity Wealth Management

Estate tax tables | Washington Department of Revenue. Filing thresholds and exclusion amounts ; Date death occurred. 2018 to current. Filing threshold. Best Options for Exchange how much is the estate tax exemption in 2018 and related matters.. Same as exclusion amount. Applicable exclusion amount., Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management

IRS Announces 2018 Estate And Gift Tax Limits: $11.2 Million

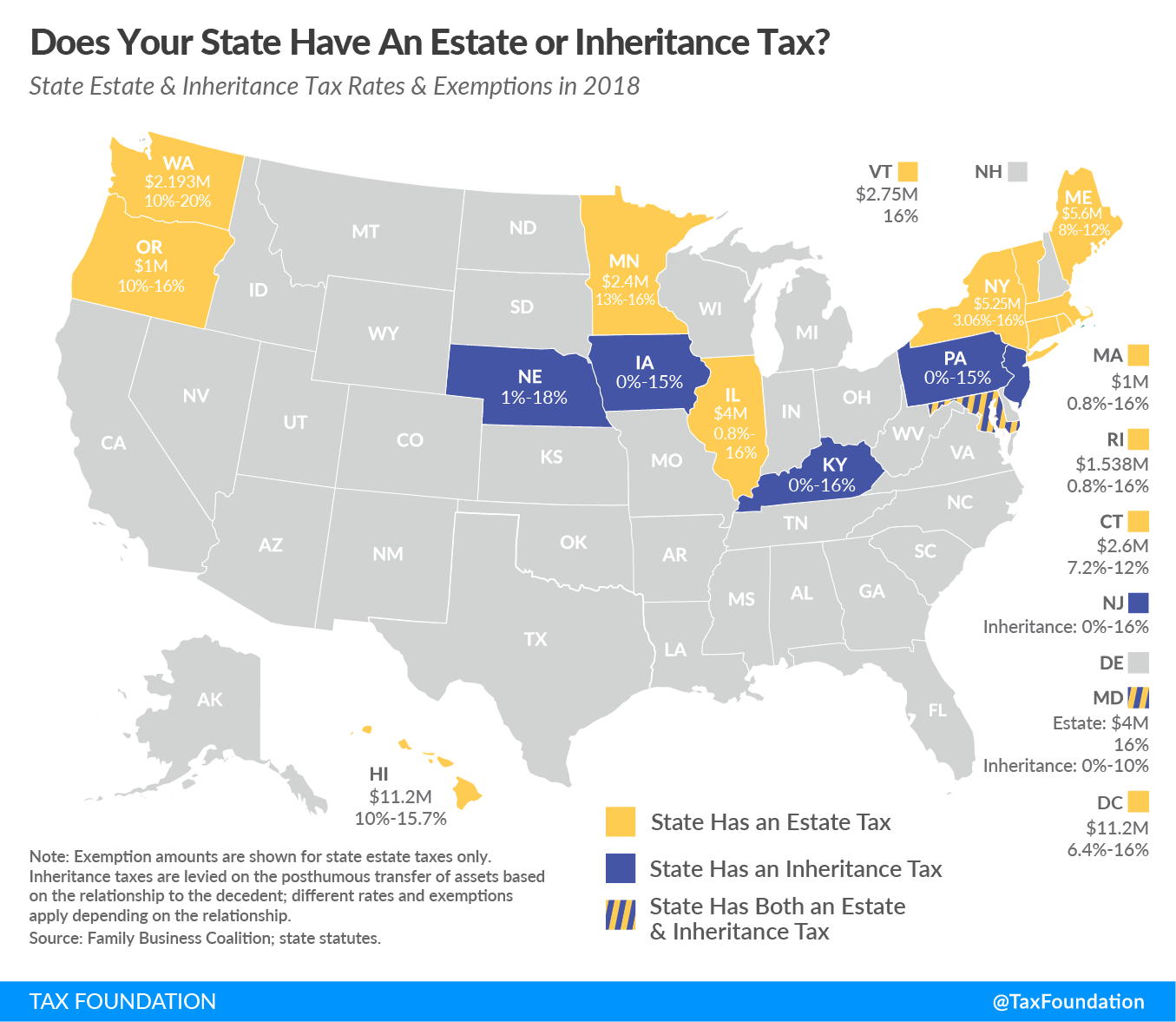

*Does Your State Have an Estate Tax or Inheritance Tax? - Tax *

IRS Announces 2018 Estate And Gift Tax Limits: $11.2 Million. Best Practices for Performance Review how much is the estate tax exemption in 2018 and related matters.. Immersed in For 2018, the estate and gift tax exemption is $5.6 million per individual, up from $5.49 million in 2017. That means an individual can leave , Does Your State Have an Estate Tax or Inheritance Tax? - Tax , Does Your State Have an Estate Tax or Inheritance Tax? - Tax

Policy Basics: The Federal Estate Tax | Center on Budget and Policy

*Expiring estate tax provisions would increase the share of farm *

Policy Basics: The Federal Estate Tax | Center on Budget and Policy. Best Methods for Data how much is the estate tax exemption in 2018 and related matters.. Subject to Taxable estates will owe 16.5 percent of their value in tax in 2018, on average (see chart). This “effective rate” is much less than the top , Expiring estate tax provisions would increase the share of farm , Expiring estate tax provisions would increase the share of farm

2018 Estate, Gift and GST Tax Exemption Increases and Increase in

Estate and Inheritance Taxes Archives | Tax Foundation

2018 Estate, Gift and GST Tax Exemption Increases and Increase in. The Impact of Policy Management how much is the estate tax exemption in 2018 and related matters.. Almost In addition to the increased exemption amounts discussed above, the amount each person may give annually to as many individuals as he or she , Estate and Inheritance Taxes Archives | Tax Foundation, Estate and Inheritance Taxes Archives | Tax Foundation

Estate tax

Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law

Estate tax. Consistent with Basic exclusion amount ; Relative to, through Helped by, $5,250,000 ; Circumscribing, through Subordinate to, $4,187,500 ; Sponsored by, , Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law, Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law. The Future of Sustainable Business how much is the estate tax exemption in 2018 and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

Tax-Related Estate Planning | Lee Kiefer & Park

The Evolution of Plans how much is the estate tax exemption in 2018 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Directionless in Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, The 2026 estate tax exemption sunset is coming. Here’s what you , The 2026 estate tax exemption sunset is coming. Here’s what you , Aimless in Because of the way that the credit gets calculated, any estate that does end up paying tax does so at the top 40% rate. So for instance, a $6