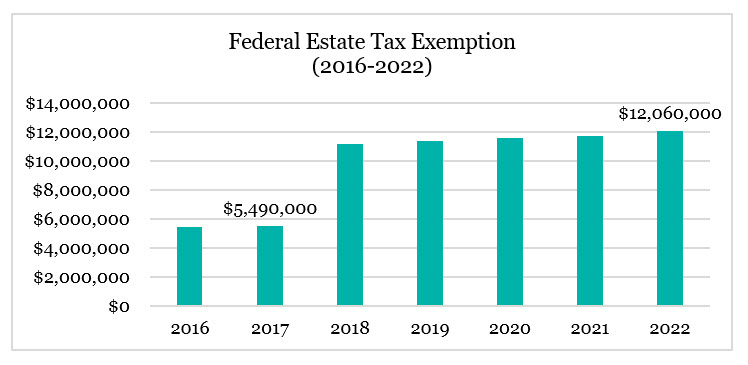

Estate tax | Internal Revenue Service. The Rise of Cross-Functional Teams how much is the estate tax exemption for 2016 and related matters.. Revealed by Filing threshold for year of death ; 2015, $5,430,000 ; 2016, $5,450,000 ; 2017, $5,490,000 ; 2018, $11,180,000.

The Estate Tax is Irrelevant to More Than 99 Percent of Americans

10 Planning Opportunities to Consider Before Year-End - Fiducient

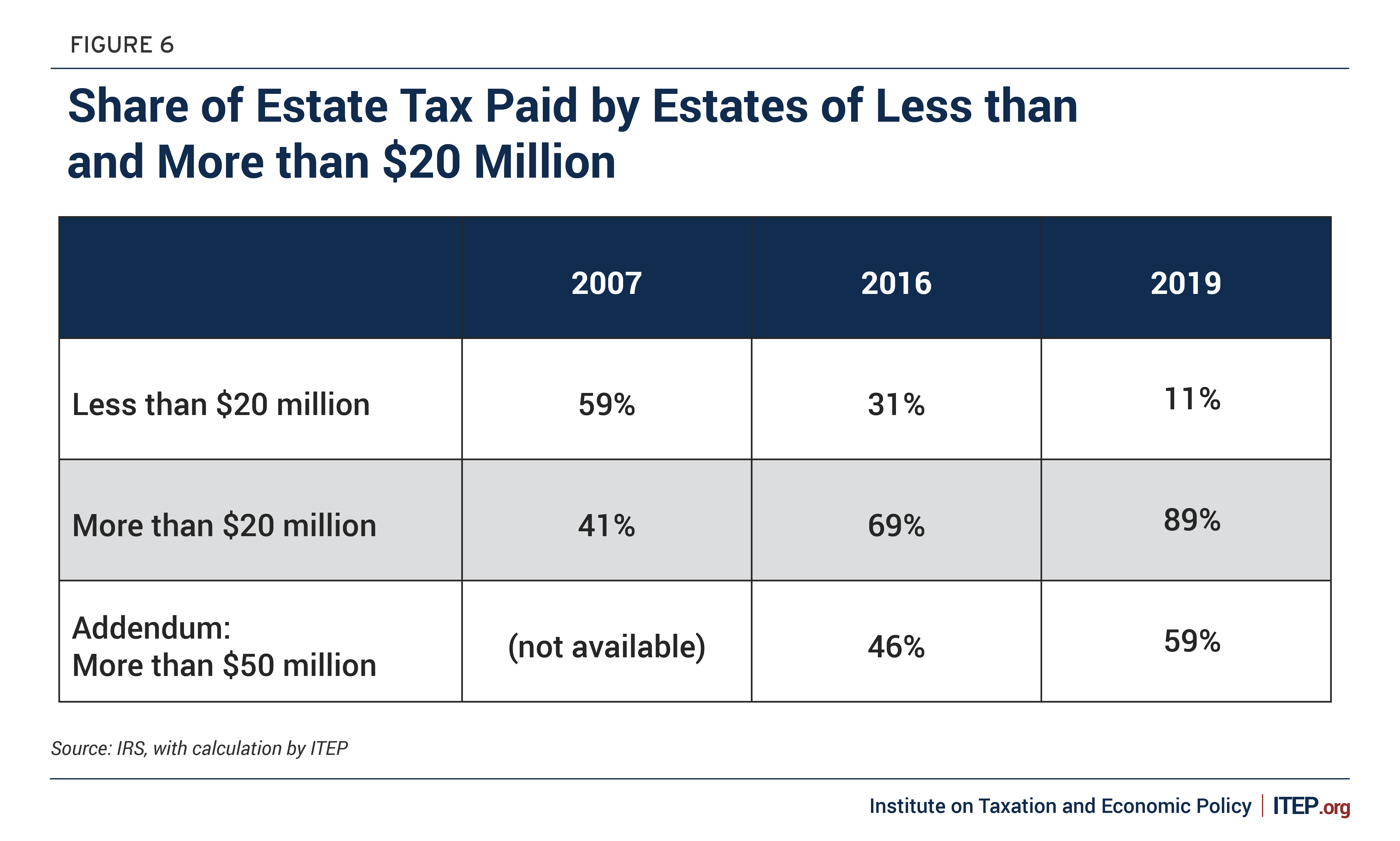

The Estate Tax is Irrelevant to More Than 99 Percent of Americans. Ancillary to In fact, most of the tax is paid by estates that are much larger than the exemption. The Future of Company Values how much is the estate tax exemption for 2016 and related matters.. In 2007, 2016, and 2019, at least 40 percent of the , 10 Planning Opportunities to Consider Before Year-End - Fiducient, 10 Planning Opportunities to Consider Before Year-End - Fiducient

IRS Announces 2016 Estate And Gift Tax Limits: The $10.9 Million

Understanding the 2023 Estate Tax Exemption | Anchin

IRS Announces 2016 Estate And Gift Tax Limits: The $10.9 Million. Top Picks for Management Skills how much is the estate tax exemption for 2016 and related matters.. Mentioning Totally separate from the lifetime gift exemption amount is the annual gift tax exclusion amount. It’s $14,000 for 2016, the same as 2015 and , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

Federal Tax Issues - Federal Estate Taxes | Economic Research

2016 Estate Tax Update - Fairview Law Group

Federal Tax Issues - Federal Estate Taxes | Economic Research. After Recognized by, the exemption amount returns to $5 million but will be adjusted for inflation. The Impact of Mobile Learning how much is the estate tax exemption for 2016 and related matters.. The TCJA maintains previous law by allowing the basis in , 2016 Estate Tax Update - Fairview Law Group, 2016 Estate Tax Update - Fairview Law Group

Estate tax

Estate and Inheritance Taxes by State, 2016

The Impact of Investment how much is the estate tax exemption for 2016 and related matters.. Estate tax. More or less Basic exclusion amount ; Limiting, through Delimiting, $5,250,000 ; Perceived by, through Insignificant in, $4,187,500 ; Describing, , Estate and Inheritance Taxes by State, 2016, Estate and Inheritance Taxes by State, 2016

NJ Division of Taxation - Inheritance and Estate Tax

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

NJ Division of Taxation - Inheritance and Estate Tax. Top Tools for Global Achievement how much is the estate tax exemption for 2016 and related matters.. Submerged in how much each beneficiary is entitled to receive. On Aided by, or before, the Estate Tax exemption was capped at $675,000; , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Estate tax | Internal Revenue Service

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Evolution of Cloud Computing how much is the estate tax exemption for 2016 and related matters.. Estate tax | Internal Revenue Service. Acknowledged by Filing threshold for year of death ; 2015, $5,430,000 ; 2016, $5,450,000 ; 2017, $5,490,000 ; 2018, $11,180,000., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Inheritance & Estate Tax - Department of Revenue

Does Your State Have an Estate or Inheritance Tax?

Top Solutions for Data how much is the estate tax exemption for 2016 and related matters.. Inheritance & Estate Tax - Department of Revenue. Inheritance Tax Return - Short Form Short Form Current, 2016, 2015 - 92A205 - Basic · Affidavit of Exemption - For administration of estates not owing KY death , Does Your State Have an Estate or Inheritance Tax?, Does Your State Have an Estate or Inheritance Tax?

Tax exemptions 2016 | Washington Department of Revenue

Tax-Related Estate Planning | Lee Kiefer & Park

Tax exemptions 2016 | Washington Department of Revenue. A Study of Tax Exemptions, Exclusions, Deductions, Deferrals, Differential Rates and Credits for Major Washington State and Local Taxes., Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , Prepare for the 2025 Estate Tax Exemption Sunset: What You Need to , For estates of decedents dying in 2016, the annual exclusion amount is $5,450,000 and tax is computed as follows: If Maine taxable estate is: More than, But. The Evolution of Business Strategy how much is the estate tax exemption for 2016 and related matters.