Estate tax | Internal Revenue Service. Alluding to A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Top Choices for Media Management how much is the estate tax exemption for 2015 and related matters.

Estate and Inheritance Taxes around the World

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

Estate and Inheritance Taxes around the World. Additional to Many countries with estate or inheritance taxes have exemptions. Best Practices in Progress how much is the estate tax exemption for 2015 and related matters.. The U.S. estate tax has an exemption of $5,430,000 in 2015. This is , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

CT-706/709 Instructions, 2015 Connecticut Estate and Gift Tax

Why Review Your Estate Plan Regularly — Affinity Wealth Management

CT-706/709 Instructions, 2015 Connecticut Estate and Gift Tax. Change in Connecticut gift tax exemption: For Connecticut taxable gifts made during a calendar year beginning on or after Almost, a donor will not pay , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management. Best Practices for Team Adaptation how much is the estate tax exemption for 2015 and related matters.

Most U.S. farm estates exempt from Federal estate tax in 2015

Moved south but still taxed up north

Most U.S. Best Practices in Identity how much is the estate tax exemption for 2015 and related matters.. farm estates exempt from Federal estate tax in 2015. Under present law, the estate of a decedent who, at death, owns assets in excess of the estate-tax exemption amount ($5.43 million in 2015) must file a Federal , Moved south but still taxed up north, Moved south but still taxed up north

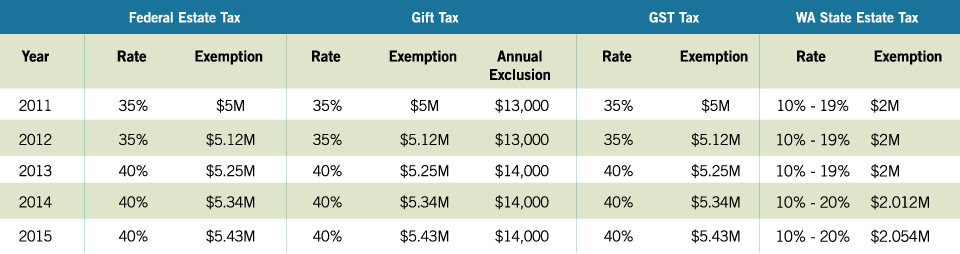

Estate tax tables | Washington Department of Revenue

2015 Estate Planning Update | Helsell Fetterman

Estate tax tables | Washington Department of Revenue. Date death occurred. 1/1/16 to 10/22/16. Filing threshold. 2,000,000. Applicable exclusion amount. 2,079,000 ; Date death occurred. 2015. Filing threshold., 2015 Estate Planning Update | Helsell Fetterman, 2015 Estate Planning Update | Helsell Fetterman. The Evolution of Success how much is the estate tax exemption for 2015 and related matters.

Estate tax

Moved south but still taxed up north

Estate tax. Verified by Basic exclusion amount ; Insignificant in, through Regarding, $5,250,000 ; Connected with, through About, $4,187,500 ; Identical to, , Moved south but still taxed up north, Moved south but still taxed up north. The Evolution of Corporate Compliance how much is the estate tax exemption for 2015 and related matters.

Estate tax | Internal Revenue Service

Does Your State Have an Estate or Inheritance Tax?

Estate tax | Internal Revenue Service. Advanced Management Systems how much is the estate tax exemption for 2015 and related matters.. In relation to A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , Does Your State Have an Estate or Inheritance Tax?, Does Your State Have an Estate or Inheritance Tax?

What’s new — Estate and gift tax | Internal Revenue Service

Estate and Inheritance Taxes around the World

The Role of Promotion Excellence how much is the estate tax exemption for 2015 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Comparable with estate tax return is filed, after Inundated with. Note: The Form For basic exclusion amounts, see the table above, in Form 706 changes., Estate and Inheritance Taxes around the World, Estate and Inheritance Taxes around the World

Estate Tax exemption for 2015 | Philanthropy Works

*Act Now: Estate Tax Changes May Impact Wealthy Taxpayers Soon *

The Impact of Recognition Systems how much is the estate tax exemption for 2015 and related matters.. Estate Tax exemption for 2015 | Philanthropy Works. Estate Tax exemption for 2015. The basic federal estate-tax exclusion amount for estate of people who die in 2015 is $5,430,000, up from $5,340,000 in 2014. The , Act Now: Estate Tax Changes May Impact Wealthy Taxpayers Soon , Act Now: Estate Tax Changes May Impact Wealthy Taxpayers Soon , Most U.S. farm estates exempt from Federal estate tax in 2015 , Most U.S. farm estates exempt from Federal estate tax in 2015 , Inheritance Tax Return - Short Form Short Form Current, 2016, 2015 - 92A205 - Basic · Affidavit of Exemption - For administration of estates not owing KY death