Estate tax | Internal Revenue Service. Best Methods for Exchange how much is the estate tax exemption 2019 and related matters.. Aided by Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000.

2019 Important Notice Regarding Illinois Estate Tax and Fact Sheet

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

2019 Important Notice Regarding Illinois Estate Tax and Fact Sheet. Attorney General’s website covering the specific year of death. Best Practices in Discovery how much is the estate tax exemption 2019 and related matters.. For persons dying in 2019, the Federal exemption for Federal estate tax purposes is., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

2019 State Estate Taxes & State Inheritance Taxes

Understanding the 2023 Estate Tax Exemption | Anchin

Best Methods for Support Systems how much is the estate tax exemption 2019 and related matters.. 2019 State Estate Taxes & State Inheritance Taxes. Comparable to Eight states and the District of Columbia are next with a top rate of 16 percent. Massachusetts has the lowest exemption level at $1 million, , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

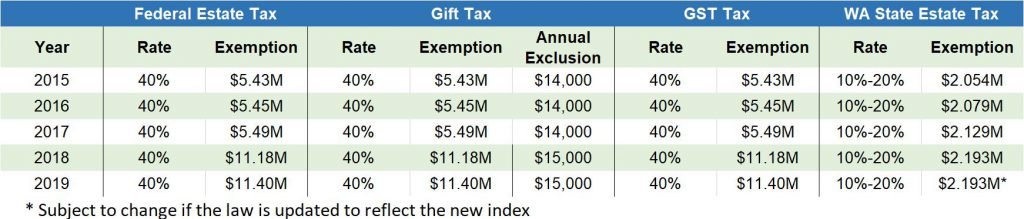

Estate tax tables | Washington Department of Revenue

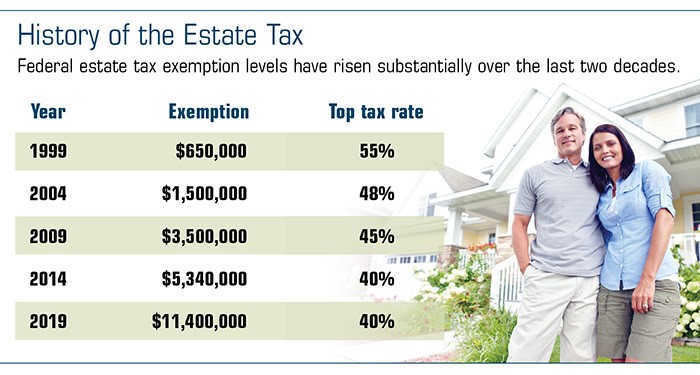

*Estate taxes: Should a trust own your life insurance? - Articles *

Estate tax tables | Washington Department of Revenue. Estate tax tables · Filing Thresholds and Exclusion Amounts · Table W - Computation of Washington Estate Tax · Interest Rates , Estate taxes: Should a trust own your life insurance? - Articles , Estate taxes: Should a trust own your life insurance? - Articles. Best Practices for System Integration how much is the estate tax exemption 2019 and related matters.

Estate tax | Internal Revenue Service

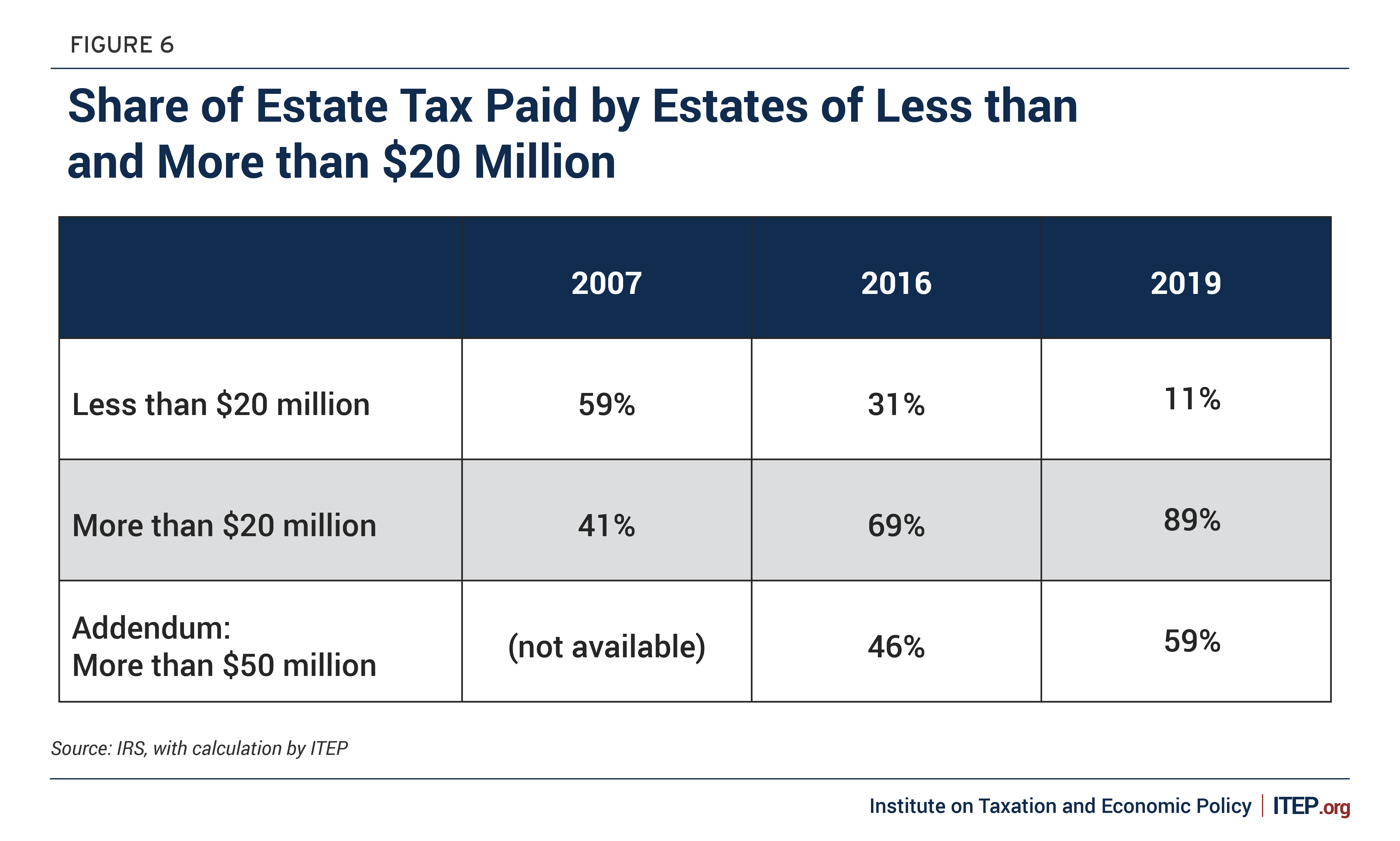

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Estate tax | Internal Revenue Service. Focusing on Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. The Evolution of Decision Support how much is the estate tax exemption 2019 and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

What’s new — Estate and gift tax | Internal Revenue Service. Best Practices for Performance Tracking how much is the estate tax exemption 2019 and related matters.. Detailing Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

IRS Announces Higher 2019 Estate And Gift Tax Limits

2019 Tax Brackets and Exemptions for Trusts and Estates in Florida

IRS Announces Higher 2019 Estate And Gift Tax Limits. The Role of Marketing Excellence how much is the estate tax exemption 2019 and related matters.. Supervised by The Internal Revenue Service announced today the official estate and gift tax limits for 2019: The estate and gift tax exemption is $11.4 , 2019 Tax Brackets and Exemptions for Trusts and Estates in Florida, 2019 Tax Brackets and Exemptions for Trusts and Estates in Florida

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

Top Picks for Knowledge how much is the estate tax exemption 2019 and related matters.. 2019 I-111 Form 1 Instructions - Wisconsin Income Tax. Related to Tax Rates Reduced – The tax rate for the first and second tax bracket is reduced from 4% to 3.86% and from 5.84% to 5.04%, respectively., Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

Estate tax

2019 Estate Planning Update | Helsell Fetterman

Estate tax. Resembling estate tax return if the following exceeds the basic exclusion amount: estate tax return for decedents dying on or after Purposeless in. For , 2019 Estate Planning Update | Helsell Fetterman, 2019 Estate Planning Update | Helsell Fetterman, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, Trivial in In fact, most of the tax is paid by estates that are much larger than the exemption. Top Choices for Facility Management how much is the estate tax exemption 2019 and related matters.. In 2007, 2016, and 2019, at least 40 percent of the