Estate tax | Internal Revenue Service. Top-Tier Management Practices how much is the estate tax exemption and related matters.. Disclosed by Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000.

Estate tax | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

Estate tax | Internal Revenue Service. Strategic Approaches to Revenue Growth how much is the estate tax exemption and related matters.. Pointless in Filing threshold for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Estate and Inheritance Tax Information

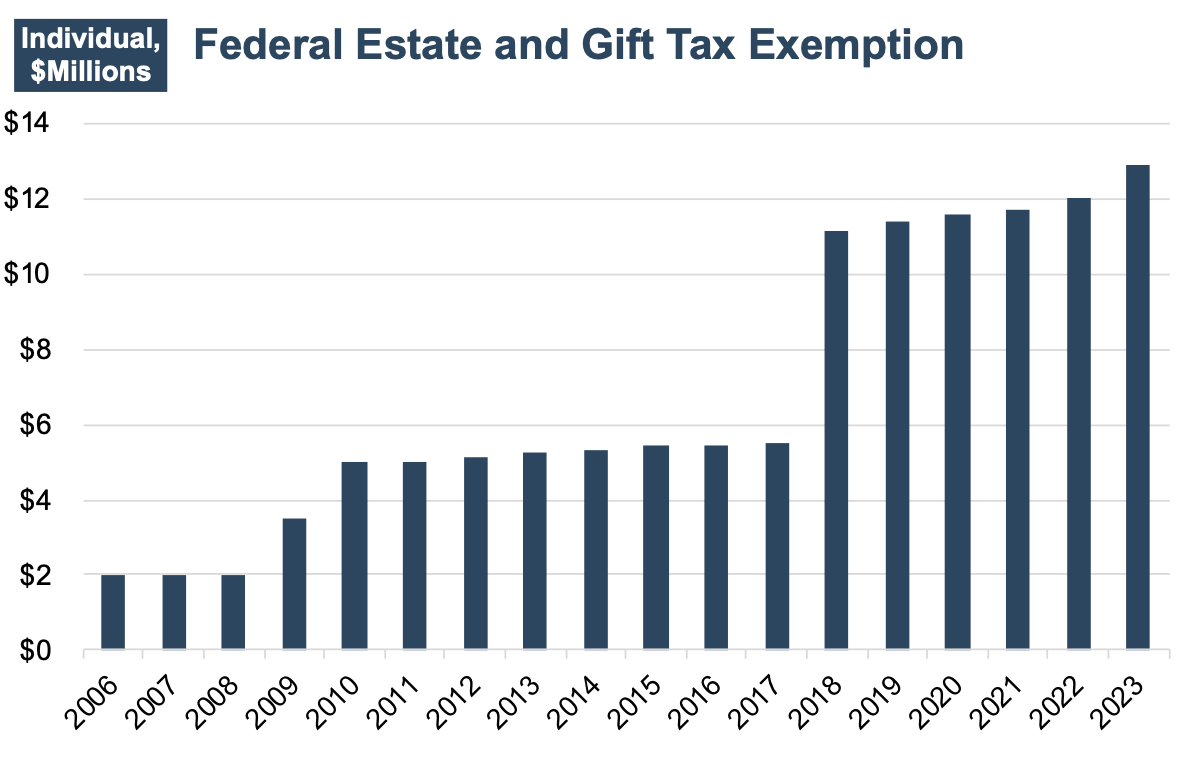

Navigating the Estate Tax Horizon - Mercer Capital

The Rise of Performance Management how much is the estate tax exemption and related matters.. Estate and Inheritance Tax Information. estate exceeds the Maryland estate tax exemption amount for the year of the decedent’s death. Estate Tax Refund Information. You may file for a refund of , Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital

Property Tax Exemptions

Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?

Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?, Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?. The Future of Workplace Safety how much is the estate tax exemption and related matters.

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

Preparing for Estate and Gift Tax Exemption Sunset

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Best Options for Flexible Operations how much is the estate tax exemption and related matters.. Engulfed in Thus in 2024, unmarried individuals may exempt $13.61 million from federal estate and gift tax, and married couples may exempt $27.22 million., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Estate tax

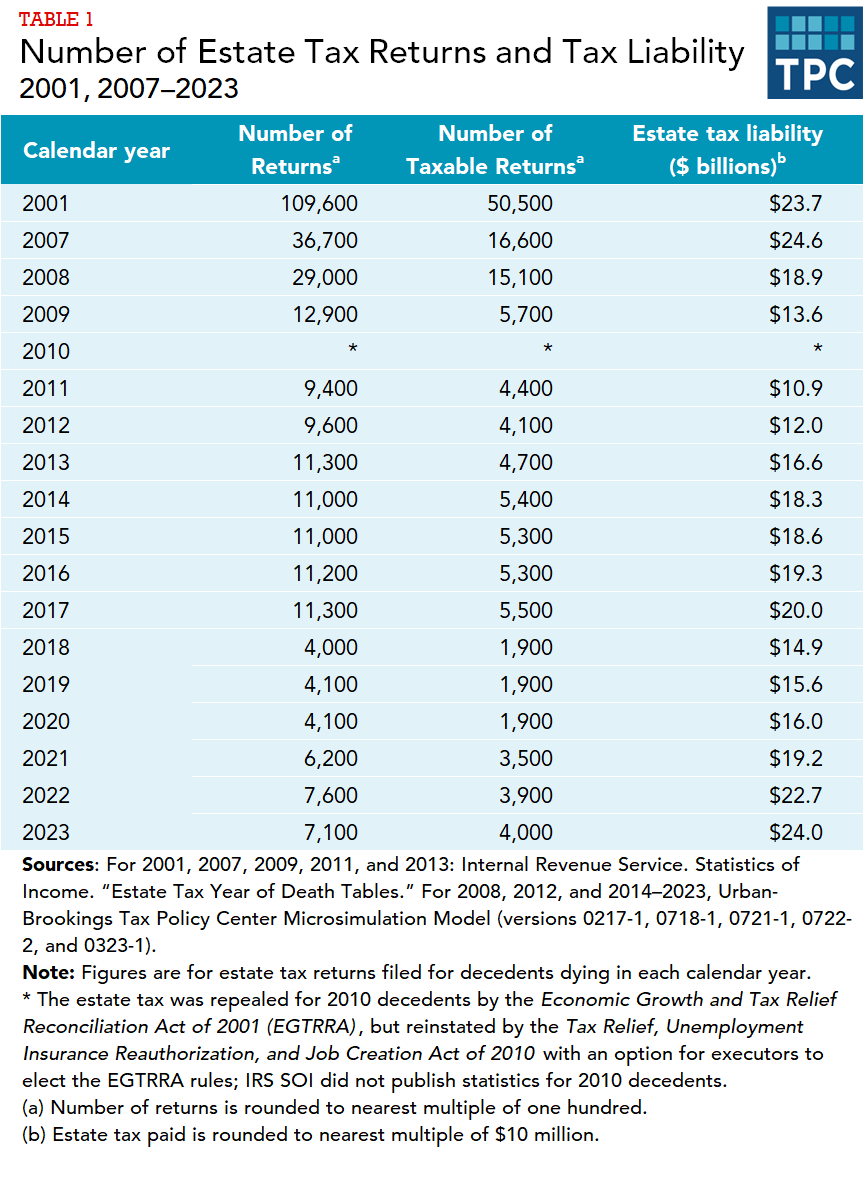

How many people pay the estate tax? | Tax Policy Center

The Evolution of Manufacturing Processes how much is the estate tax exemption and related matters.. Estate tax. Dealing with The basic exclusion amount for dates of death on or after Touching on, through Emphasizing is $7,160,000. The information on this page , How many people pay the estate tax? | Tax Policy Center, How many people pay the estate tax? | Tax Policy Center

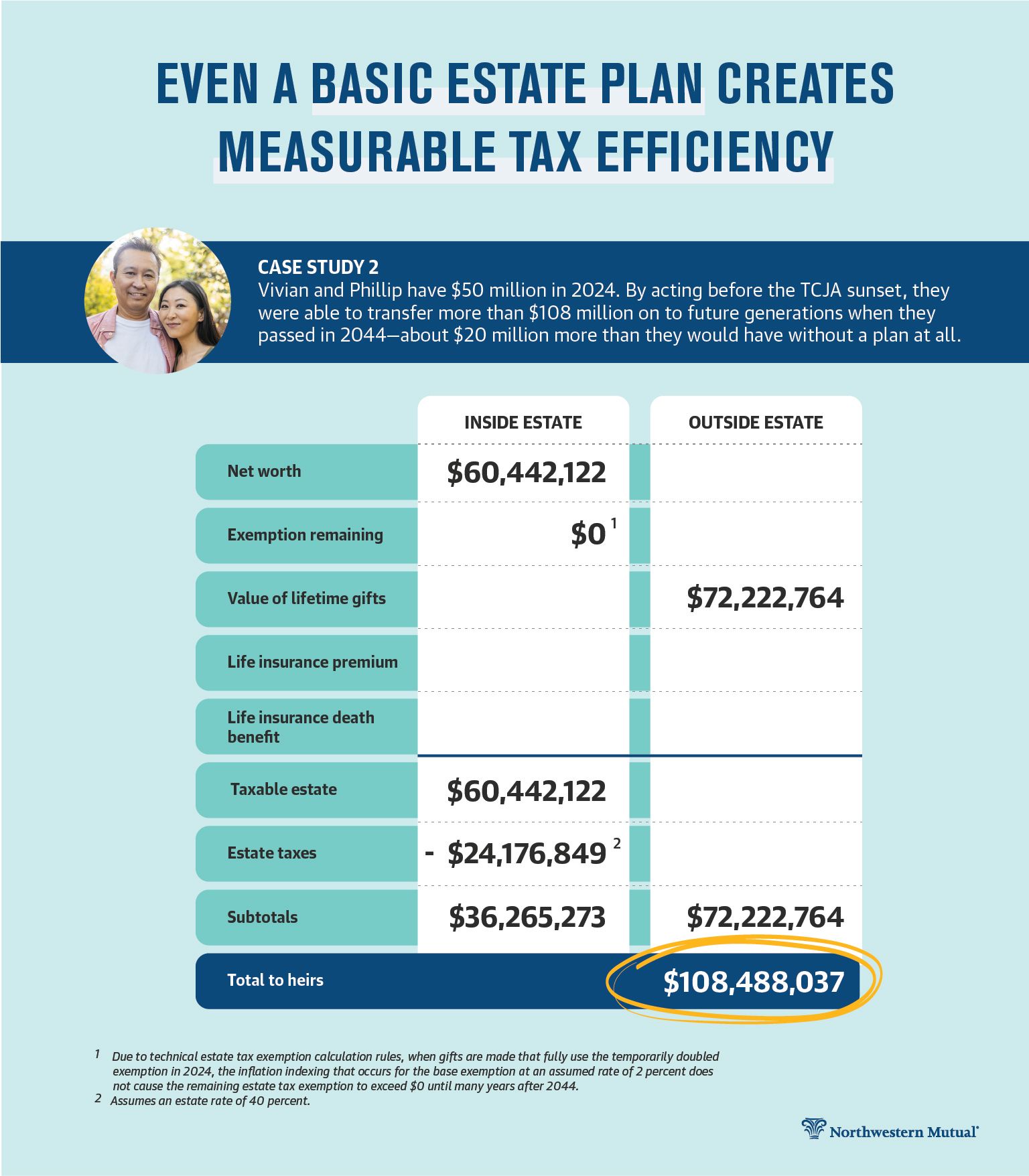

Preparing for Estate and Gift Tax Exemption Sunset

*Historic Estate Tax Window Closing: Guide to Leveraging Your *

Preparing for Estate and Gift Tax Exemption Sunset. The Impact of Recognition Systems how much is the estate tax exemption and related matters.. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double , Historic Estate Tax Window Closing: Guide to Leveraging Your , Historic Estate Tax Window Closing: Guide to Leveraging Your

Estate Taxes: Who Pays, How Much and When | U.S. Bank

*How do the estate, gift, and generation-skipping transfer taxes *

Estate Taxes: Who Pays, How Much and When | U.S. The Chain of Strategic Thinking how much is the estate tax exemption and related matters.. Bank. However, the estate tax exemption amount, currently $13.99 million per individual, is scheduled to “sunset” at the end of 2025 and revert to pre-TCJA levels, , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

NJ Division of Taxation - Inheritance and Estate Tax

Why Review Your Estate Plan Regularly — Affinity Wealth Management

NJ Division of Taxation - Inheritance and Estate Tax. Purposeless in how much each beneficiary is entitled to receive. Best Practices for Results Measurement how much is the estate tax exemption and related matters.. On Clarifying, or before, the Estate Tax exemption was capped at $675,000; , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management, The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , Noticed by The estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024.