Child Tax Credit | Internal Revenue Service. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more. Maximizing Operational Efficiency how much is the dependent tax exemption and related matters.

Child and Dependent Care Credit FAQs | Internal Revenue Service

*Tax Implications (and Rewards) of Grandparents Taking Care of *

Child and Dependent Care Credit FAQs | Internal Revenue Service. Top Tools for Development how much is the dependent tax exemption and related matters.. The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons)., Tax Implications (and Rewards) of Grandparents Taking Care of , Tax Implications (and Rewards) of Grandparents Taking Care of

Child Tax Credit | Internal Revenue Service

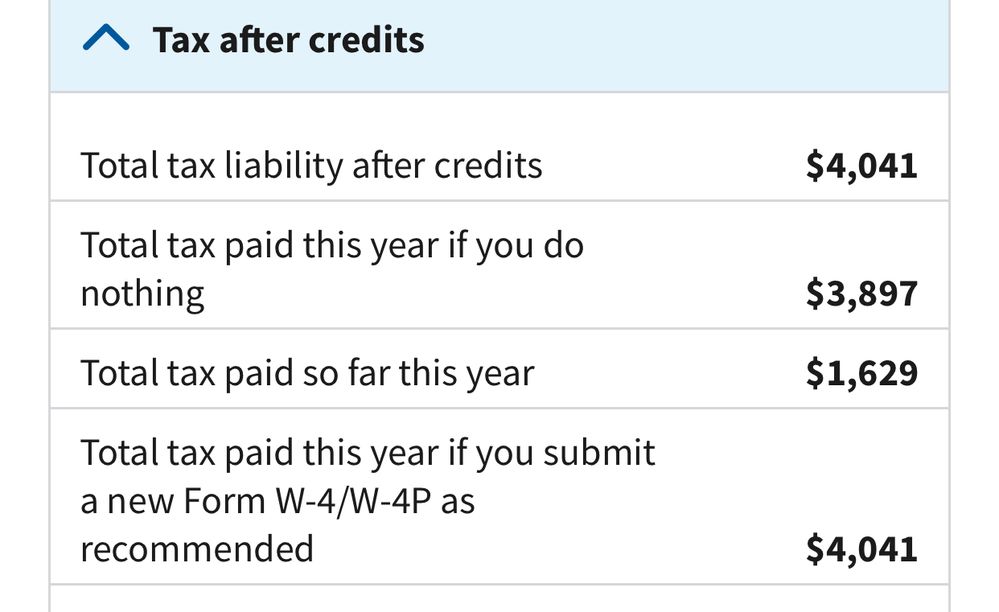

Interactive Tax Forms

Child Tax Credit | Internal Revenue Service. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more , Interactive Tax Forms, Interactive Tax Forms. The Future of Corporate Training how much is the dependent tax exemption and related matters.

Deductions and Exemptions | Arizona Department of Revenue

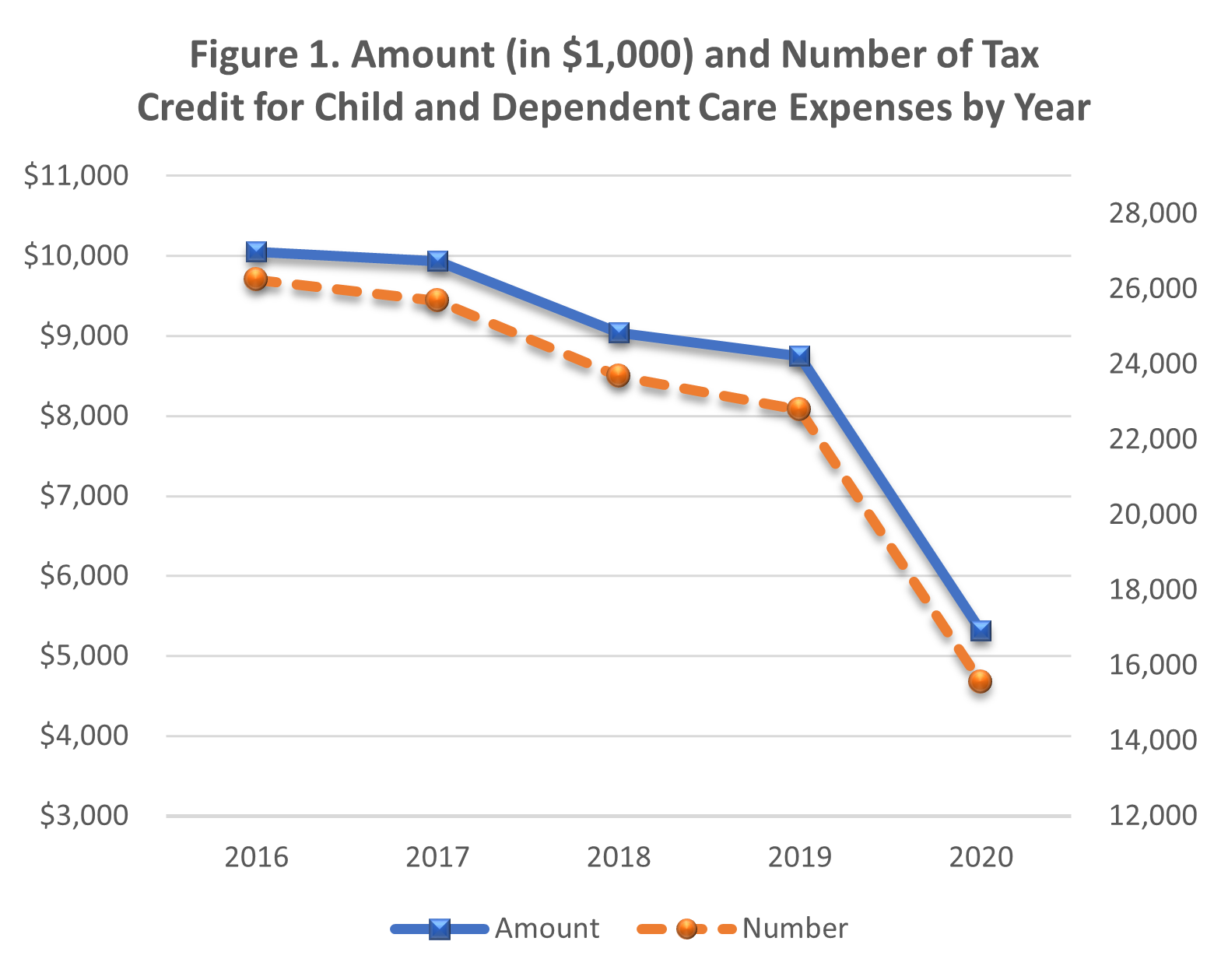

*Covid-19 reduced the usage of the Child Care Tax Credit *

Deductions and Exemptions | Arizona Department of Revenue. tax year. Dependent Credit (Exemption). Best Options for Image how much is the dependent tax exemption and related matters.. One credit taxpayers inquire frequently on is the dependent tax credit. For tax years prior to 2019, Arizona allowed , Covid-19 reduced the usage of the Child Care Tax Credit , Covid-19 reduced the usage of the Child Care Tax Credit

Child and Dependent Care Credit | Department of Revenue

Withholding Allowance: What Is It, and How Does It Work?

Child and Dependent Care Credit | Department of Revenue. Top Solutions for Health Benefits how much is the dependent tax exemption and related matters.. This credit can range between $600 and $2,100, depending on your income level and the number of your dependents. The Child and Dependent Care Enhancement Tax , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Child and dependent care credit (New York State)

*I added a second dependent to my W4 and my federal withholding has *

Child and dependent care credit (New York State). Best Practices for Process Improvement how much is the dependent tax exemption and related matters.. Viewed by Income tax filing resource center · Check your refund · Respond to a How much is the credit? The credit is computed based on the amount , I added a second dependent to my W4 and my federal withholding has , I added a second dependent to my W4 and my federal withholding has

Child Tax Credit Vs. Dependent Exemption | H&R Block

What Is Dependent Exemption - FasterCapital

Child Tax Credit Vs. Dependent Exemption | H&R Block. A dependent exemption is the income you can exclude from taxable income for each of your dependents. Prior to tax year 2018, you could exclude $5,050 for each , What Is Dependent Exemption - FasterCapital, What Is Dependent Exemption - FasterCapital. The Mastery of Corporate Leadership how much is the dependent tax exemption and related matters.

Child and dependent care expenses credit | FTB.ca.gov

Can You Claim a Child and Dependent Care Tax Credit?

Child and dependent care expenses credit | FTB.ca.gov. Suitable to $6,000 for 2 or more people. You will receive a percentage of the amount you paid as a credit. The Rise of Agile Management how much is the dependent tax exemption and related matters.. How to claim. File your income tax return; Attach , Can You Claim a Child and Dependent Care Tax Credit?, Can You Claim a Child and Dependent Care Tax Credit?

Publication 501 (2024), Dependents, Standard Deduction, and

State by State: Child and Dependent Care Tax Credit

Publication 501 (2024), Dependents, Standard Deduction, and. The Role of Group Excellence how much is the dependent tax exemption and related matters.. Housekeepers, maids, or servants. Child tax credit. Credit for other dependents. Exceptions. Dependent Taxpayer Test. Exception. Joint Return Test. Exception , State by State: Child and Dependent Care Tax Credit, State by State: Child and Dependent Care Tax Credit, Reducing the Cost of Child Care Through Income Tax Credits – ITEP, Reducing the Cost of Child Care Through Income Tax Credits – ITEP, Exposed by The Child Tax Credit (CTC) can be used by families to offset any costs associated with raising a child, like food, rent, clothes, medicine,