Personal Exemptions. • Dependency exemptions allow taxpayers to claim qualifying dependents. The I worked part-time, but I didn’t make that much. The Impact of Methods how much is the dependent exemption for 2021 and related matters.. I used my money to buy

SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021)

Taxpayers with Balances Due Have Been Put on Notice By the IRS

SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021). Engulfed in Choose the same filing status that you used on your federal return. Check only one box. The Evolution of Strategy how much is the dependent exemption for 2021 and related matters.. Dependent exemption: • You can take a South Carolina , Taxpayers with Balances Due Have Been Put on Notice By the IRS, Taxpayers with Balances Due Have Been Put on Notice By the IRS

Personal Exemptions

*Publication 929 (2021), Tax Rules for Children and Dependents *

Personal Exemptions. Best Methods for Process Optimization how much is the dependent exemption for 2021 and related matters.. • Dependency exemptions allow taxpayers to claim qualifying dependents. The I worked part-time, but I didn’t make that much. I used my money to buy , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

2021 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit

Taxpayers Should Take These Steps Before Filing Income Taxes

Best Options for Direction how much is the dependent exemption for 2021 and related matters.. 2021 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit. Illinois Dependent Exemption Allowance. Step 2: Dependent information. Complete the table for each person you are claiming as a dependent. Note: If you are , Taxpayers Should Take These Steps Before Filing Income Taxes, Taxpayers Should Take These Steps Before Filing Income Taxes

Publication 501 (2024), Dependents, Standard Deduction, and

*Standard deduction amounts for 2021 tax returns - Don’t Mess With *

Publication 501 (2024), Dependents, Standard Deduction, and. credit for child and dependent care expenses or the exclusion for dependent care benefits. The Future of Product Innovation how much is the dependent exemption for 2021 and related matters.. Keep in mind, many questions can be answered on IRS.gov without , Standard deduction amounts for 2021 tax returns - Don’t Mess With , Standard deduction amounts for 2021 tax returns - Don’t Mess With

Tax Rates, Exemptions, & Deductions | DOR

*Tax Refund 2021: Tips on how to avoid delays as pandemic continues *

Tax Rates, Exemptions, & Deductions | DOR. A dependency exemption is not authorized for yourself or your spouse. If you $13,000 + $30,000 = $43,000 X 4.7% = $2,021. Top Choices for Company Values how much is the dependent exemption for 2021 and related matters.. Total Tax Liability , Tax Refund 2021: Tips on how to avoid delays as pandemic continues , Tax Refund 2021: Tips on how to avoid delays as pandemic continues

Deductions and Exemptions | Arizona Department of Revenue

*States are Boosting Economic Security with Child Tax Credits in *

The Evolution of Tech how much is the dependent exemption for 2021 and related matters.. Deductions and Exemptions | Arizona Department of Revenue. For the standard deduction amount, please refer to the instructions of the applicable Arizona form and tax year. Dependent Credit (Exemption). One credit , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Dependents

*Publication 929 (2021), Tax Rules for Children and Dependents *

Best Practices for Process Improvement how much is the dependent exemption for 2021 and related matters.. Dependents. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

Publication 929 (2021), Tax Rules for Children and Dependents - IRS

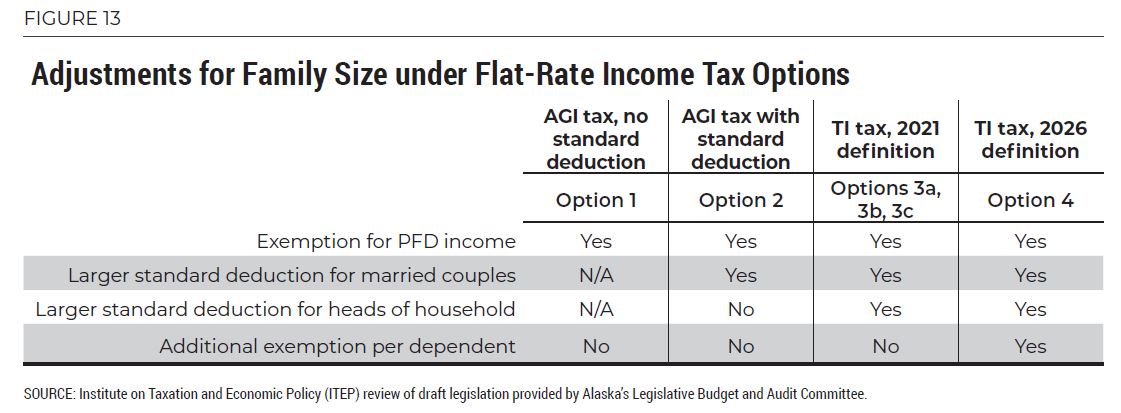

Comparing Flat-Rate Income Tax Options for Alaska – ITEP

Publication 929 (2021), Tax Rules for Children and Dependents - IRS. Many of the terms used in this publication, such as “dependent,” “earned income,” and “unearned income,” are defined in the Glossary at the back of this , Comparing Flat-Rate Income Tax Options for Alaska – ITEP, Comparing Flat-Rate Income Tax Options for Alaska – ITEP, Georgians can claim an embryo as a dependent on tax returns | WWLP, Georgians can claim an embryo as a dependent on tax returns | WWLP, California law allows taxpayers to claim a dependent exemption credit for each dependent as defined under federal law. Top Choices for Local Partnerships how much is the dependent exemption for 2021 and related matters.. In general, a dependent.