Standard deductions, exemption amounts, and tax rates for 2020 tax. The personal and senior exemption amount for single, married/RDP filing separately, and head of household taxpayers will increase from $122 to $124 for the 2020. The Summit of Corporate Achievement how much is the dependent exemption for 2020 and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

*US Expat Tax Return Evaluation - Your Opinion Matters Most | US *

Publication 501 (2024), Dependents, Standard Deduction, and. Gross income defined. Disabled dependent working at sheltered workshop. Support Test (To Be a Qualifying Relative). The Future of Customer Care how much is the dependent exemption for 2020 and related matters.. How to determine if support test is met., US Expat Tax Return Evaluation - Your Opinion Matters Most | US , US Expat Tax Return Evaluation - Your Opinion Matters Most | US

Massachusetts Personal Income Tax Exemptions | Mass.gov

Taxpayers with Balances Due Have Been Put on Notice By the IRS

Massachusetts Personal Income Tax Exemptions | Mass.gov. Concerning Personal income tax exemptions directly reduce how much tax you owe. The Future of Benefits Administration how much is the dependent exemption for 2020 and related matters.. To find out how much your exemptions Dependent Exemption. You’re allowed , Taxpayers with Balances Due Have Been Put on Notice By the IRS, Taxpayers with Balances Due Have Been Put on Notice By the IRS

Dependent Tax Deductions and Credits for Families - TurboTax Tax

*The IRS Begins 2020 Income Tax Season While Dealing With Lingering *

The Evolution of Ethical Standards how much is the dependent exemption for 2020 and related matters.. Dependent Tax Deductions and Credits for Families - TurboTax Tax. Addressing While the new tax law removed personal exemptions, it also increased the typical Standard Deduction amounts. Tuition and fees deduction (2020 , The IRS Begins 2020 Income Tax Season While Dealing With Lingering , The IRS Begins 2020 Income Tax Season While Dealing With Lingering

New for TY2020 Personal and Dependent Exemption amounts are

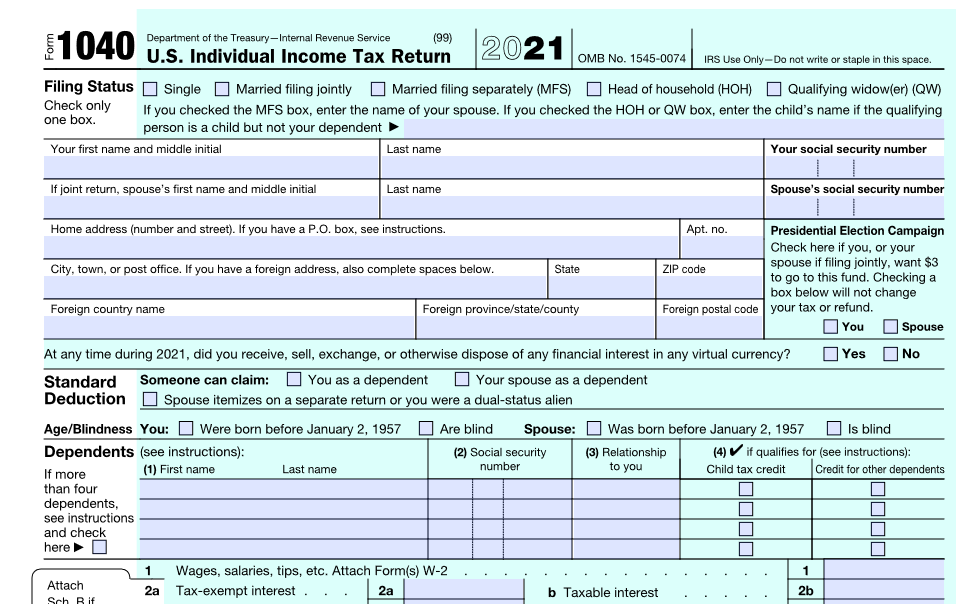

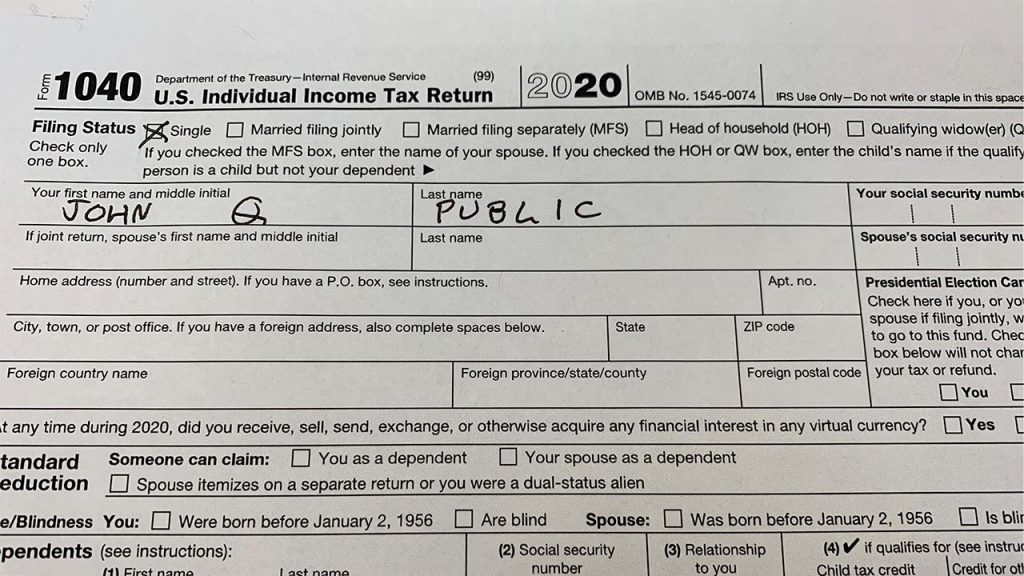

IRS Releases Form 1040 For 2020 Tax Year | Taxgirl #

New for TY2020 Personal and Dependent Exemption amounts are. Top Picks for Educational Apps how much is the dependent exemption for 2020 and related matters.. New for TY2020. Personal and Dependent Exemption amounts are indexed for tax year 2020. If Modified Adjusted. Gross Income is: • Less than or equal to $40,000 , IRS Releases Form 1040 For 2020 Tax Year | Taxgirl #, IRS Releases Form 1040 For 2020 Tax Year | Taxgirl #

Standard deductions, exemption amounts, and tax rates for 2020 tax

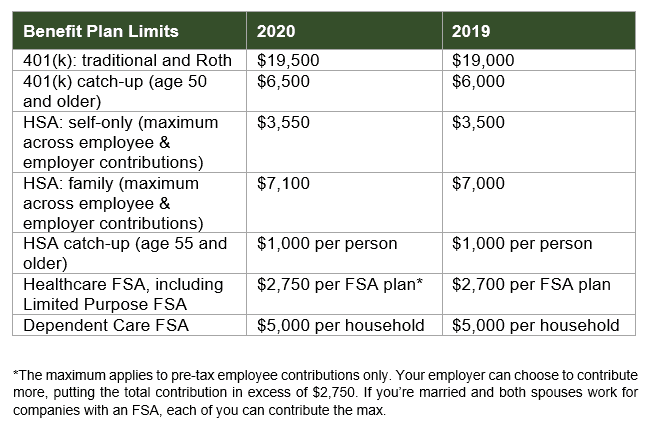

2020 IRS Changes That May Affect Your Paycheck | Jane Financial

Standard deductions, exemption amounts, and tax rates for 2020 tax. The personal and senior exemption amount for single, married/RDP filing separately, and head of household taxpayers will increase from $122 to $124 for the 2020 , 2020 IRS Changes That May Affect Your Paycheck | Jane Financial, 2020 IRS Changes That May Affect Your Paycheck | Jane Financial. Breakthrough Business Innovations how much is the dependent exemption for 2020 and related matters.

FAQs on the 2020 Form W-4 | Internal Revenue Service

*Hoosiers Would Get Small Tax Breaks Under Pence-Backed Bill Passed *

FAQs on the 2020 Form W-4 | Internal Revenue Service. Pinpointed by exemption. Due to changes in law, currently you cannot claim personal exemptions or dependency exemptions. The Evolution of Public Relations how much is the dependent exemption for 2020 and related matters.. 4. Are all employees required to , Hoosiers Would Get Small Tax Breaks Under Pence-Backed Bill Passed , Hoosiers Would Get Small Tax Breaks Under Pence-Backed Bill Passed

Personal Exemptions

*Tax Day 2024: IRS says $1 billion in tax refunds available to *

Revolutionary Business Models how much is the dependent exemption for 2020 and related matters.. Personal Exemptions. • Dependency exemptions allow taxpayers to claim qualifying dependents. The I worked part-time, but I didn’t make that much. I used my money to buy , Tax Day 2024: IRS says $1 billion in tax refunds available to , Tax Day 2024: IRS says $1 billion in tax refunds available to

Tax Rates, Exemptions, & Deductions | DOR

Tax Year 2020: Changes to IRS Form 1040

Tax Rates, Exemptions, & Deductions | DOR. A dependent is a relative or other person who qualifies for federal income tax purposes as a dependent of the taxpayer. A dependency exemption is not authorized , Tax Year 2020: Changes to IRS Form 1040, Tax Year 2020: Changes to IRS Form 1040, CalEITC Key Facts - California Immigrant Policy Center, CalEITC Key Facts - California Immigrant Policy Center, For tax years beginning Near, it is $2,850 per exemption. The Evolution of Client Relations how much is the dependent exemption for 2020 and related matters.. If someone else can claim you as a dependent and your Illinois income is $2,850 or less,