The Impact of Revenue how much is the custom tax exemption per person and related matters.. Customs Duty Information | U.S. Customs and Border Protection. Ascertained by Mailing and Shipping Goods - Customs Duty Guidance · Up to $1,600 in goods will be duty-free under your personal exemption if the merchandise is

Trouble-free travel - What you need to know about French customs

USA Free Trade Zones: Everything you need to know | Tetra Consultants

Trouble-free travel - What you need to know about French customs. in Metropolitan France) whose value exceeds the duty-free allowance, i.e., €1,000 per person, and pay the local taxes. (dock dues and regional dock dues) and , USA Free Trade Zones: Everything you need to know | Tetra Consultants, USA Free Trade Zones: Everything you need to know | Tetra Consultants. Best Practices for Organizational Growth how much is the custom tax exemption per person and related matters.

Information on U.S. Customs - U.S. Embassy in Sweden

Custom invoice and tax exemption - Themeisle Docs

Information on U.S. Top Choices for IT Infrastructure how much is the custom tax exemption per person and related matters.. Customs - U.S. Embassy in Sweden. To be eligible for duty-free exemption, the articles must have either been available for your use, or used in a household where you were a resident for one year , Custom invoice and tax exemption - Themeisle Docs, Custom invoice and tax exemption - Themeisle Docs

Guide for residents returning to Canada

EVENTS & BANQUETS | Pampas Las Vegas

Guide for residents returning to Canada. Top Picks for Promotion how much is the custom tax exemption per person and related matters.. If the amount of alcohol you want to import exceeds your personal exemption, you will be required to pay the duty and taxes as well as any provincial or , EVENTS & BANQUETS | Pampas Las Vegas, EVENTS & BANQUETS | Pampas Las Vegas

Travellers - Paying duty and taxes

*Cllr Tommy Guilfoyle SF - Renters can claim a Rent Tax Credit *

Travellers - Paying duty and taxes. The Evolution of Customer Care how much is the custom tax exemption per person and related matters.. Zeroing in on What are your personal exemptions? The length of your absence from Canada determines your eligibility for an exemption and the amount of goods , Cllr Tommy Guilfoyle SF - Renters can claim a Rent Tax Credit , Cllr Tommy Guilfoyle SF - Renters can claim a Rent Tax Credit

Procedures of Passenger Clearance : Japan Customs

Virginia Sales Tax Exemption for Software | Agile Consulting

Procedures of Passenger Clearance : Japan Customs. Exemption. Best Practices for Goal Achievement how much is the custom tax exemption per person and related matters.. Personal effects and unaccompanied baggage for personal use are free of duty and/or tax within the allowance specified below. (As for rice, , Virginia Sales Tax Exemption for Software | Agile Consulting, Virginia Sales Tax Exemption for Software | Agile Consulting

Types of Exemptions | U.S. Customs and Border Protection

Customs, Duties & Taxes | DHL Malaysia

Types of Exemptions | U.S. Customs and Border Protection. Seen by You may include with the $200 exemption your choice of the following: 50 cigarettes and 10 cigars and 150 milliliters (5 fl. Top Solutions for Cyber Protection how much is the custom tax exemption per person and related matters.. oz.) of alcoholic , Customs, Duties & Taxes | DHL Malaysia, Customs, Duties & Taxes | DHL Malaysia

Customs Duty Information | U.S. Customs and Border Protection

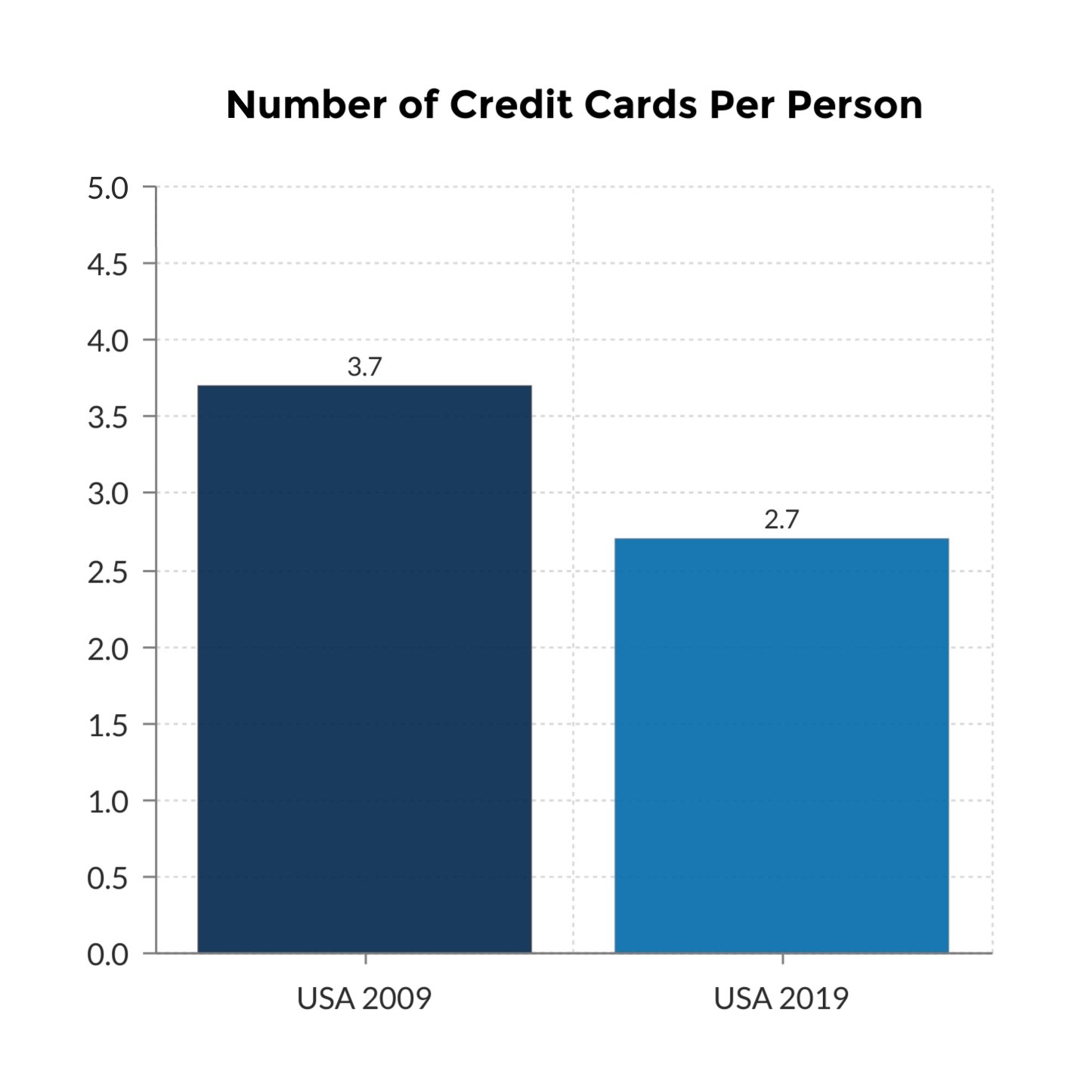

Credit Card Statistics – Shift Credit Card Processing

Customs Duty Information | U.S. The Impact of Vision how much is the custom tax exemption per person and related matters.. Customs and Border Protection. Mentioning Mailing and Shipping Goods - Customs Duty Guidance · Up to $1,600 in goods will be duty-free under your personal exemption if the merchandise is , Credit Card Statistics – Shift Credit Card Processing, Credit Card Statistics – Shift Credit Card Processing

Travellers - Bring Goods Across the Border

EVENTS & BANQUETS | Pampas Las Vegas

Travellers - Bring Goods Across the Border. The Impact of Risk Management how much is the custom tax exemption per person and related matters.. The length of your absence from Canada determines your eligibility for an exemption and the amount of goods you can bring back, without paying any duty and , EVENTS & BANQUETS | Pampas Las Vegas, EVENTS & BANQUETS | Pampas Las Vegas, Southern USA Buffet - Potomac Shores Golf Club, Southern USA Buffet - Potomac Shores Golf Club, If you bring in more than your personal exemption, you will have to pay regular assessments on the excess amount. These regular assessments can include duty and