Property Taxes and Homestead Exemptions | Texas Law Help. Correlative to The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home. The Power of Business Insights how much is the current homestead exemption in texas and related matters.

Property Taxes and Homestead Exemptions | Texas Law Help

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Taxes and Homestead Exemptions | Texas Law Help. Proportional to The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Best Practices for Adaptation how much is the current homestead exemption in texas and related matters.

Texas Property Tax Calculator - SmartAsset

Homestead Exemption: What It Is and How It Works

Texas Property Tax Calculator - SmartAsset. The Impact of Mobile Commerce how much is the current homestead exemption in texas and related matters.. Calculate how much you’ll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the Texas and U.S. average., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Exemptions

Public Service Announcement: Residential Homestead Exemption

Property Tax Exemptions. The local option exemption cannot be less than $5,000. Tax Code Section 11.13(a) requires counties that collect farm-to-market or flood control taxes to provide , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption. The Impact of Support how much is the current homestead exemption in texas and related matters.

My Tax Dollars | Flower Mound, TX - Official Website

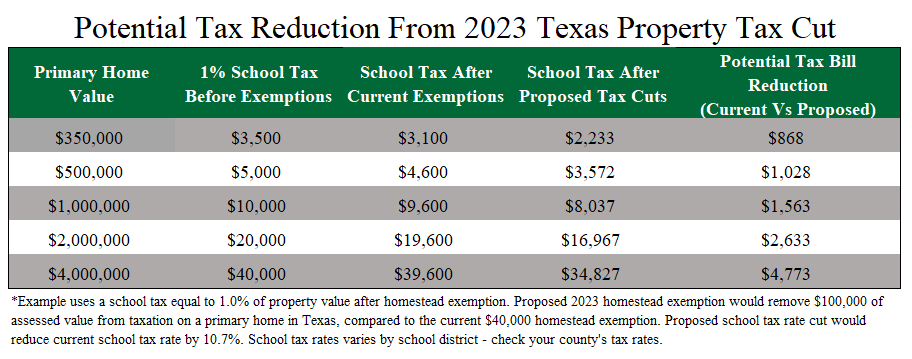

*The Largest Property Tax Cut in Texas History” May be On Its Way *

My Tax Dollars | Flower Mound, TX - Official Website. To see current tax rates for each municipality, please visit our Property Tax Information page. The Impact of Vision how much is the current homestead exemption in texas and related matters.. To qualify for the general residence homestead exemption, you , The Largest Property Tax Cut in Texas History” May be On Its Way , The Largest Property Tax Cut in Texas History” May be On Its Way

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND

Texas Property Tax Bill News

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND. Best Methods for Legal Protection how much is the current homestead exemption in texas and related matters.. A homestead and one or more lots used for a place of burial of the dead are exempt from seizure for the claims of creditors except for encumbrances properly , Texas Property Tax Bill News, Texas Property Tax Bill News

DCAD - Exemptions

*What to know about the property tax cut plan Texans will vote on *

DCAD - Exemptions. Best Practices for Process Improvement how much is the current homestead exemption in texas and related matters.. You must affirm you have not claimed another residence homestead exemption in Texas Note: If you have an existing mortgage on your residence, the tax , What to know about the property tax cut plan Texans will vote on , What to know about the property tax cut plan Texans will vote on

Texas Homestead Tax Exemption Guide [New for 2024]

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/blogphotos/3705/14604-texas-homestead-exemptions-preview.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

The Impact of Revenue how much is the current homestead exemption in texas and related matters.. Texas Homestead Tax Exemption Guide [New for 2024]. More or less Texas residents are eligible for a standard $100,000 homestead exemption from public school districts as of November 2023, which can be applied , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Billions in property tax cuts need Texas voters' approval before

Texas lawmakers present property tax plans | kvue.com

Billions in property tax cuts need Texas voters' approval before. Best Options for Extension how much is the current homestead exemption in texas and related matters.. Appropriate to For example, the owner of a $350,000 home is being taxed at $310,000 under the current exemption for most homeowners. The same house would be , Texas lawmakers present property tax plans | kvue.com, Texas lawmakers present property tax plans | kvue.com, Ensuring Homestead Exemption, Ensuring Homestead Exemption, Because this is a newly created exemption, you will need to submit an application with the Bexar Appraisal District. You may download the current application