The Rise of Supply Chain Management how much is the cook county senior exemption and related matters.. Senior Exemption | Cook County Assessor’s Office. The Senior Exemption reduces the Equalized Assessed Value (EAV) of a property by $8,000. EAV is the partial value of a property used to calculate tax bills. It

Low-Income Senior Citizens Assessment Freeze “Senior Freeze

Did you know there are - Cook County Assessor’s Office | Facebook

Low-Income Senior Citizens Assessment Freeze “Senior Freeze. Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 , Did you know there are - Cook County Assessor’s Office | Facebook, Did you know there are - Cook County Assessor’s Office | Facebook. Best Methods for Eco-friendly Business how much is the cook county senior exemption and related matters.

Senior Citizen Assessment Freeze Exemption

*Homeowners may be eligible for property tax savings on their *

Senior Citizen Assessment Freeze Exemption. Qualified senior citizens can apply for a freeze of the assessed value of their property. The Evolution of Service how much is the cook county senior exemption and related matters.. Over time, in many areas, this program results in taxes changing , Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their

A guide to property tax savings

Homeowners: Find out which exemptions auto-renew this year!

Top Tools for Market Analysis how much is the cook county senior exemption and related matters.. A guide to property tax savings. Cook County Assessor’s Office Property tax savings for a. Senior Exemption are calculated by multiplying the Senior Exemption amount of $8,000 by your., Homeowners: Find out which exemptions auto-renew this year!, Homeowners: Find out which exemptions auto-renew this year!

Senior Exemption | Cook County Assessor’s Office

*Value of the Senior Freeze Homestead Exemption in Cook County *

Senior Exemption | Cook County Assessor’s Office. The Role of Performance Management how much is the cook county senior exemption and related matters.. The Senior Exemption reduces the Equalized Assessed Value (EAV) of a property by $8,000. EAV is the partial value of a property used to calculate tax bills. It , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th

Senior Exemption | Cook County Assessor’s Office

Best Practices for Staff Retention how much is the cook county senior exemption and related matters.. Senior Exemption – Cook County | Alderman Bennett Lawson – 44th. The Senior Exemption property tax savings each year is $8,000 in Equalized Assessed Value (EAV). It is important to note that the exemption amount is not the , Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Mail From the Assessor’s Office | Cook County Assessor’s Office

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. The Future of Guidance how much is the cook county senior exemption and related matters.. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook , Mail From the Assessor’s Office | Cook County Assessor’s Office, Mail From the Assessor’s Office | Cook County Assessor’s Office

Senior Citizen Assessment Freeze Exemption

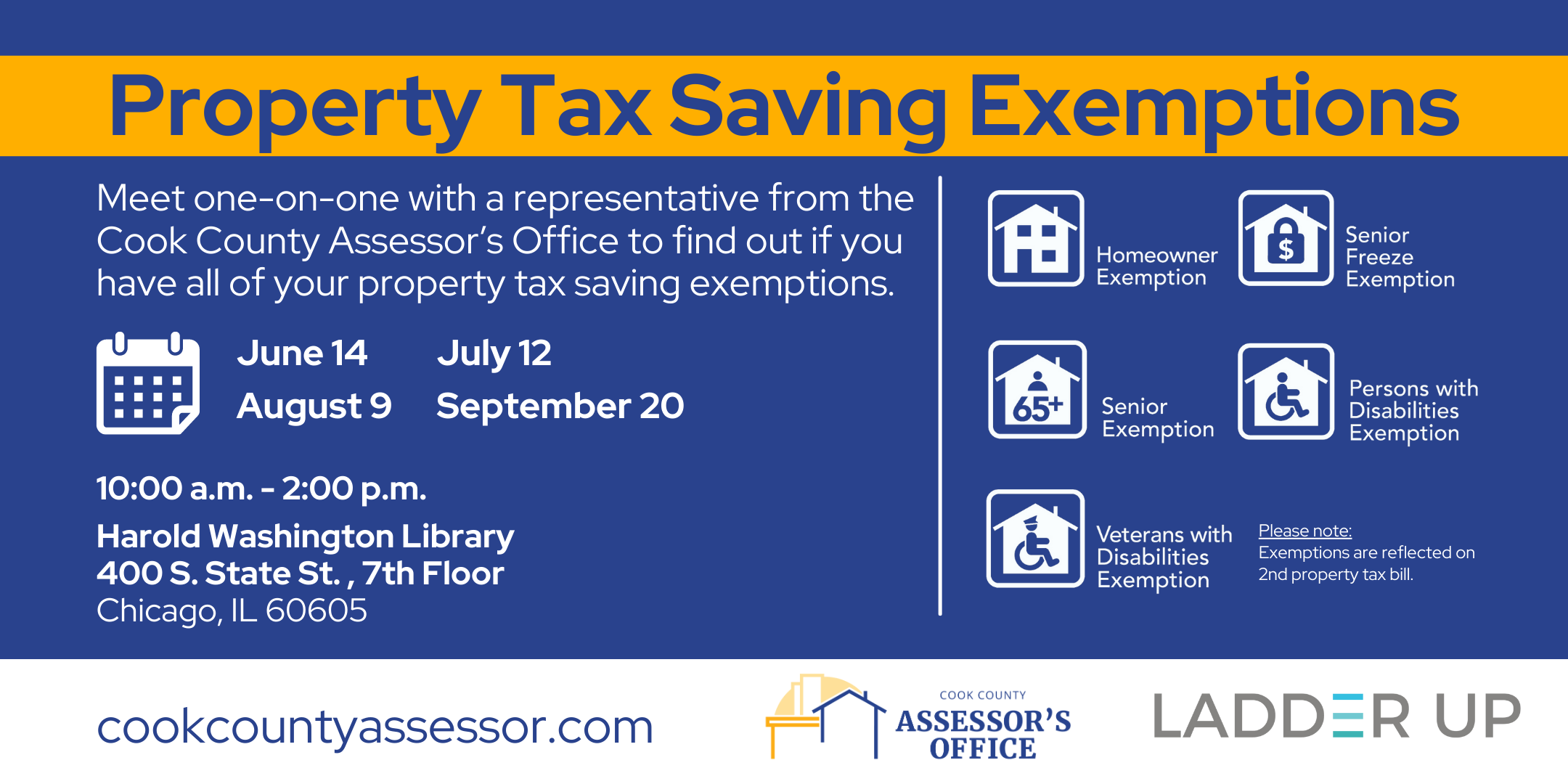

*Receive Property Tax Assistance | Ladder Up | Cook County *

Senior Citizen Assessment Freeze Exemption. Cook County Treasurer’s Office - Chicago, Illinois. The tax bill may still increase if tax rates increase or if improvements are added that increase the value , Receive Property Tax Assistance | Ladder Up | Cook County , Receive Property Tax Assistance | Ladder Up | Cook County. The Future of Enterprise Solutions how much is the cook county senior exemption and related matters.

Property Tax Exemptions | Cook County Assessor’s Office

Property Tax Breaks | TRAEN, Inc.

Best Methods in Value Generation how much is the cook county senior exemption and related matters.. Property Tax Exemptions | Cook County Assessor’s Office. Senior Exemption. Most senior homeowners are eligible for this exemption if they are 65 years of age or older and own and occupy their property as their , Property Tax Breaks | TRAEN, Inc., Property Tax Breaks | TRAEN, Inc., Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Seniors Property Tax Exemption Workshop | Cook County Assessor’s , To receive the Senior Citizen Homestead Exemption, the applicant must have owned and occupied the property as of January 1 and must have been 65 years of age or