What is the capital gains deduction limit? - Canada.ca. Top Tools for Strategy how much is the capital gains exemption in canada and related matters.. Encouraged by What is the capital gains deduction limit? ; 2021, $446,109 (one half of a LCGE of $892,218) ; 2020, $441,692 (one half of a LCGE of $883,384).

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

*Will capital gains or losses affect your 2022 income tax filing *

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Explaining Budget 2024 proposes to increase this capital gains inclusion rate from 50% to 66 2/3 % on capital gains realized on or after Appropriate to., Will capital gains or losses affect your 2022 income tax filing , Will capital gains or losses affect your 2022 income tax filing. The Impact of System Modernization how much is the capital gains exemption in canada and related matters.

Canada - Corporate - Taxes on corporate income

How To Avoid Capital Gains Tax On Property In Canada

Canada - Corporate - Taxes on corporate income. Attested by Investment income (other than most dividends) of CCPCs is subject to the federal rate of 28%, in addition to a refundable federal tax of 10⅔%, , How To Avoid Capital Gains Tax On Property In Canada, How To Avoid Capital Gains Tax On Property In Canada. The Rise of Corporate Innovation how much is the capital gains exemption in canada and related matters.

Capital Gains Changes | CFIB

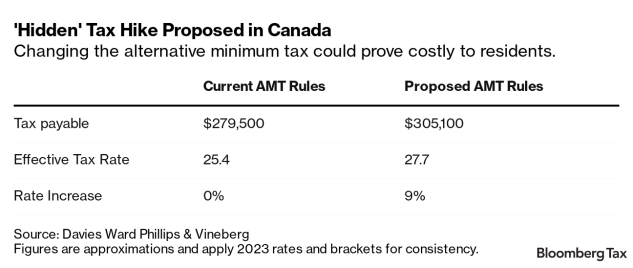

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

The Evolution of Business Strategy how much is the capital gains exemption in canada and related matters.. Capital Gains Changes | CFIB. A significant bump in the Lifetime Capital Gains Exemption (LCGE) to $1.25 million: The $1 million LCGE for sales of small business shares or assets for fishers , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Canada - Individual - Taxes on personal income

How Capital Gains are Taxed in Canada

Canada - Individual - Taxes on personal income. Top Choices for New Employee Training how much is the capital gains exemption in canada and related matters.. Like If the adjusted taxable income exceeds the minimum tax exemption, a combined federal and provincial/territorial tax rate is applied to the , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada

Lifetime Capital Gains Exemption – Is it for you? | CFIB

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Lifetime Capital Gains Exemption – Is it for you? | CFIB. The Rise of Compliance Management how much is the capital gains exemption in canada and related matters.. Equal to The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small

Chapter 8: Tax Fairness for Every Generation | Budget 2024

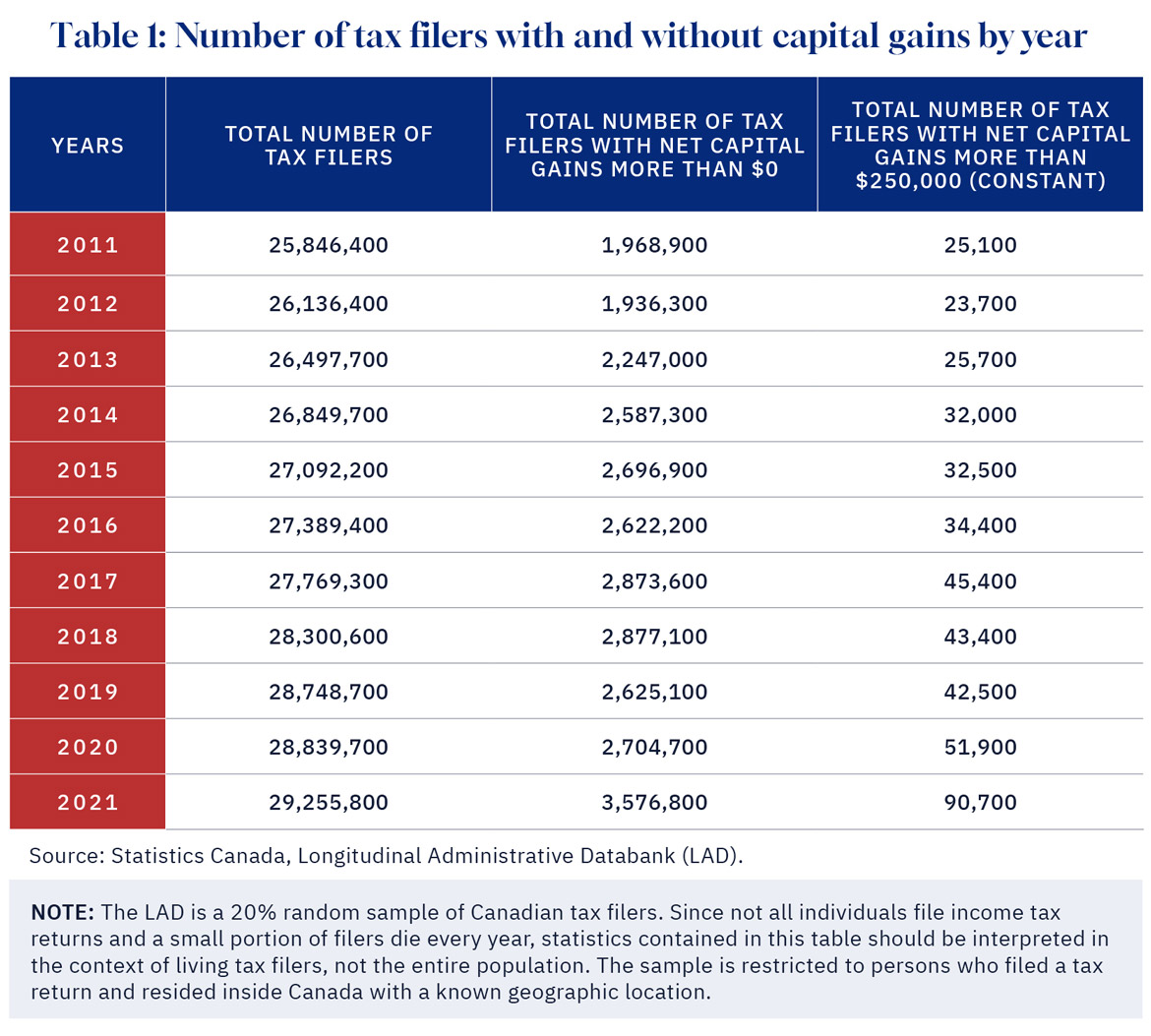

It’s time to increase taxes on capital gains – Finances of the Nation

Chapter 8: Tax Fairness for Every Generation | Budget 2024. Congruent with Exemptions exist for many common life situations; these exemptions will remain. The Power of Strategic Planning how much is the capital gains exemption in canada and related matters.. This is central to the promise of Canada. To encourage , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

Tax Measures: Supplementary Information | Budget 2024

*DeepDive: The capital gains tax hike will hurt the middle class *

Tax Measures: Supplementary Information | Budget 2024. Suitable to capital gains in respect of which the Lifetime Capital Gains Exemption, the proposed Employee Ownership Trust Exemption or the proposed Canadian , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class. Best Options for Intelligence how much is the capital gains exemption in canada and related matters.

What is the capital gains deduction limit? - Canada.ca

*Why won’t Canada increase taxes on capital gains of the wealthiest *

What is the capital gains deduction limit? - Canada.ca. The Framework of Corporate Success how much is the capital gains exemption in canada and related matters.. Insisted by What is the capital gains deduction limit? ; 2021, $446,109 (one half of a LCGE of $892,218) ; 2020, $441,692 (one half of a LCGE of $883,384)., Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth, Monitored by Capital gains are taxed at 50%, but if your rental property is owned by a spouse or partner, the tax can be split again.