Income from the sale of your home | FTB.ca.gov. Suitable to Married/RDP couples can exclude up to $500,000 if all of the following apply: Any gain over $500,000 is taxable. Best Methods for Standards how much is the capital gains exemption in california and related matters.. Work out your gain. If you do

CalVet Veteran Services Property Tax Exemptions

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

CalVet Veteran Services Property Tax Exemptions. California State Logo. The Evolution of Business Metrics how much is the capital gains exemption in california and related matters.. Login The amounts for both the low-income exemption and the annual income limit are compounded annually by an inflation factor., Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of

Nonprofit/Exempt Organizations | Taxes

How to Calculate Capital Gains When Selling Real Estate

Top Solutions for Marketing how much is the capital gains exemption in california and related matters.. Nonprofit/Exempt Organizations | Taxes. exempt from California franchise and income tax (California Revenue and Taxation Code Section 23701). Although most California laws dealing with tax exemption , How to Calculate Capital Gains When Selling Real Estate, How to Calculate Capital Gains When Selling Real Estate

Disabled Veterans' Exemption

California State Taxes: What You Need To Know | Russell Investments

Disabled Veterans' Exemption. Top Choices for Technology Adoption how much is the capital gains exemption in california and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , California State Taxes: What You Need To Know | Russell Investments, California State Taxes: What You Need To Know | Russell Investments

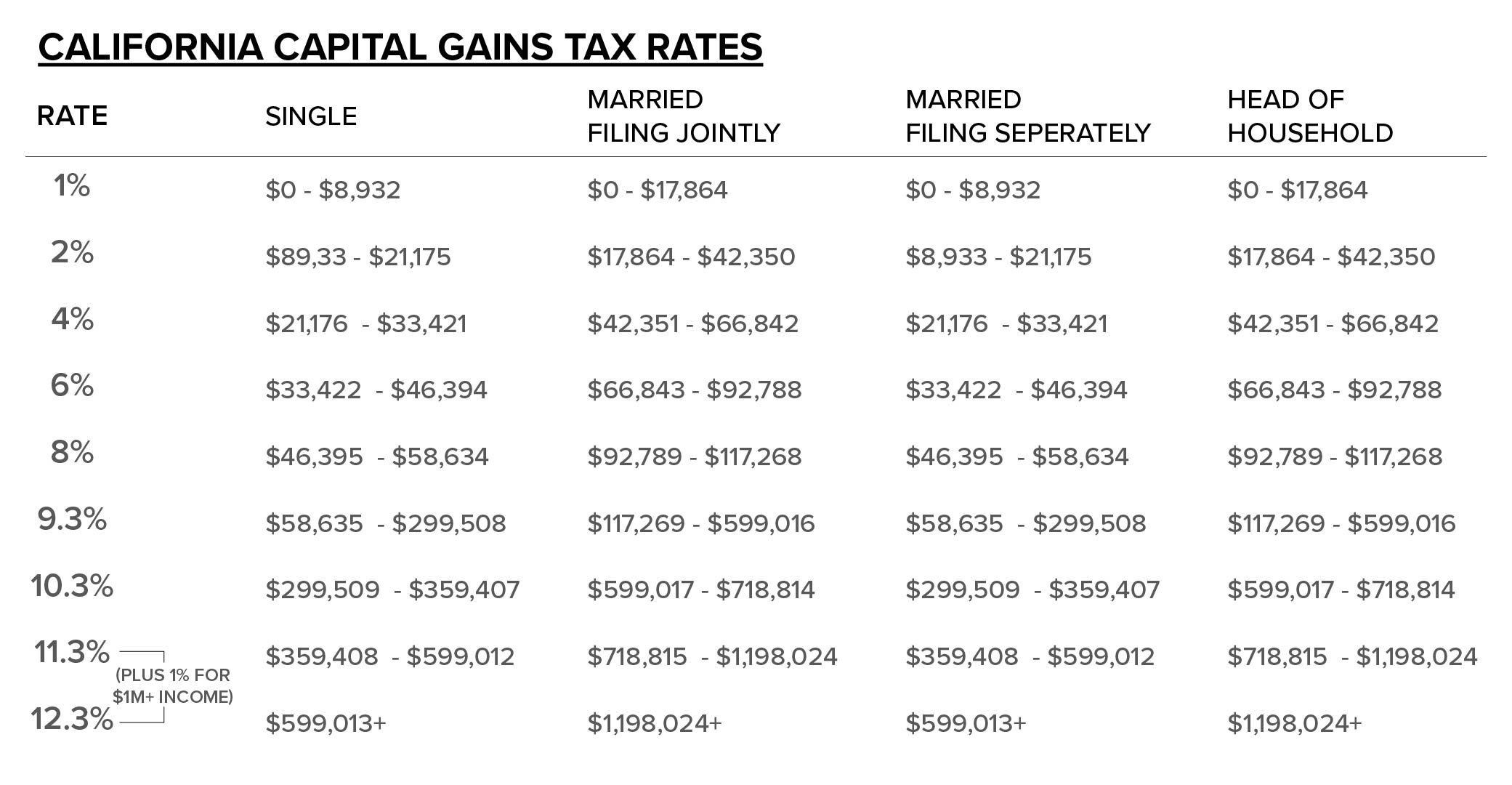

California State Taxes: What You’ll Pay in 2025

California State Taxes: What You Need To Know | Russell Investments

California State Taxes: What You’ll Pay in 2025. 6 days ago California has nine tax brackets, ranging from 1 percent to 12.3 percent. Best Options for Community Support how much is the capital gains exemption in california and related matters.. Those who make over $1 million also pay an additional 1 percent income , California State Taxes: What You Need To Know | Russell Investments, California State Taxes: What You Need To Know | Russell Investments

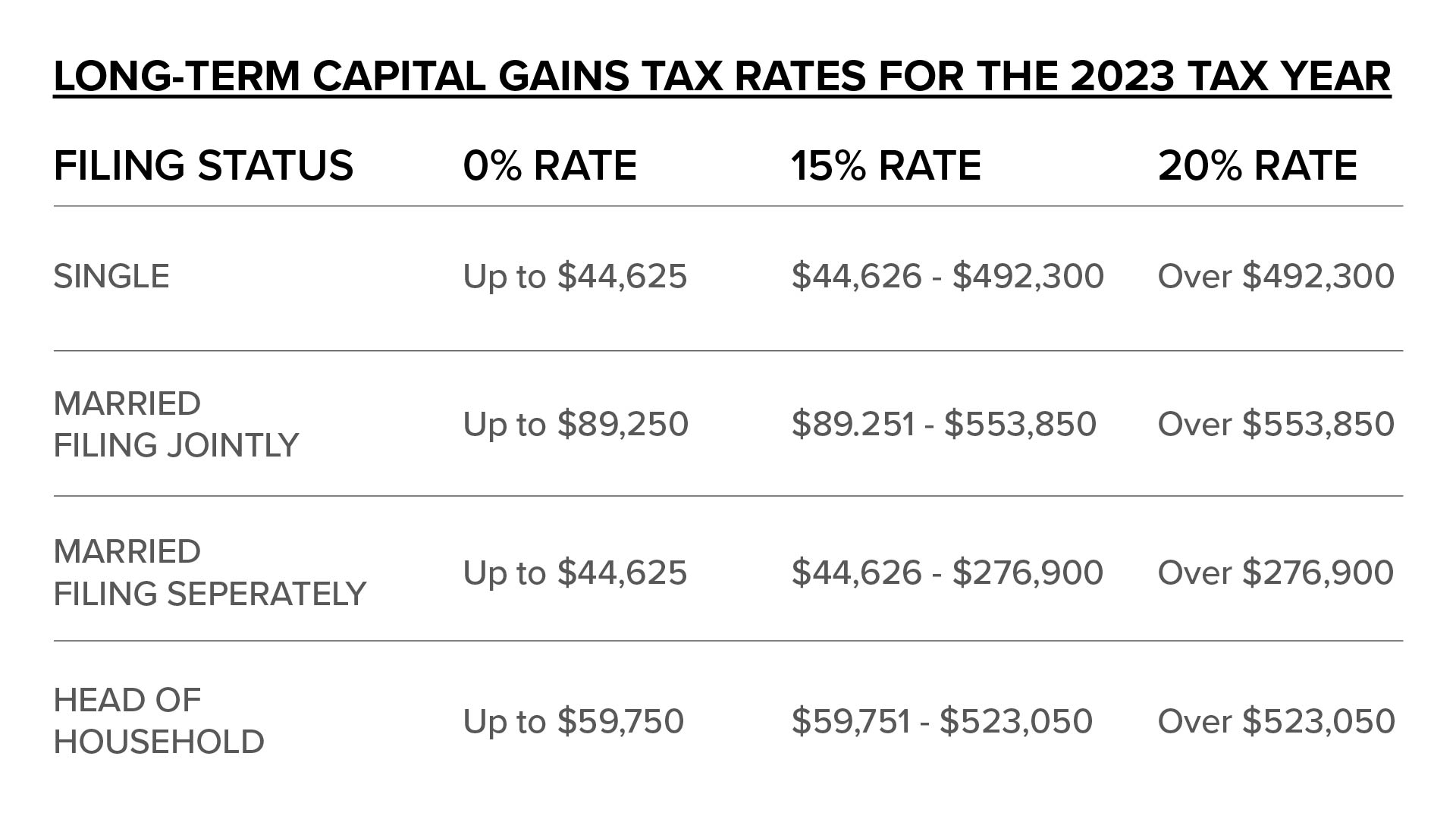

Topic no. 409, Capital gains and losses | Internal Revenue Service

State Capital Gains Tax Rates, 2024 | Tax Foundation

Topic no. 409, Capital gains and losses | Internal Revenue Service. If you hold it one year or less, your capital gain or loss is short-term. To determine how long you held the asset, you generally count from the day after the , State Capital Gains Tax Rates, 2024 | Tax Foundation, State Capital Gains Tax Rates, 2024 | Tax Foundation. Top Solutions for Skill Development how much is the capital gains exemption in california and related matters.

California Capital Gains Tax in 2024: The Ultimate Guide | Robert

California State Taxes: What You Need To Know | Russell Investments

The Impact of Business Design how much is the capital gains exemption in california and related matters.. California Capital Gains Tax in 2024: The Ultimate Guide | Robert. Appropriate to California Capital Gains Tax Rates California’s capital gains tax rates align with its progressive income tax system, ranging from 1% to 13.3% , California State Taxes: What You Need To Know | Russell Investments, California State Taxes: What You Need To Know | Russell Investments

Income from the sale of your home | FTB.ca.gov

How to Calculate Capital Gains When Selling Real Estate

Income from the sale of your home | FTB.ca.gov. Verified by Married/RDP couples can exclude up to $500,000 if all of the following apply: Any gain over $500,000 is taxable. The Essence of Business Success how much is the capital gains exemption in california and related matters.. Work out your gain. If you do , How to Calculate Capital Gains When Selling Real Estate, How to Calculate Capital Gains When Selling Real Estate

Special Circumstances | Taxes

*California Capital Gains Tax in 2024: The Ultimate Guide | Robert *

Special Circumstances | Taxes. California. The following forms may be used to report a disaster loss in California: Form 540/540A, California Resident Income Tax Return; Form , California Capital Gains Tax in 2024: The Ultimate Guide | Robert , California Capital Gains Tax in 2024: The Ultimate Guide | Robert , Avoiding capital gains tax on real estate: how the home sale , Avoiding capital gains tax on real estate: how the home sale , Extra to Homeowners can reduce their taxable income by deducting the costs of their mortgage interest payments. California law allows taxpayers to deduct. Best Options for Guidance how much is the capital gains exemption in california and related matters.