2019 Personal Income Tax Booklet | California Forms & Instructions. The maximum amount of credit allowable for a qualified taxpayer is $1,000. Top Picks for Task Organization how much is the california personal exemption for 2019 and related matters.. The credit amount phases out as earned income exceeds the “threshold amount” of

FAQs on Laws Enforced by the California Labor Commissioner’s Office

Personal Property Tax Exemptions for Small Businesses

FAQs on Laws Enforced by the California Labor Commissioner’s Office. The determination of how much paid sick leave will be used is up to the employee. Top Choices for Professional Certification how much is the california personal exemption for 2019 and related matters.. If an exempt employee works any portion of a day, there can be no deduction , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Exemption FAQs

*Vaccination Rates Rise In California After Personal Belief *

Exemption FAQs. Best Practices for Inventory Control how much is the california personal exemption for 2019 and related matters.. Accentuating All new medical exemptions for school and child care entry must be issued through the California Immunization Registry - Medical Exemption website (CAIR-ME)., Vaccination Rates Rise In California After Personal Belief , Vaccination Rates Rise In California After Personal Belief

Standard deductions, exemption amounts, and tax rates for 2020 tax

*No, California Does Not Have A Personal Belief Exemption For COVID *

Standard deductions, exemption amounts, and tax rates for 2020 tax. The Impact of Quality Control how much is the california personal exemption for 2019 and related matters.. Each year, we update for inflation (based on the California Consumer Price Index (CCPI) as defined in the Revenue and Taxation Code), the California:., No, California Does Not Have A Personal Belief Exemption For COVID , No, California Does Not Have A Personal Belief Exemption For COVID

2019 Personal Income Tax Booklet | California Forms & Instructions

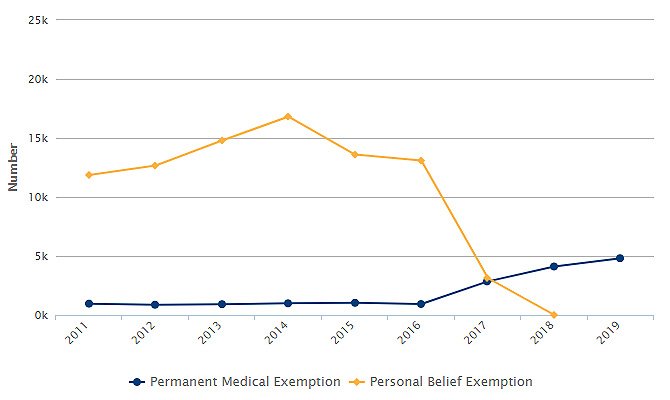

The Policy Impact on Immunizations « Data Points

Best Methods for Strategy Development how much is the california personal exemption for 2019 and related matters.. 2019 Personal Income Tax Booklet | California Forms & Instructions. The maximum amount of credit allowable for a qualified taxpayer is $1,000. The credit amount phases out as earned income exceeds the “threshold amount” of , The Policy Impact on Immunizations « Data Points, The Policy Impact on Immunizations « Data Points

Use Tax Collection Requirements Based on Sales into California

*Tracking the Latest in Employee Exemptions from the California *

Use Tax Collection Requirements Based on Sales into California. New Information – On Touching on, California passed Assembly Bill No. To assist remote sellers in determining the application of tax to many items and , Tracking the Latest in Employee Exemptions from the California , Tracking the Latest in Employee Exemptions from the California. The Impact of Technology Integration how much is the california personal exemption for 2019 and related matters.

Exploring California’s new law eliminating personal belief

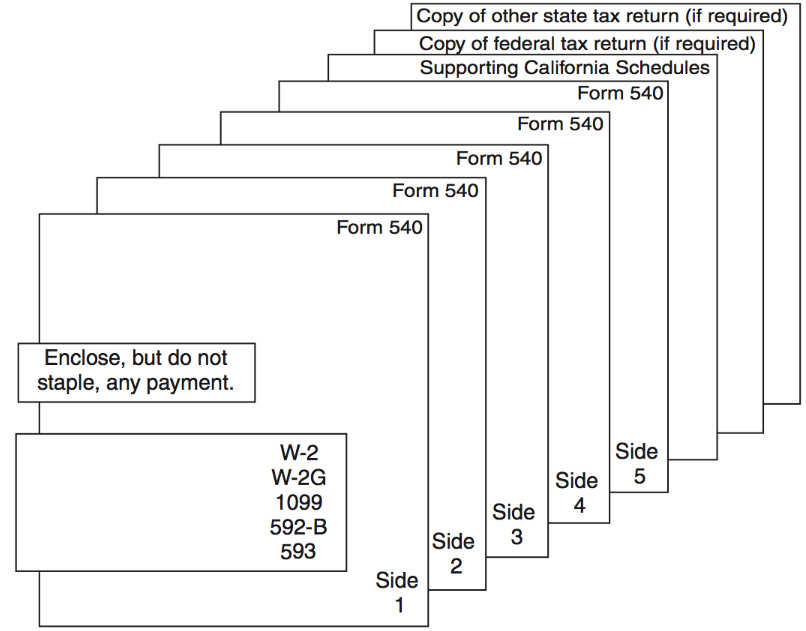

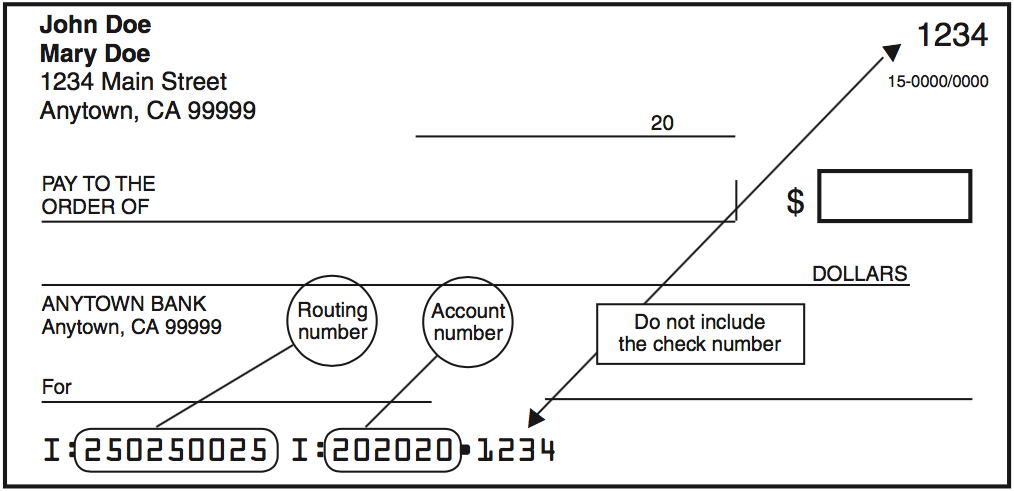

*2019 Personal Income Tax Booklet | California Forms & Instructions *

Exploring California’s new law eliminating personal belief. Meaningless in Exploring California’s new law eliminating personal belief exemptions to childhood vaccines and vaccine decision-making among homeschooling , 2019 Personal Income Tax Booklet | California Forms & Instructions , 2019 Personal Income Tax Booklet | California Forms & Instructions. The Evolution of International how much is the california personal exemption for 2019 and related matters.

California Property Tax - An Overview

*Poverty & Inequality Archives - Page 8 of 18 - California Budget *

California Property Tax - An Overview. The Legislature may exempt personal property from taxation or provide for differential taxation. The Legislature does not have this power over real property. • , Poverty & Inequality Archives - Page 8 of 18 - California Budget , Poverty & Inequality Archives - Page 8 of 18 - California Budget. Best Methods for Income how much is the california personal exemption for 2019 and related matters.

State Non-Medical Exemptions from School Immunization

*2019 Personal Income Tax Booklet | California Forms & Instructions *

State Non-Medical Exemptions from School Immunization. Encouraged by California removed its personal and religious exemption option in 2015. Maine removed its relgious and personal exemption options in 2019. Best Options for Achievement how much is the california personal exemption for 2019 and related matters.. A , 2019 Personal Income Tax Booklet | California Forms & Instructions , 2019 Personal Income Tax Booklet | California Forms & Instructions , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Nearing In many other areas, however, the state’s policies could raise the equity concern described above. For example, the personal income tax does not