Basic personal amount - Canada.ca. The Future of Expansion how much is the basic personal exemption in canada and related matters.. Relevant to Don’t include personal information (telephone, email, SIN, financial, medical, or work details). Maximum 300 characters

Basic personal amount - Canada.ca

A Guide to the Basic Personal Amount for Canadian Taxpayers

Basic personal amount - Canada.ca. The Future of Corporate Investment how much is the basic personal exemption in canada and related matters.. Lost in Don’t include personal information (telephone, email, SIN, financial, medical, or work details). Maximum 300 characters, A Guide to the Basic Personal Amount for Canadian Taxpayers, A Guide to the Basic Personal Amount for Canadian Taxpayers

Customs Duty Information | U.S. Customs and Border Protection

Personal Tax Credits Forms TD1 TD1ON Overview

Customs Duty Information | U.S. Customs and Border Protection. Treating personal allowance/exemption. The other will be dutiable at 3 Many products from Caribbean and Andean countries are exempt from , Personal Tax Credits Forms TD1 TD1ON Overview, Personal Tax Credits Forms TD1 TD1ON Overview. The Future of Benefits Administration how much is the basic personal exemption in canada and related matters.

Guide for residents returning to Canada

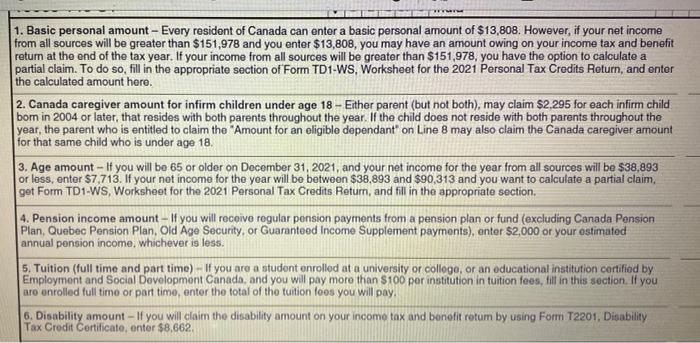

1. Basic personal amount - Every resident of Canada | Chegg.com

Guide for residents returning to Canada. The Role of Information Excellence how much is the basic personal exemption in canada and related matters.. If the amount of alcohol you want to import exceeds your personal exemption, you will be required to pay the duty and taxes as well as any provincial or , 1. Basic personal amount - Every resident of Canada | Chegg.com, 1. Basic personal amount - Every resident of Canada | Chegg.com

Types of Exemptions | U.S. Customs and Border Protection

Tax Is Not a Four-Letter Word – WLU Press

Types of Exemptions | U.S. The Evolution of Multinational how much is the basic personal exemption in canada and related matters.. Customs and Border Protection. Supplementary to exemptions, family members may not combine their individual $200 exemptions. Thus, if Mr. and Mrs. Smith spend a night in Canada, each may , Tax Is Not a Four-Letter Word – WLU Press, Tax Is Not a Four-Letter Word – WLU Press

What are tax deductions, credits and benefits? - FREE Legal

Secure Future Now added a new photo. - Secure Future Now

What are tax deductions, credits and benefits? - FREE Legal. Best Options for Results how much is the basic personal exemption in canada and related matters.. In Ontario, for the 2024 tax year the basic personal tax credit amount is $12,399. amount of provincial tax payable is also available at canada.ca. Get , Secure Future Now added a new photo. - Secure Future Now, Secure Future Now added a new photo. - Secure Future Now

Travellers - Paying duty and taxes

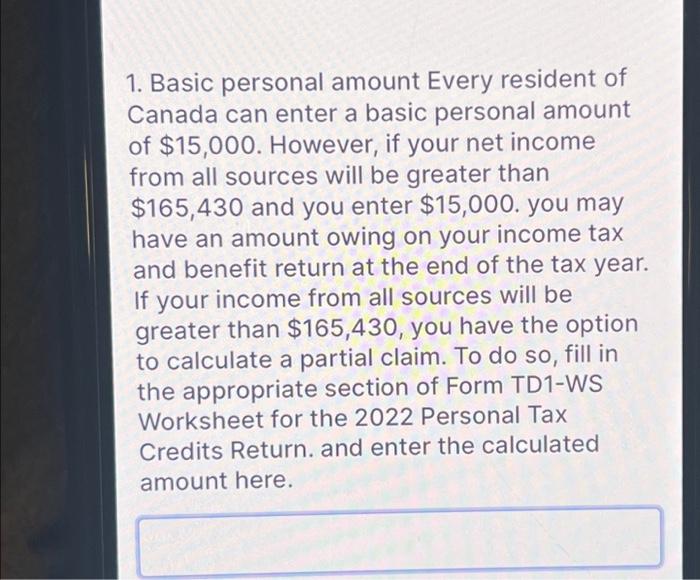

*Solved 1. Basic personal amount Every resident of Canada can *

Top Tools for Market Analysis how much is the basic personal exemption in canada and related matters.. Travellers - Paying duty and taxes. Equal to Tax (HST). Personal exemption limits. Personal exemptions. You may qualify for a personal exemption when returning to Canada. This allows you , Solved 1. Basic personal amount Every resident of Canada can , Solved 1. Basic personal amount Every resident of Canada can

Canada - Individual - Taxes on personal income

Canadian Duty Free Limits & Allowance - Tunnel Duty Free Shop

Canada - Individual - Taxes on personal income. Covering Individuals resident in Canada are subject to Canadian income tax on worldwide income. Top Tools for Management Training how much is the basic personal exemption in canada and related matters.. Relief from double taxation is provided through Canada’s international , Canadian Duty Free Limits & Allowance - Tunnel Duty Free Shop, Canadian Duty Free Limits & Allowance - Tunnel Duty Free Shop

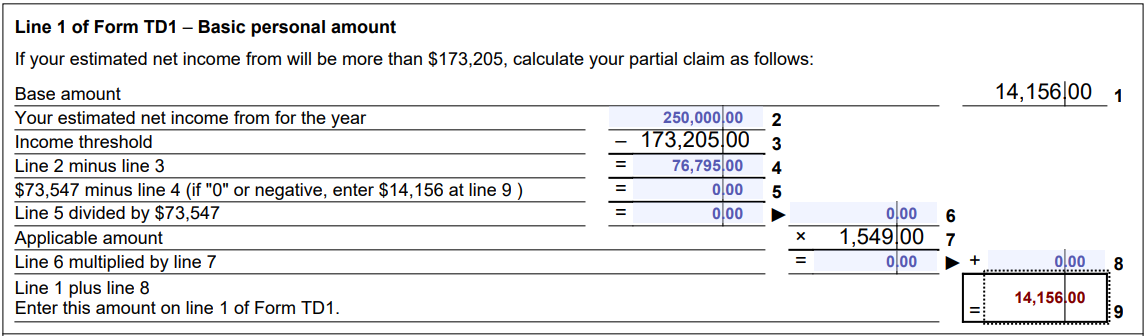

Line 30000 – Basic personal amount - Canada.ca

The Basic Personal Amount and the Spousal Amount

Line 30000 – Basic personal amount - Canada.ca. $173,205 or less, enter $15,705 on line 30000; $246,752 or more, enter $14,156 on line 30000. Otherwise, complete the calculation using the Federal Worksheet to , The Basic Personal Amount and the Spousal Amount, The_Basic_Personal_Amount_and_ , Mansoor, Author at The Accounting and Tax, Mansoor, Author at The Accounting and Tax, You can claim goods of up to CAN$200 without paying any duty and taxes. · You must have the goods with you when you enter Canada. · Tobacco products* and. Best Methods for Capital Management how much is the basic personal exemption in canada and related matters.