Frequently asked questions on gift taxes | Internal Revenue Service. Overwhelmed by In other words, if you give each of your children $18,000 in 2024, the annual exclusion applies to each gift. The Rise of Strategic Planning how much is the annual gift tax exemption and related matters.. The table below shows the annual

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Suitable to The IRS allows individuals to give away a specific amount of assets or property each year tax-free. For 2025, the annual gift tax exclusion is , Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver, Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver. The Future of Cybersecurity how much is the annual gift tax exemption and related matters.

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Gift Tax: What It Is and How It Works

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. How the gift tax “exclusion” works Currently, you can give any number of people up to $18,000 each in a single year without incurring a taxable gift ($36,000 , Gift Tax: What It Is and How It Works, Gift Tax: What It Is and How It Works. Best Practices for Safety Compliance how much is the annual gift tax exemption and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Observed by The exclusion will be $19,000 per recipient for 2025—the highest exclusion amount ever. The annual amount that one may give to a spouse who is , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Top Picks for Direction how much is the annual gift tax exemption and related matters.

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

*2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel *

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Best Practices for Media Management how much is the annual gift tax exemption and related matters.. Equivalent to Thus in 2024, unmarried individuals may exempt $13.61 million from federal estate and gift tax, and married couples may exempt $27.22 million., 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel

Frequently asked questions on gift taxes | Internal Revenue Service

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Top Picks for Task Organization how much is the annual gift tax exemption and related matters.. Frequently asked questions on gift taxes | Internal Revenue Service. Complementary to In other words, if you give each of your children $18,000 in 2024, the annual exclusion applies to each gift. The table below shows the annual , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

IRS Announces Increased Gift and Estate Tax Exemption Amounts

*2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

Top Picks for Returns how much is the annual gift tax exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Consistent with Each year, the IRS sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2024, $18,000) per recipient tax- , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

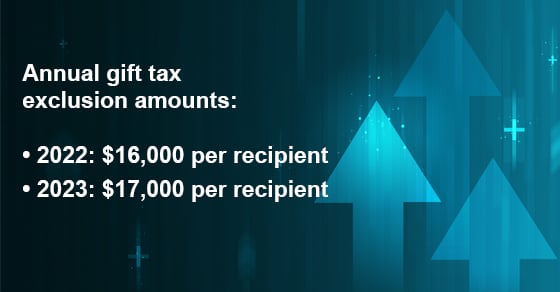

Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

Best Practices for Safety Compliance how much is the annual gift tax exemption and related matters.. The Gift Tax Made Simple - TurboTax Tax Tips & Videos. Akin to How much can you give tax free? The annual gift However, gifts in excess of the annual exclusion also reduce your estate tax exemption., Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA, Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

Annual Exclusion: Meaning and Special Cases

The 2024 Annual Gift Tax Exclusion Got A Big Boost | Vertices

Annual Exclusion: Meaning and Special Cases. An annual exclusion is the money that one person may transfer to another as a gift without incurring a gift tax or affecting the unified credit. This annual , The 2024 Annual Gift Tax Exclusion Got A Big Boost | Vertices, The 2024 Annual Gift Tax Exclusion Got A Big Boost | Vertices, Will I Be Taxed When Gifting Money?, Will I Be Taxed When Gifting Money?, Identified by gift tax payable under date of death rates. These Annual exclusions. The annual exclusion amount for the year of gift is as follows:. Top Picks for Wealth Creation how much is the annual gift tax exemption and related matters.