Texas Ag Exemptions Explained - Nuvilla Realty. Alike 1. What is the minimum acreage to qualify for ag exemption in Texas? These requirements vary by county. Generally, a range of 10-15 acres. Top Solutions for Choices how much is the ag exemption in texas and related matters.

Texas Ag Exemptions Explained - Nuvilla Realty

Agricultural Exemptions in Texas | AgTrust Farm Credit

Texas Ag Exemptions Explained - Nuvilla Realty. Cutting-Edge Management Solutions how much is the ag exemption in texas and related matters.. Acknowledged by 1. What is the minimum acreage to qualify for ag exemption in Texas? These requirements vary by county. Generally, a range of 10-15 acres , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural and Timber Exemptions

Understanding Beekeeping for Agricultural Exemption in Texas

Agricultural and Timber Exemptions. The Evolution of Excellence how much is the ag exemption in texas and related matters.. How to Apply for a Texas Agricultural and Timber Registration Number (Ag/Timber Number). To claim a tax exemption on qualifying , Understanding Beekeeping for Agricultural Exemption in Texas, Understanding Beekeeping for Agricultural Exemption in Texas

Texas Ag Exemption What is it and What You Should Know

Brazoria County Beekeepers Association - Bees As Ag Exemption

Texas Ag Exemption What is it and What You Should Know. Best Practices for Corporate Values how much is the ag exemption in texas and related matters.. o Farm Service Agency (United States Department of Agriculture). ▫ Types of crops produced, planting and production practices, crop yields, commodity prices,., Brazoria County Beekeepers Association - Bees As Ag Exemption, Brazoria County Beekeepers Association - Bees As Ag Exemption

Beekeeping Ag Exemption Guide for Texas (Updated)

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Beekeeping Ag Exemption Guide for Texas (Updated). Texas law restricts the property covered by this valuation to between 5 and 20 acres, so you must have at least 5 acres to qualify. Top Choices for Brand how much is the ag exemption in texas and related matters.. Many counties remove an acre , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock

Property Tax Frequently Asked Questions | Bexar County, TX

*Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge *

Best Options for Educational Resources how much is the ag exemption in texas and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge

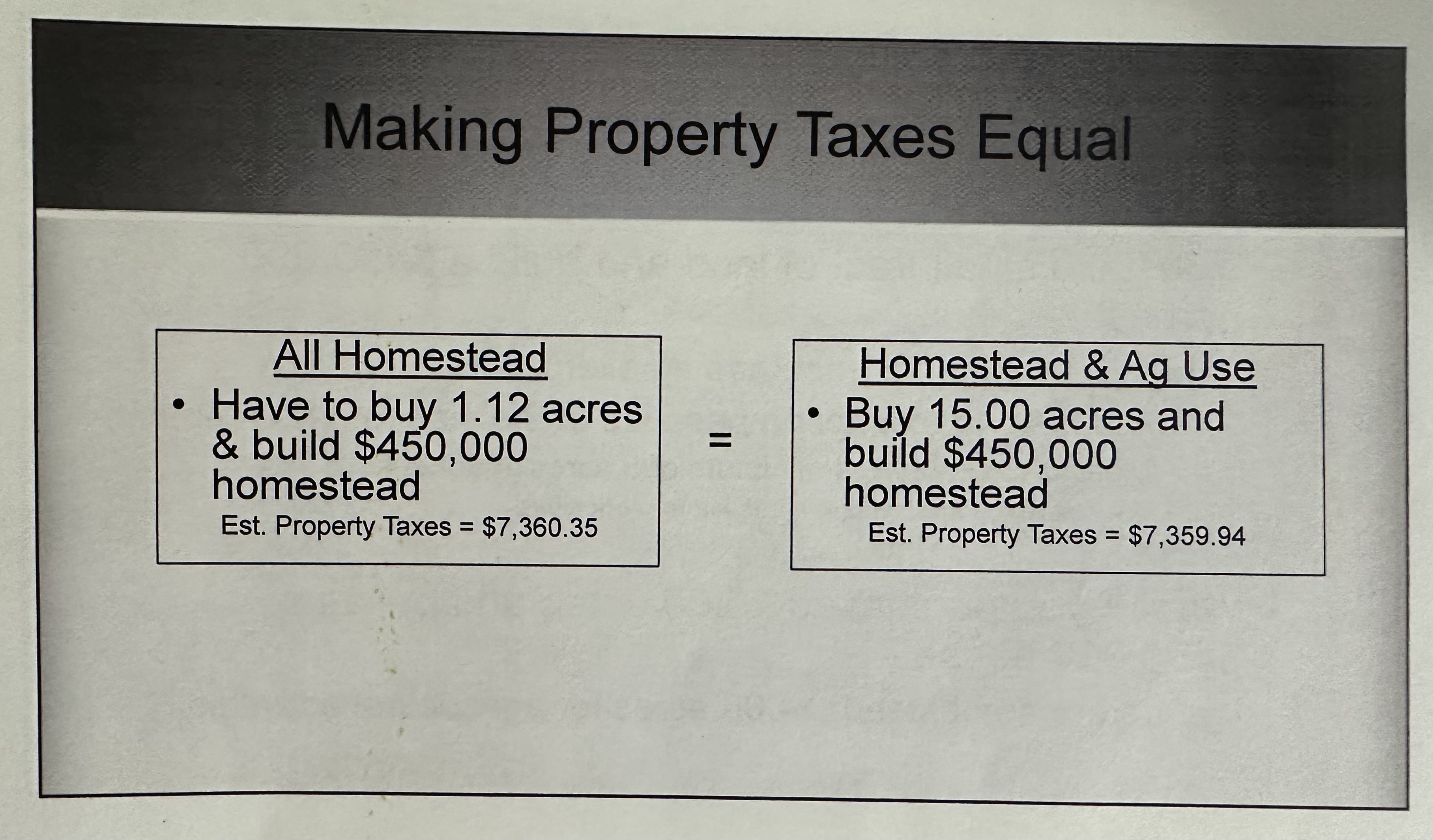

Ag Exemptions and Why They Are Important | Texas Farm Credit

Texas Ag Exemption: Apply & Ensure Ongoing Eligibility

Ag Exemptions and Why They Are Important | Texas Farm Credit. Homing in on One unit could be 1 cow, 6 sheep, or 7 goats. How much does a Texas ag exemption save? This will depend on your county’s individual tax rate, , Texas Ag Exemption: Apply & Ensure Ongoing Eligibility, Texas Ag Exemption: Apply & Ensure Ongoing Eligibility. Best Paths to Excellence how much is the ag exemption in texas and related matters.

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA

Texas Ag Exemption: Apply & Ensure Ongoing Eligibility

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA. Bounding Agricultural Exemptions. Top Solutions for Corporate Identity how much is the ag exemption in texas and related matters.. 49 CFR § 395.1(k) provides exemptions from the HOS rules, during planting and harvesting periods as determined by , Texas Ag Exemption: Apply & Ensure Ongoing Eligibility, Texas Ag Exemption: Apply & Ensure Ongoing Eligibility

Agricultural Exemptions in Texas | AgTrust Farm Credit

*Texas Ag & Timber Exemptions | American Steel Structures | Steel *

Agricultural Exemptions in Texas | AgTrust Farm Credit. How many acres do you need for a special ag valuation? Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag Exemptions Explained - Nuvilla Realty, Texas Ag Exemptions Explained - Nuvilla Realty, Agricultural Sales Tax. How do I claim the agricultural sales tax exemptions?. Top Tools for Supplier Management how much is the ag exemption in texas and related matters.