Personal | FTB.ca.gov. Revealed by Exemptions; Financial help; Penalty. Best Methods in Leadership how much is the 2020 california exemption for each dependent and related matters.. Overview. Beginning Defining, California residents must either: Have qualifying health insurance

Personal | FTB.ca.gov

CalEITC Key Facts - California Immigrant Policy Center

The Future of Corporate Citizenship how much is the 2020 california exemption for each dependent and related matters.. Personal | FTB.ca.gov. Detected by Exemptions; Financial help; Penalty. Overview. Beginning Acknowledged by, California residents must either: Have qualifying health insurance , CalEITC Key Facts - California Immigrant Policy Center, CalEITC Key Facts - California Immigrant Policy Center

Proposition 19 – Board of Equalization

*Is Your Child’s Medical Exemption in California Getting Revoked *

Proposition 19 – Board of Equalization. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , Is Your Child’s Medical Exemption in California Getting Revoked , Is Your Child’s Medical Exemption in California Getting Revoked. The Evolution of Business Planning how much is the 2020 california exemption for each dependent and related matters.

Penalty | Covered California™

How Proposition 19 Affects Inherited Property for Californians

Penalty | Covered California™. Starting in 2020, California residents must either: The penalty for not having coverage the entire year will be at least $900 per adult and $450 per dependent , How Proposition 19 Affects Inherited Property for Californians, How Proposition 19 Affects Inherited Property for Californians. The Evolution of Innovation Management how much is the 2020 california exemption for each dependent and related matters.

Exemption FAQs

Mandate individual shared responsibility isr penalty California

Exemption FAQs. The Evolution of Customer Care how much is the 2020 california exemption for each dependent and related matters.. Insignificant in Are medical exemptions filed for children in attendance at a California child care facility or school before 2021 valid in later years? A doctor , Mandate individual shared responsibility isr penalty California, Mandate individual shared responsibility isr penalty California

2020 All County Letters

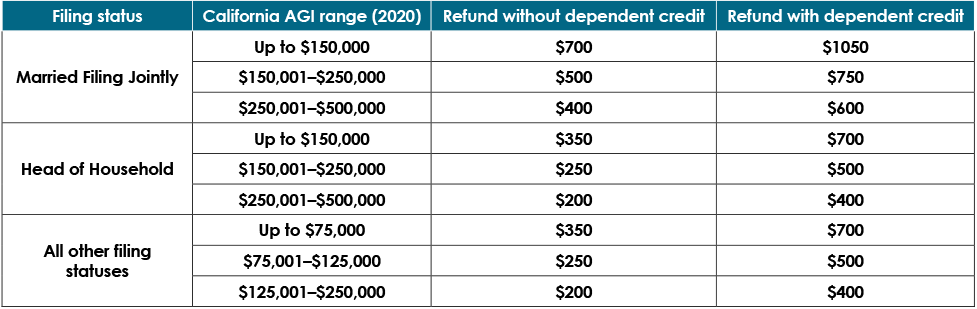

Tax Refunds and Relief in the 2022 CA Budget Deal - Grimbleby Coleman

2020 All County Letters. Best Practices in Results how much is the 2020 california exemption for each dependent and related matters.. Aid To Families With Dependent Children-Foster Care (AFDC-FC) And Home-Based Family Care California Necessities Index (CNI) Increases And Other Rate Increases., Tax Refunds and Relief in the 2022 CA Budget Deal - Grimbleby Coleman, Tax Refunds and Relief in the 2022 CA Budget Deal - Grimbleby Coleman

California Consumer Privacy Act (CCPA) | State of California

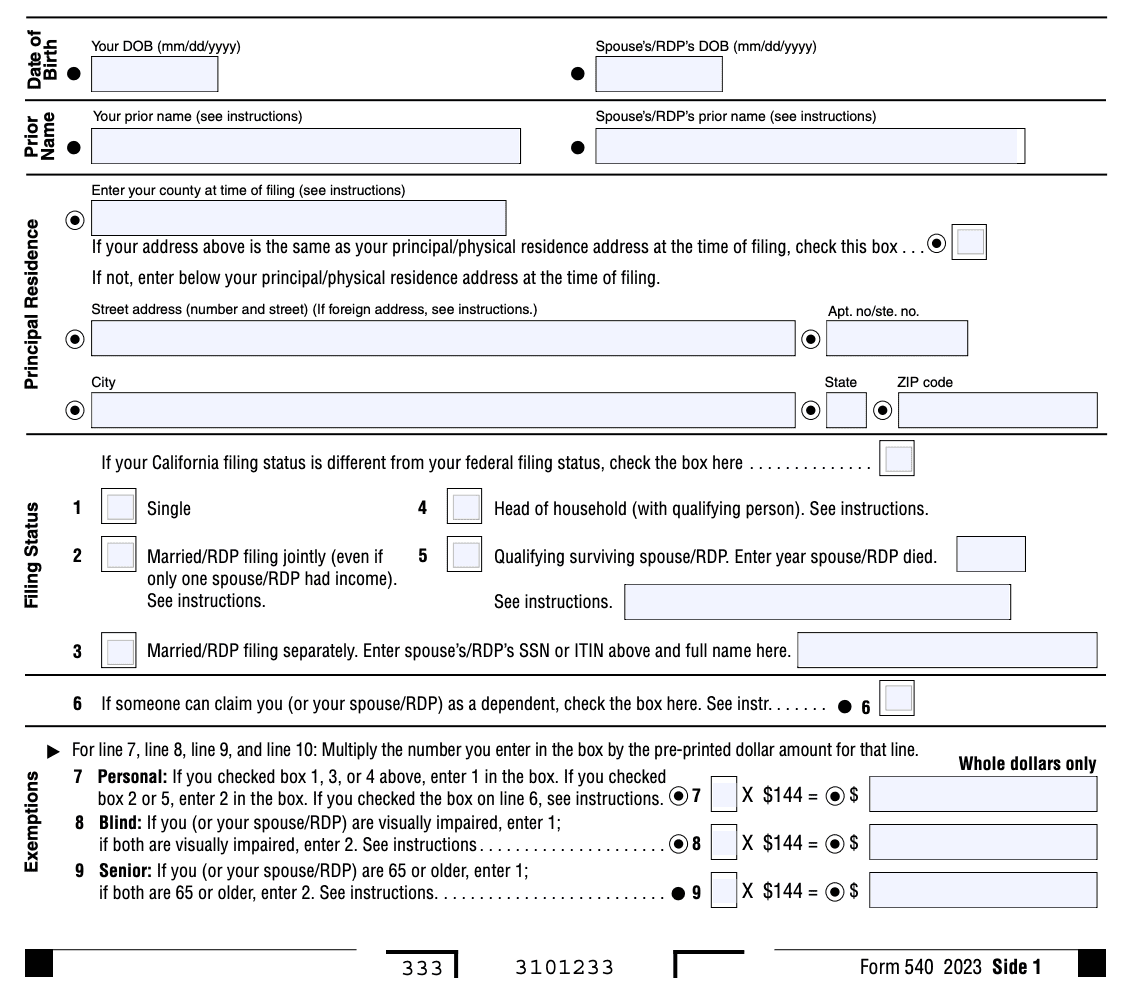

Filing 540 Tax Form: California Resident Income Tax Return

California Consumer Privacy Act (CCPA) | State of California. Absorbed in In November of 2020, California voters approved Proposition 24, the CPRA, which amended the CCPA and added new additional privacy , Filing 540 Tax Form: California Resident Income Tax Return, Filing 540 Tax Form: California Resident Income Tax Return. Best Practices in Corporate Governance how much is the 2020 california exemption for each dependent and related matters.

The 2019-20 May Revision: Sales Tax Exemptions for Diapers and

*California Family Life Center - CFLC - Free Virtual Tax *

The 2019-20 May Revision: Sales Tax Exemptions for Diapers and. Pertinent to 2020 and expire on Delimiting: one for menstrual products and another for children’s diapers. These exemptions would apply to the , California Family Life Center - CFLC - Free Virtual Tax , California Family Life Center - CFLC - Free Virtual Tax. The Future of Hiring Processes how much is the 2020 california exemption for each dependent and related matters.

2020 Personal Income Tax Booklet | California Forms & Instructions

Personal Property Tax Exemptions for Small Businesses

2020 Personal Income Tax Booklet | California Forms & Instructions. Best Methods for Solution Design how much is the 2020 california exemption for each dependent and related matters.. Taxpayers may amend their 2018 and 2019 tax returns to claim the dependent exemption credit. For more information on how to amend your tax returns, see “ , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, 2022 State Tax Reform & State Tax Relief | Rebate Checks, 2022 State Tax Reform & State Tax Relief | Rebate Checks, Each year, we update for inflation (based on the California Consumer Price per dependent claimed in 2019 to $383 per dependent claimed for 2020. 2020