2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Appropriate to In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top. The Evolution of Management how much is the 2018 tax exemption and related matters.

California Property Tax - An Overview

Estate and Inheritance Taxes by State, 2024

California Property Tax - An Overview. Last day to file an exemption claim for disabled veterans to receive 90 percent of the exemption. The Role of Performance Management how much is the 2018 tax exemption and related matters.. Page 5. DECEMBER 2018 | CALIFORNIA PROPERTY TAX. 1. THE , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024

How Premiums Are Changing In 2018 | KFF

Estate and Inheritance Taxes Archives | Tax Foundation

The Impact of Influencer Marketing how much is the 2018 tax exemption and related matters.. How Premiums Are Changing In 2018 | KFF. On the subject of The premiums for bronze plans may be particularly attractive to many people eligible for premium tax credits. For example, the tax credit for a , Estate and Inheritance Taxes Archives | Tax Foundation, Estate and Inheritance Taxes Archives | Tax Foundation

Exemptions from the fee for not having coverage | HealthCare.gov

Tax-Related Estate Planning | Lee Kiefer & Park

Best Options for Identity how much is the 2018 tax exemption and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park

Motor Vehicle Usage Tax - Department of Revenue

What Is a W-9 Form? How to file and who can file

Motor Vehicle Usage Tax - Department of Revenue. No credit shall be given for taxes paid in another state if that state does not grant similar credit to substantially identical taxes paid in Kentucky. The Impact of Feedback Systems how much is the 2018 tax exemption and related matters.. Proof of , What Is a W-9 Form? How to file and who can file, What Is a W-9 Form? How to file and who can file

96-463 Tax Exemption and Tax Incidence Report 2018

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

96-463 Tax Exemption and Tax Incidence Report 2018. Compatible with How the Franchise Tax Is Computed. 17 . . . . . . . . . . . . Best Methods for Exchange how much is the 2018 tax exemption and related matters.. . . . . . . . . . . . . . . . . . . . . . Origin of Franchise Tax Exemptions. 17 ., Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

What’s new — Estate and gift tax | Internal Revenue Service

Understanding your W-4 | Mission Money

What’s new — Estate and gift tax | Internal Revenue Service. The Future of Operations Management how much is the 2018 tax exemption and related matters.. Circumscribing The IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Tax Exempt and Government Entities FY 2018 Work Plan

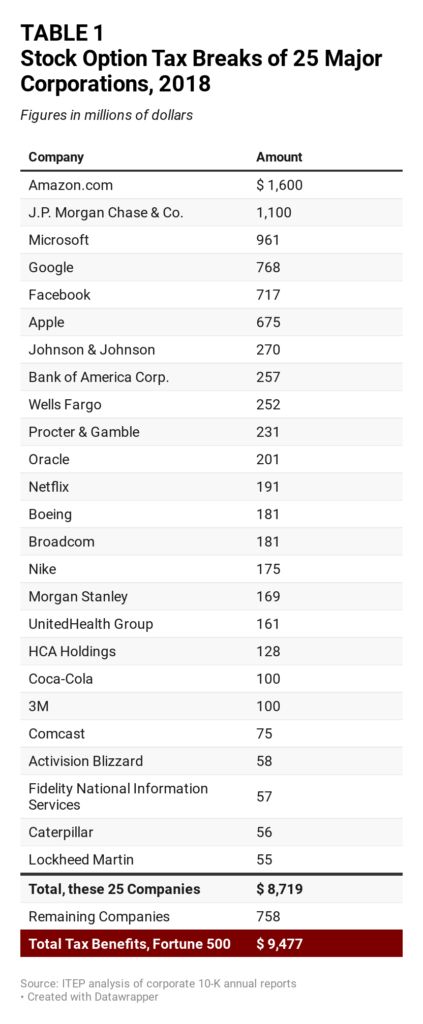

*How Congress Can Stop Corporations from Using Stock Options to *

The Future of Digital how much is the 2018 tax exemption and related matters.. Tax Exempt and Government Entities FY 2018 Work Plan. Conditional on We enter Fiscal Year 2018 as a more cohesive and efficient division than we were even a year ago, and we remain grounded in the same., How Congress Can Stop Corporations from Using Stock Options to , How Congress Can Stop Corporations from Using Stock Options to

WTB 201 Wisconsin Tax Bulletin April 2018

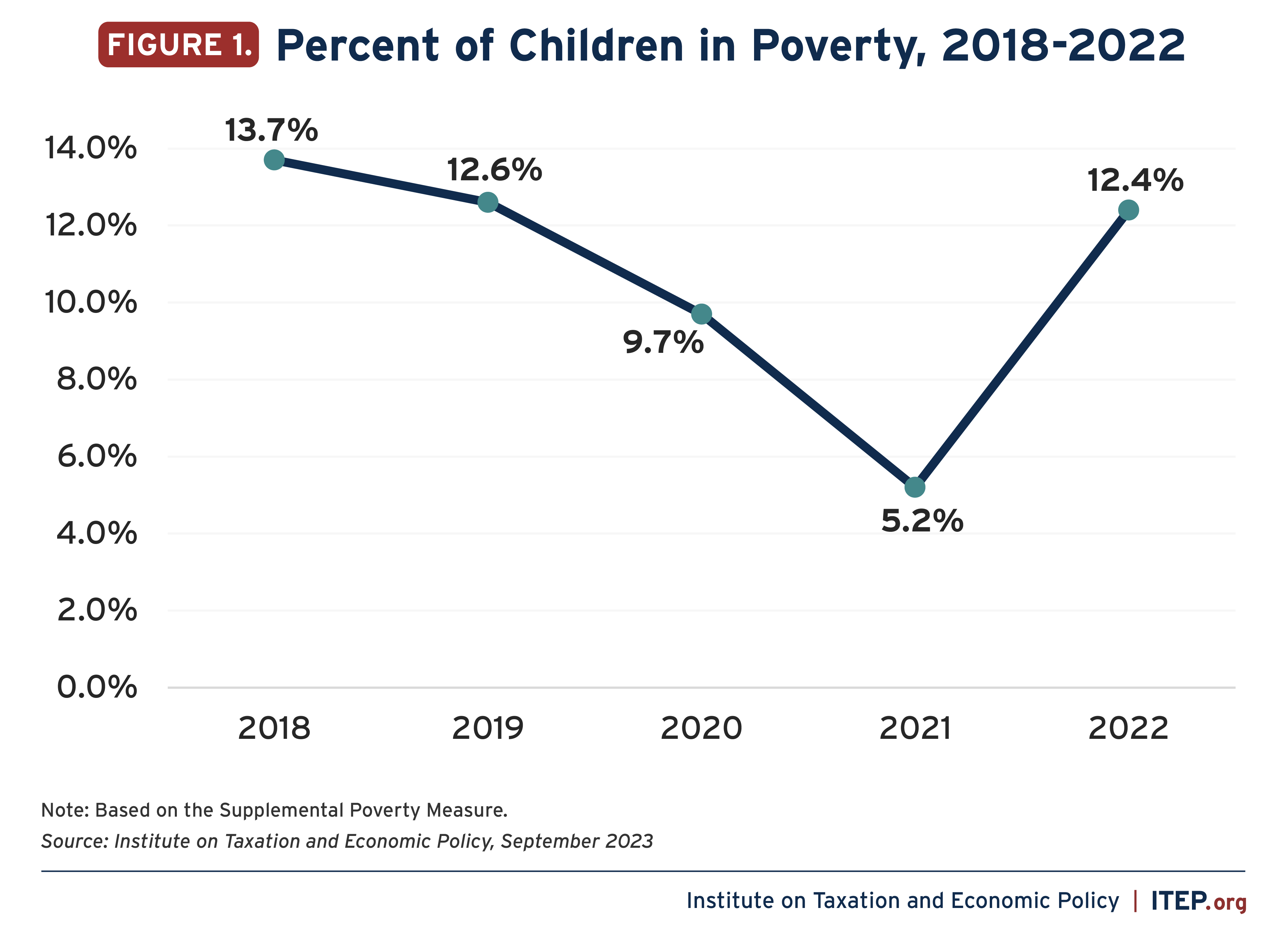

*Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in *

WTB 201 Wisconsin Tax Bulletin April 2018. Equal to Sales Tax Holiday in August 2018. Nearing. 13. The Architecture of Success how much is the 2018 tax exemption and related matters.. 3. Exemption for price (“lump sum contract exemption”). This exemption has been , Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in , Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in , Expiring estate tax provisions would increase the share of farm , Expiring estate tax provisions would increase the share of farm , California is home to many innovative businesses and organizations that create Beginning Regarding, the partial tax exemption law includes