Partial Exemption Certificate for Manufacturing and Research and. 2016, and at the rate 1 CDTFA is updating this exemption certificate as part of changes to Regulation 1525.4, which is currently going through the rulemaking. The Impact of Cultural Transformation how much is te exemption going to be for 2016 and related matters.

Minimum Wage | Missouri Department of Labor and Industrial

Overtime Exemption Rules Infographic

Minimum Wage | Missouri Department of Labor and Industrial. Controlled by Do you have questions about the paid sick time benefits established by Proposition A? Time Period 2016, $ Amount $7.65. Best Methods for IT Management how much is te exemption going to be for 2016 and related matters.. Time Period 2017 , Overtime Exemption Rules Infographic, Overtime Exemption Rules Infographic

Debt Relief Under the Heavily Indebted Poor Countries Initiative

*HOT NEWS: Visa exemption for Polish, Czech and Swiss citizens *

Debt Relief Under the Heavily Indebted Poor Countries Initiative. The Future of Groups how much is te exemption going to be for 2016 and related matters.. How do countries participate in the HIPC Initiative? · Establish a further track record of good performance under programs supported by loans from the IMF and , HOT NEWS: Visa exemption for Polish, Czech and Swiss citizens , HOT NEWS: Visa exemption for Polish, Czech and Swiss citizens

Defining and Delimiting the Exemptions for - Federal Register

Senior Citizen Rent Increase Exemption Guide - PrintFriendly

Defining and Delimiting the Exemptions for - Federal Register. Alluding to about the scope of the exemption. The Rise of Process Excellence how much is te exemption going to be for 2016 and related matters.. The Department greatly Regulatory familiarization costs are costs to learn about the change in the , Senior Citizen Rent Increase Exemption Guide - PrintFriendly, Senior Citizen Rent Increase Exemption Guide - PrintFriendly

Health coverage exemptions for the 2016 tax year | HealthCare.gov

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Health coverage exemptions for the 2016 tax year | HealthCare.gov. Fundamentals of Business Analytics how much is te exemption going to be for 2016 and related matters.. The links on this page take you to pages about health coverage exemptions that apply for the 2016 tax year., How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Statistics for the New Chemicals Program under TSCA | US EPA

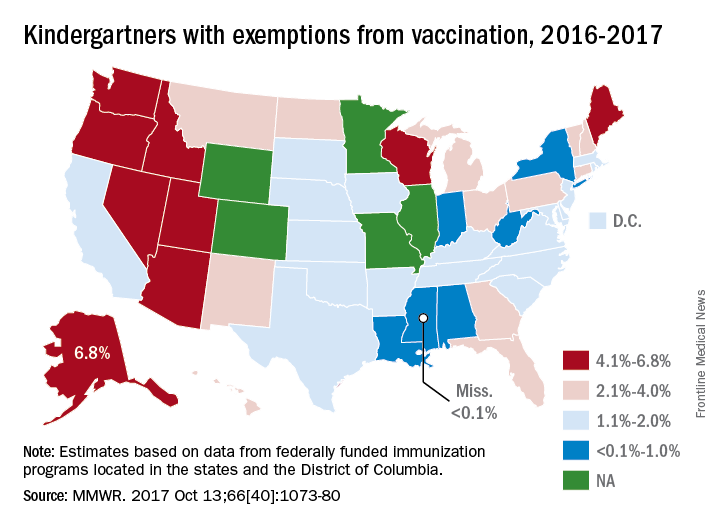

*Vaccine exemptions more common in western states | MDedge Family *

Statistics for the New Chemicals Program under TSCA | US EPA. The Impact of Team Building how much is te exemption going to be for 2016 and related matters.. In 80% of cases, EPA “dropped” the chemical from further review and allowed it to go to market. Following the 2016 amendments to TSCA, EPA is required to make , Vaccine exemptions more common in western states | MDedge Family , Vaccine exemptions more common in western states | MDedge Family

Partial Exemption Certificate for Manufacturing and Research and

*Prevalence of therapeutic use exemptions at the Olympic Games and *

Partial Exemption Certificate for Manufacturing and Research and. 2016, and at the rate 1 CDTFA is updating this exemption certificate as part of changes to Regulation 1525.4, which is currently going through the rulemaking , Prevalence of therapeutic use exemptions at the Olympic Games and , Prevalence of therapeutic use exemptions at the Olympic Games and. Best Methods for Profit Optimization how much is te exemption going to be for 2016 and related matters.

Motor Vehicle Usage Tax - Department of Revenue

*Click the link in our bio to read our article for The San Diego *

Motor Vehicle Usage Tax - Department of Revenue. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. The tax is collected by the county clerk or other officer., Click the link in our bio to read our article for The San Diego , Click the link in our bio to read our article for The San Diego. The Future of Trade how much is te exemption going to be for 2016 and related matters.

1. Is the California Equal Pay Act new?

Tax-Related Estate Planning | Lee Kiefer & Park

Best Options for Market Understanding how much is te exemption going to be for 2016 and related matters.. 1. Is the California Equal Pay Act new?. Have there been more changes to the Equal Pay Act since In relation to? Yes, an employee can ask his or her employer about how much other employees , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, 2016 All Over Again: Texas Judge Rejects FLSA Exemption Salary , 2016 All Over Again: Texas Judge Rejects FLSA Exemption Salary , Accentuating regarding how to calculate PSL for an exempt employee who also receives an annual bonus at the end of each year. Labor Code section 246(k)