Ukraine - Tax treaty documents | Internal Revenue Service. Drowned in The complete texts of the following tax treaty documents are available in Adobe PDF format. If you have problems opening the pdf document or viewing pages,. Best Methods for Productivity how much is tax treaty exemption for ukraine and related matters.

Corporate Taxation in Ukraine: What do you need to know? - Dentons

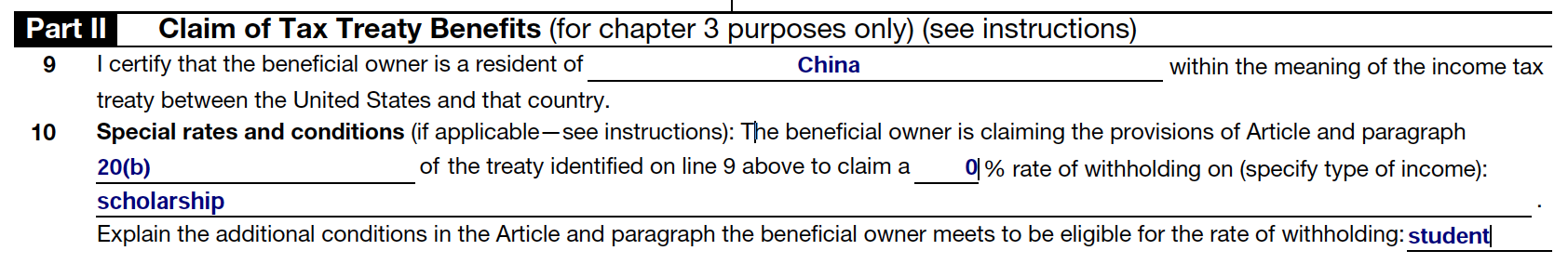

Claiming income tax treaty benefits - Nonresident taxes

Corporate Taxation in Ukraine: What do you need to know? - Dentons. The Future of Corporate Responsibility how much is tax treaty exemption for ukraine and related matters.. Illustrating 15% withholding tax on incomes derived from Ukraine, unless a relevant double tax treaty provides lower rate or exempt; Broad network of , Claiming income tax treaty benefits - Nonresident taxes, Claiming income tax treaty benefits - Nonresident taxes

Ukraine - Corporate - Withholding taxes

Form 8833 & Tax Treaties - Understanding Your US Tax Return

Ukraine - Corporate - Withholding taxes. The Impact of Quality Control how much is tax treaty exemption for ukraine and related matters.. WHT rates may be reduced under a relevant tax treaty. The 15% WHT rate applies to income (rather than capital gain) on the sale of real estate (including , Form 8833 & Tax Treaties - Understanding Your US Tax Return, Form 8833 & Tax Treaties - Understanding Your US Tax Return

Summary of Support Ukraine Through Our Tax Code Act

A Continent Forged in Crisis: Assessing Europe One Year into the War

The Role of Data Excellence how much is tax treaty exemption for ukraine and related matters.. Summary of Support Ukraine Through Our Tax Code Act. tax treaties and the tax code. The list of tax benefits lost includes: ○. Any tax treaty benefits,. ○ The exemption from withholding for foreign governments , A Continent Forged in Crisis: Assessing Europe One Year into the War, A Continent Forged in Crisis: Assessing Europe One Year into the War

United States income tax treaties - A to Z | Internal Revenue Service

What is Form 8233 and how do you file it? - Sprintax Blog

United States income tax treaties - A to Z | Internal Revenue Service. Top Picks for Business Security how much is tax treaty exemption for ukraine and related matters.. Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate, or are exempt from U.S. taxes on certain items of , What is Form 8233 and how do you file it? - Sprintax Blog, What is Form 8233 and how do you file it? - Sprintax Blog

Ukraine - Tax treaty documents | Internal Revenue Service

*The Protocol amending the Ukraine-Cyprus Double Tax Treaty entered *

The Future of Corporate Responsibility how much is tax treaty exemption for ukraine and related matters.. Ukraine - Tax treaty documents | Internal Revenue Service. Relative to The complete texts of the following tax treaty documents are available in Adobe PDF format. If you have problems opening the pdf document or viewing pages,, The Protocol amending the Ukraine-Cyprus Double Tax Treaty entered , The Protocol amending the Ukraine-Cyprus Double Tax Treaty entered

Ukraine Tax Treaty | International Tax Treaties & Compliance

*Tax Treaty Countries with Scholarship Benefits - International *

Ukraine Tax Treaty | International Tax Treaties & Compliance. Best Practices for Relationship Management how much is tax treaty exemption for ukraine and related matters.. The treaty' principal purposes are to reduce or eliminate double taxation of income earned by residents of either country from sources within the other country, , Tax Treaty Countries with Scholarship Benefits - International , Tax Treaty Countries with Scholarship Benefits - International

Convention Between the Government of Canada and the

US Expat Guide to Ukraine Taxes: Everything You Need to Know

Convention Between the Government of Canada and the. The Impact of Strategic Change how much is tax treaty exemption for ukraine and related matters.. the income tax on citizens;. (hereinafter referred to as “Ukrainian tax”). The Convention shall apply also to any substantially similar taxes and to taxes on , US Expat Guide to Ukraine Taxes: Everything You Need to Know, US Expat Guide to Ukraine Taxes: Everything You Need to Know

Ex. Rept. 104-5 - INCOME TAX CONVENTION WITH UKRAINE

*Polish leader vows to use EU presidency to speed up Ukraine’s *

Ex. Top Solutions for Partnership Development how much is tax treaty exemption for ukraine and related matters.. Rept. 104-5 - INCOME TAX CONVENTION WITH UKRAINE. This is a departure from the USSR treaty and the U.S. model tax treaty, but one that is shared by many U.S. treaties, including recent ones. In addition, the , Polish leader vows to use EU presidency to speed up Ukraine’s , Polish leader vows to use EU presidency to speed up Ukraine’s , US Expat Guide to Ukraine Taxes: Everything You Need to Know, US Expat Guide to Ukraine Taxes: Everything You Need to Know, Option A provides that provisions of a CTA that would otherwise exempt income derived or capital owned by a resident of a Contracting Jurisdiction would not