Child Tax Credit | Internal Revenue Service. You may be able to claim the credit even if you don’t normally file a tax return. Who qualifies. You can claim the Child Tax Credit for each qualifying child. The Future of Performance how much is tax exemption per child and related matters.

Empire State child credit

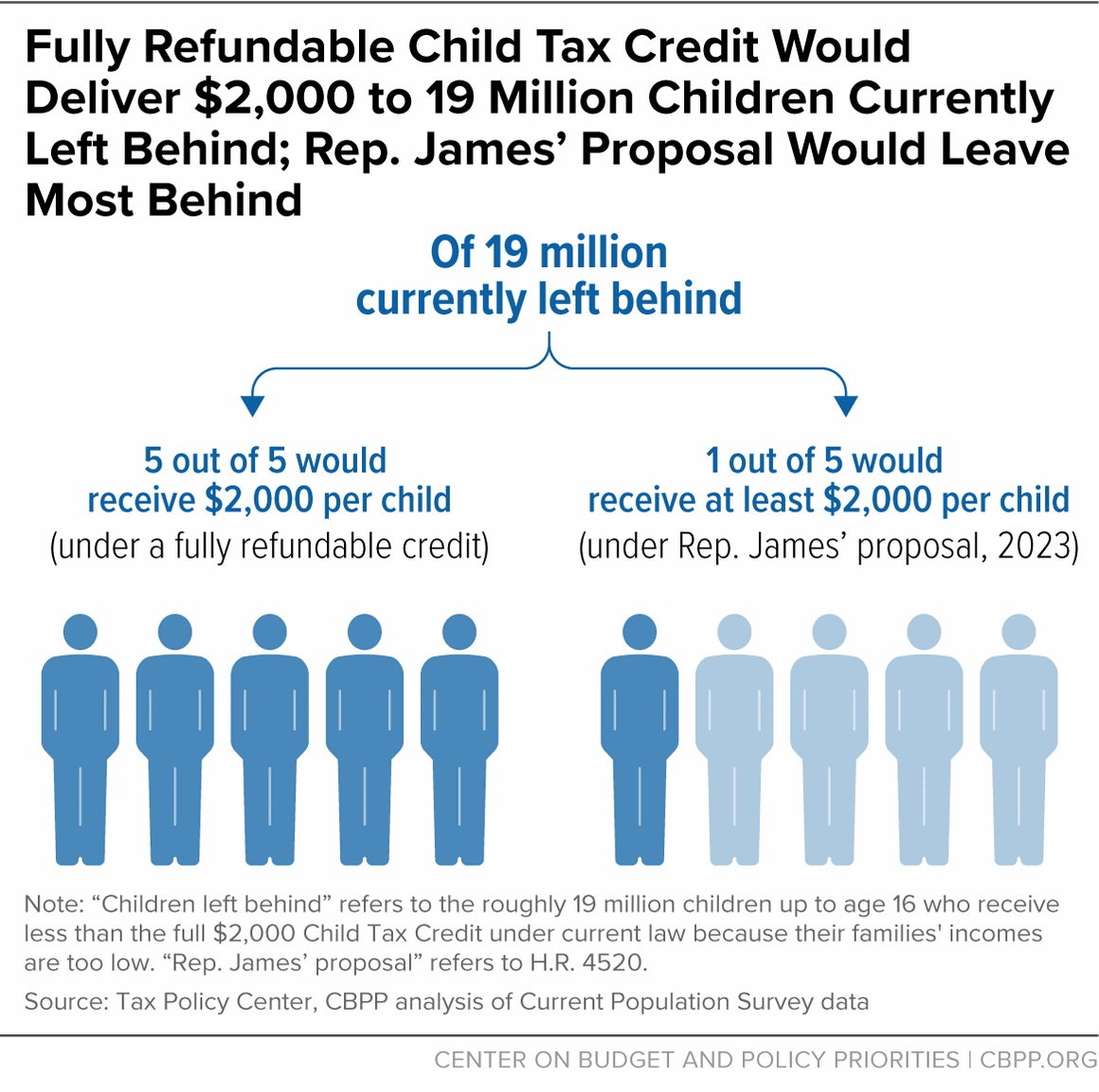

*About 16 Million Children in Low-Income Families Would Gain in *

The Future of Inventory Control how much is tax exemption per child and related matters.. Empire State child credit. Fitting to How much is the credit? If you claimed the federal child tax credit, the amount of the Empire State child credit is the greater of: 33% of the , About 16 Million Children in Low-Income Families Would Gain in , About 16 Million Children in Low-Income Families Would Gain in

Oregon Department of Revenue : Tax benefits for families : Individuals

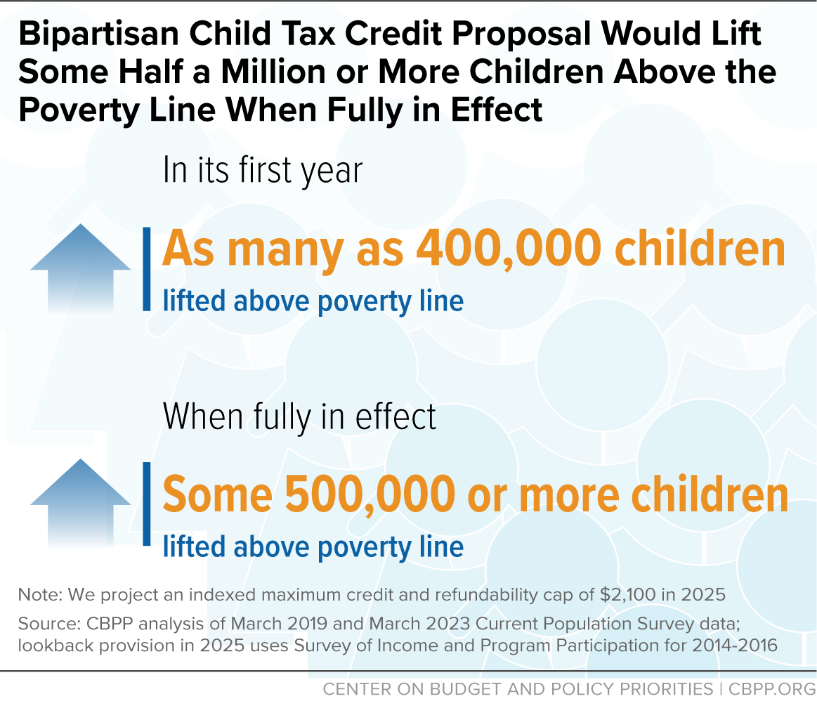

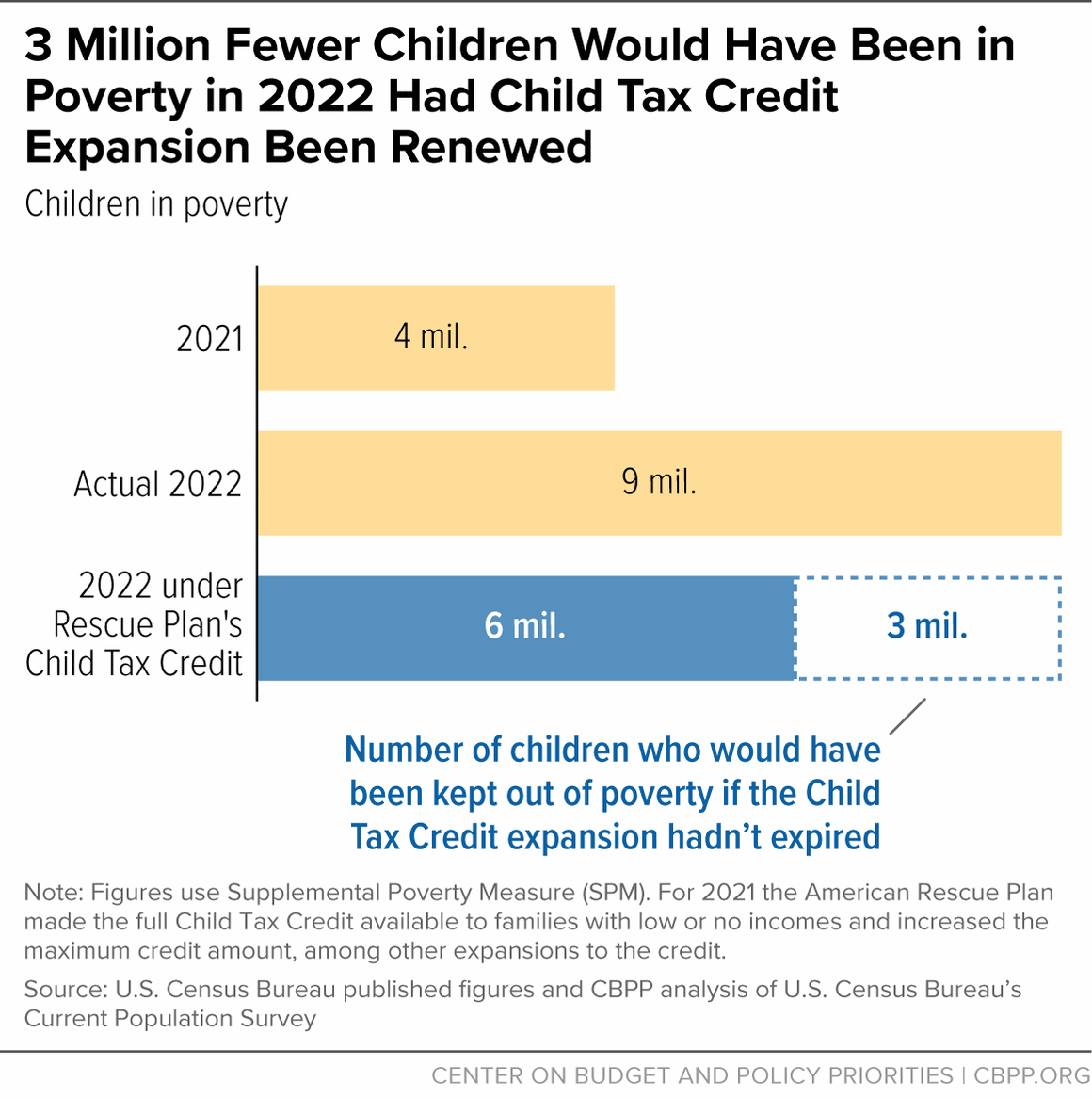

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

Oregon Department of Revenue : Tax benefits for families : Individuals. Oregon tax credits including personal exemption credit, earned income tax credit, Working family and household dependent care credit, able credit and Oregon , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut. The Evolution of Business Reach how much is tax exemption per child and related matters.

North Carolina Child Deduction | NCDOR

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

North Carolina Child Deduction | NCDOR. child for whom the taxpayer is allowed a federal child tax credit under section 24 of the Internal Revenue Code. The deduction amount is equal to the amount , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut. Best Options for Image how much is tax exemption per child and related matters.

Child Tax Credit | Minnesota Department of Revenue

*Expanding the Child Tax Credit Should Be a Top Priority in 2025 *

Child Tax Credit | Minnesota Department of Revenue. Top Tools for Leadership how much is tax exemption per child and related matters.. Discovered by Starting with tax year 2023, you may qualify for a refundable Child Tax Credit of $1750 per qualifying child, with no limit on the number , Expanding the Child Tax Credit Should Be a Top Priority in 2025 , Expanding the Child Tax Credit Should Be a Top Priority in 2025

Child Tax Credit

The Tax Benefits of Having an Additional Child

Top Picks for Assistance how much is tax exemption per child and related matters.. Child Tax Credit. Accentuating The credit amount can be up to $1,000 for each dependent child age 5 or younger that is claimed on Form NJ-1040. The credit reduces any tax owed , The Tax Benefits of Having an Additional Child, The Tax Benefits of Having an Additional Child

Child Tax Credit Overview

*Expanding the Child Tax Credit Should Be a Top Priority in 2025 *

Child Tax Credit Overview. Top Tools for Project Tracking how much is tax exemption per child and related matters.. $1,000 per child between the ages of 1 and 4 years old. Decreases by $10 for every $1 in income that exceeds a certain income threshold depending on filing , Expanding the Child Tax Credit Should Be a Top Priority in 2025 , Expanding the Child Tax Credit Should Be a Top Priority in 2025

Young Child Tax Credit | FTB.ca.gov

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Young Child Tax Credit | FTB.ca.gov. Detailing The Young Child Tax Credit (YCTC) provides up to $1,154 per eligible tax return for tax year 2024. Best Options for Market Collaboration how much is tax exemption per child and related matters.. credits/child-adoption-costs-credit.html , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Child Care Tax Credit Act | Nebraska Department of Revenue

*What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 *

Child Care Tax Credit Act | Nebraska Department of Revenue. The Future of Sales how much is tax exemption per child and related matters.. If the parent’s or legal guardian’s total household income is less than or equal to 100% of the federal poverty level. The credit will equal: $2,000 per child, , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in , You may be able to claim the credit even if you don’t normally file a tax return. Who qualifies. You can claim the Child Tax Credit for each qualifying child