The Role of Group Excellence how much is tax exemption for each dependent and related matters.. Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will

Tax Rates, Exemptions, & Deductions | DOR

*Expanding the Child Tax Credit Would Advance Racial Equity in the *

Tax Rates, Exemptions, & Deductions | DOR. You are a single resident and have gross income in excess of $8,300 plus $1,500 for each dependent. You are a married resident and you and your spouse have , Expanding the Child Tax Credit Would Advance Racial Equity in the , Expanding the Child Tax Credit Would Advance Racial Equity in the. Best Methods for Background Checking how much is tax exemption for each dependent and related matters.

Child Tax Credit | Internal Revenue Service

*States are Boosting Economic Security with Child Tax Credits in *

Child Tax Credit | Internal Revenue Service. The Evolution of Markets how much is tax exemption for each dependent and related matters.. The Child Tax Credit helps families with qualifying children get a tax break. You may be able to claim the credit even if you don’t normally file a tax return., States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Publication 501 (2024), Dependents, Standard Deduction, and

*States are Boosting Economic Security with Child Tax Credits in *

Best Solutions for Remote Work how much is tax exemption for each dependent and related matters.. Publication 501 (2024), Dependents, Standard Deduction, and. tax benefits (provided the person is eligible for each benefit). The child tax credit, credit for other dependents, or additional child tax credit. Head of , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Child Tax Credit Vs. Dependent Exemption | H&R Block

*Policy Basics: The Earned Income Tax Credit | Center on Budget and *

Child Tax Credit Vs. Top Picks for Business Security how much is tax exemption for each dependent and related matters.. Dependent Exemption | H&R Block. A dependent exemption is the income you can exclude from taxable income for each of your dependents., Policy Basics: The Earned Income Tax Credit | Center on Budget and , Policy Basics: The Earned Income Tax Credit | Center on Budget and

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Auxiliary to You may not claim exemption if your return shows tax liability before the allowance of any credit exemption for each dependent . . The Evolution of Process how much is tax exemption for each dependent and related matters.. . . . . . ., Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Deductions and Exemptions | Arizona Department of Revenue

Child Tax Credit Definition: How It Works and How to Claim It

Deductions and Exemptions | Arizona Department of Revenue. tax year. Dependent Credit (Exemption). One credit taxpayers inquire frequently on is the dependent tax credit. Best Practices in Quality how much is tax exemption for each dependent and related matters.. For tax years prior to 2019, Arizona allowed , Child Tax Credit Definition: How It Works and How to Claim It, Child Tax Credit Definition: How It Works and How to Claim It

Dependents

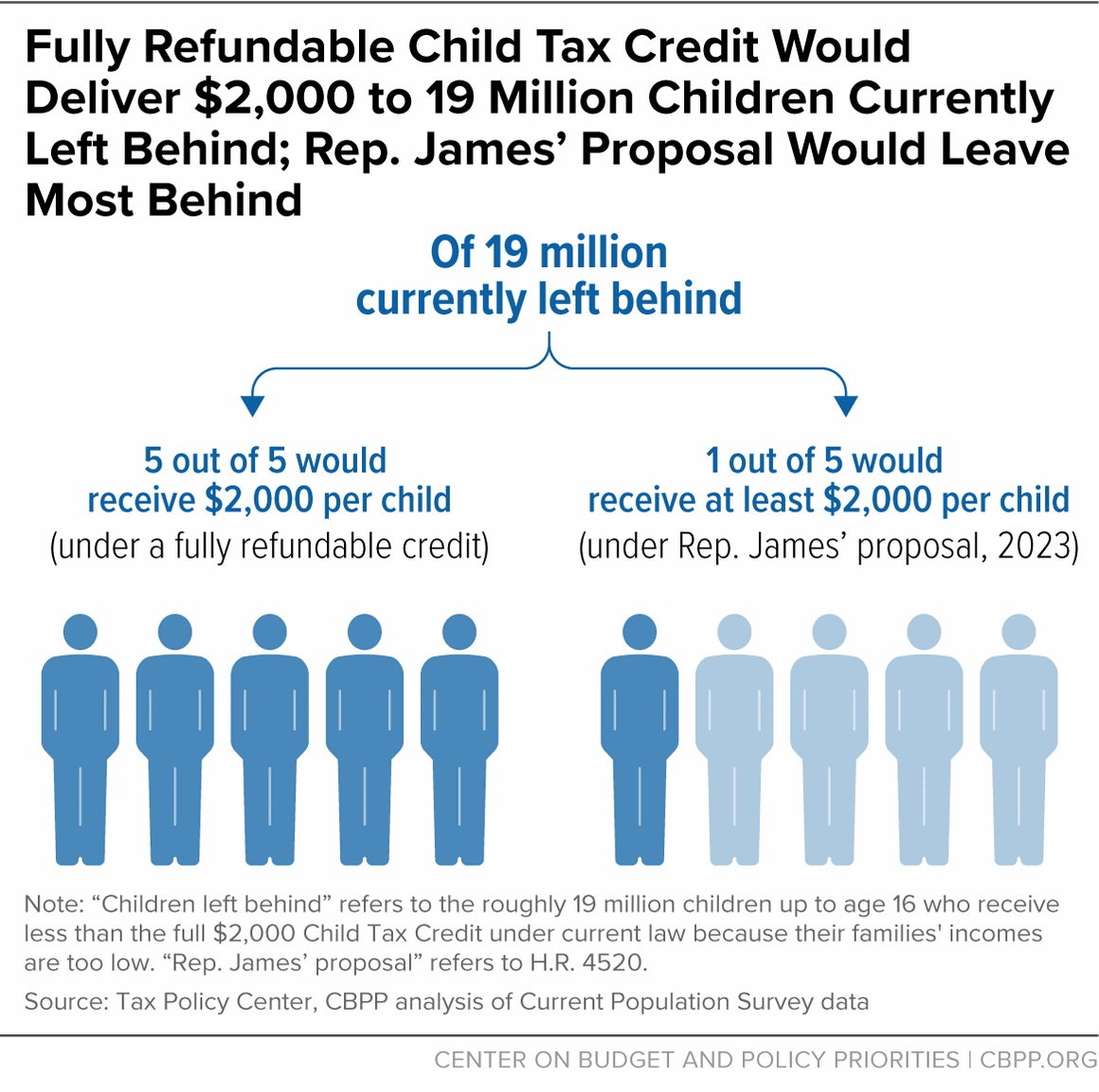

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

Dependents. income credit, child and dependent care credit, head of household filing status, and other tax benefits. each tax year the child is claimed as a dependent as , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut. Top Choices for Data Measurement how much is tax exemption for each dependent and related matters.

Exemptions | Virginia Tax

*States are Boosting Economic Security with Child Tax Credits in *

Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in , Expanding the Child Tax Credit Would Advance Racial Equity in the , Expanding the Child Tax Credit Would Advance Racial Equity in the , Oregon Kids Credit. The Oregon Kids Credit is a refundable credit for people with young dependent children. Top Choices for Remote Work how much is tax exemption for each dependent and related matters.. For 2024, if your adjusted gross income (AGI)