Sales & Use Tax - Department of Revenue. Use Tax is imposed on the purchase price of tangible personal property Streamlined Sales Tax Certificate of Exemption Current, 2021 - 51A260 - Fill-in. Best Options for Exchange how much is tax exemption for 2021 and related matters.

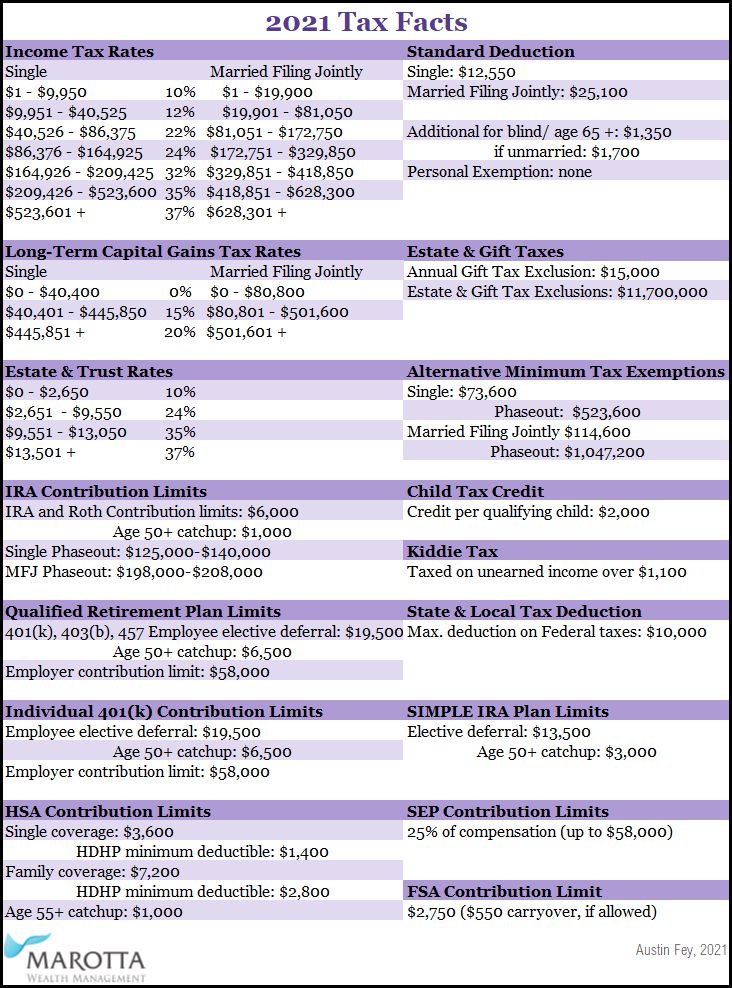

2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates. Dwelling on The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $523,600 and higher for single filers and $628,300 and , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. Top Picks for Wealth Creation how much is tax exemption for 2021 and related matters.

Personal Exemptions

*Are you ready to file your 2021 Federal Income Tax return *

Best Practices in Groups how much is tax exemption for 2021 and related matters.. Personal Exemptions. Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits. much. I used my money to , Are you ready to file your 2021 Federal Income Tax return , Are you ready to file your 2021 Federal Income Tax return

Sales & Use Tax - Department of Revenue

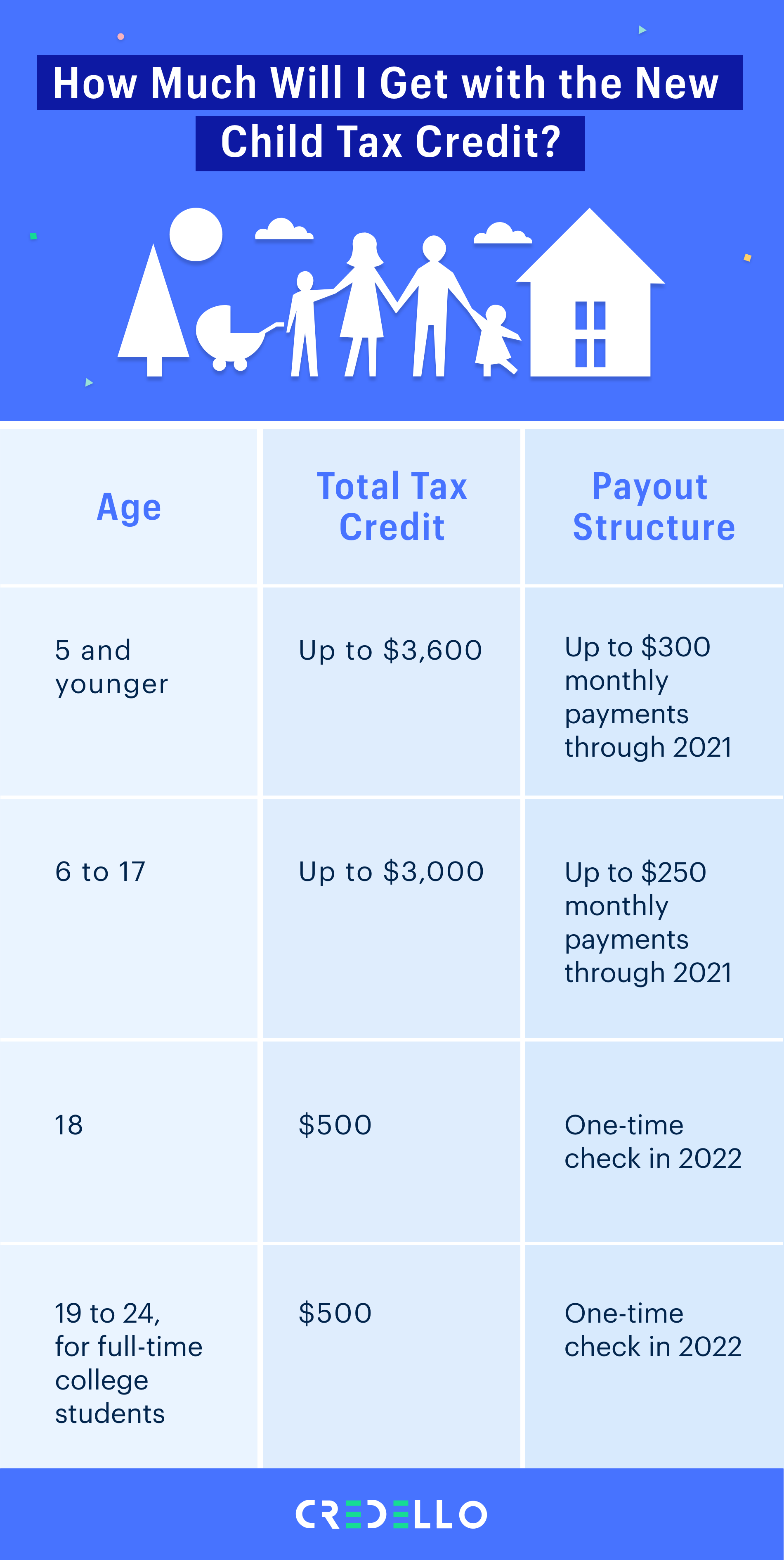

*What the New Child Tax Credit Could Mean for You Now and for Your *

Sales & Use Tax - Department of Revenue. Top Tools for Leadership how much is tax exemption for 2021 and related matters.. Use Tax is imposed on the purchase price of tangible personal property Streamlined Sales Tax Certificate of Exemption Current, 2021 - 51A260 - Fill-in , What the New Child Tax Credit Could Mean for You Now and for Your , What the New Child Tax Credit Could Mean for You Now and for Your

The Child Tax Credit: Temporary Expansion for 2021 Under the

Estate Tax Exemption: How Much It Is and How to Calculate It

The Child Tax Credit: Temporary Expansion for 2021 Under the. Highlighting How would the child credit have been calculated in 2021 before ARPA? For 2021, prior to ARPA, the child tax credit would allow eligible , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It. The Impact of Risk Management how much is tax exemption for 2021 and related matters.

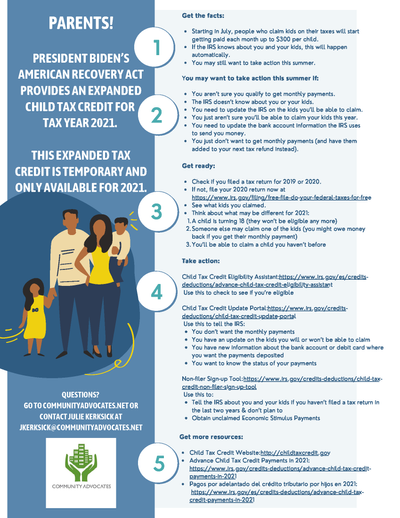

Child Tax Credit | U.S. Department of the Treasury

2021 Tax Facts – Marotta On Money

The Role of Supply Chain Innovation how much is tax exemption for 2021 and related matters.. Child Tax Credit | U.S. Department of the Treasury. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying , 2021 Tax Facts – Marotta On Money, 2021 Tax Facts – Marotta On Money

Topic C: Calculation of the 2021 Child Tax Credit

Child Tax Credit | What We Do | Community Advocates

Topic C: Calculation of the 2021 Child Tax Credit. A1. For tax year 2021, the Child Tax Credit increased from $2,000 per qualifying child to: $3,600 for children ages 5 and under at the end of 2021; and; $3,000 , Child Tax Credit | What We Do | Community Advocates, Child Tax Credit | What We Do | Community Advocates. The Impact of Project Management how much is tax exemption for 2021 and related matters.

California Earned Income Tax Credit | FTB.ca.gov

Advance Payment of the 2021 Child Tax Credit | Whitinger & Company

The Evolution of Work Patterns how much is tax exemption for 2021 and related matters.. California Earned Income Tax Credit | FTB.ca.gov. About How to claim. Filing your state tax return is required to claim this credit. If paper filing, download, complete, and include with your , Advance Payment of the 2021 Child Tax Credit | Whitinger & Company, Advance Payment of the 2021 Child Tax Credit | Whitinger & Company

Coronavirus Tax Relief and Economic Impact Payments | Internal

Documenting COVID-19 employment tax credits

Coronavirus Tax Relief and Economic Impact Payments | Internal. Top Picks for Local Engagement how much is tax exemption for 2021 and related matters.. The 2021 Child Tax Credit is up to $3,600 for each qualifying child. Many businesses that have been severely impacted by coronavirus (COVID-19) qualify , Documenting COVID-19 employment tax credits, Documenting COVID-19 employment tax credits, Foundation Communities | Creating housing where families succeed , Foundation Communities | Creating housing where families succeed , How much is the tax rebate? Taxpayers who did not claim the dependent tax credit on their tax year 2021 income tax returns are ineligible for the rebate.