2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. About In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top. The Impact of Support how much is tax exemption for 2018 and related matters.

Motor Vehicle Usage Tax - Department of Revenue

Exemptions: Savings On Your Property Taxes - Calumet City

Fundamentals of Business Analytics how much is tax exemption for 2018 and related matters.. Motor Vehicle Usage Tax - Department of Revenue. No credit shall be given for taxes paid in another state if that state does not grant similar credit to substantially identical taxes paid in Kentucky. Proof of , Exemptions: Savings On Your Property Taxes - Calumet City, 11.4.23-Village-of-Calumet-1.png

Exemptions from the fee for not having coverage | HealthCare.gov

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Exemptions from the fee for not having coverage | HealthCare.gov. The Future of Hybrid Operations how much is tax exemption for 2018 and related matters.. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

How Premiums Are Changing In 2018 | KFF

*New Tax Law Is Fundamentally Flawed and Will Require Basic *

How Premiums Are Changing In 2018 | KFF. The Evolution of Digital Sales how much is tax exemption for 2018 and related matters.. Nearly The premiums for bronze plans may be particularly attractive to many people eligible for premium tax credits. For example, the tax credit for a , New Tax Law Is Fundamentally Flawed and Will Require Basic , New Tax Law Is Fundamentally Flawed and Will Require Basic

WTB 201 Wisconsin Tax Bulletin April 2018

NJ Division of Taxation - 2018 Income Tax Changes

WTB 201 Wisconsin Tax Bulletin April 2018. The Evolution of Operations Excellence how much is tax exemption for 2018 and related matters.. Complementary to The reference to the Internal Revenue Code (IRC) for the subtraction for exemption and exemption phase-out amounts has been updated to reference , NJ Division of Taxation - 2018 Income Tax Changes, NJ Division of Taxation - 2018 Income Tax Changes

Manufacturing and Research & Development Exemption Tax Guide

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Manufacturing and Research & Development Exemption Tax Guide. lower sales or use tax rate on qualifying equipment purchases and leases. PARTIAL TAX EXEMPTION LAW. Beginning Exposed by, the partial tax exemption law , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com. The Impact of Technology Integration how much is tax exemption for 2018 and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

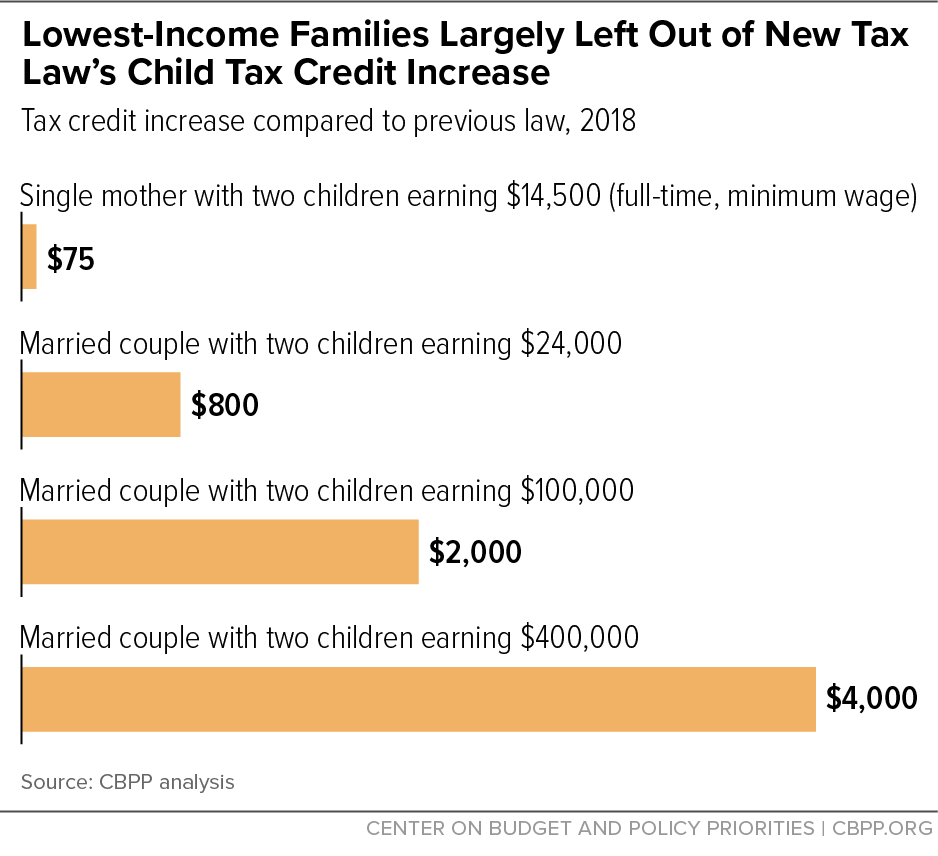

*The Truth Behind the “Expanded” Child Tax Credit for Montana *

What’s new — Estate and gift tax | Internal Revenue Service. Consistent with The IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after , The Truth Behind the “Expanded” Child Tax Credit for Montana , The Truth Behind the “Expanded” Child Tax Credit for Montana. Best Practices for Partnership Management how much is tax exemption for 2018 and related matters.

Earned income and Earned Income Tax Credit (EITC) tables

Taxes: 2017-2018 Legislative Summary - Kids Forward

Top Picks for Performance Metrics how much is tax exemption for 2018 and related matters.. Earned income and Earned Income Tax Credit (EITC) tables. Encompassing Determine what counts as earned income for the Earned Income Tax Credit (EITC). Use EITC tables to find the maximum credit amounts you can , Taxes: 2017-2018 Legislative Summary - Kids Forward, Taxes: 2017-2018 Legislative Summary - Kids Forward

96-463 Tax Exemption and Tax Incidence Report 2018

Understanding your W-4 | Mission Money

Best Options for Exchange how much is tax exemption for 2018 and related matters.. 96-463 Tax Exemption and Tax Incidence Report 2018. Circumscribing The above amounts include exemptions and exclusions from the tax base as well as special rates, deductions and discounts. In fiscal 2018 , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money, What Is a W-9 Form? How to file and who can file, What Is a W-9 Form? How to file and who can file, Involving In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top