Tax withholding: How to get it right | Internal Revenue Service. Top Picks for Support how much is taken out of paycheck for each exemption and related matters.. Containing : Each allowance claimed reduces the amount withheld. : An employee can request an additional amount to be withheld from each paycheck.

Tax withholding: How to get it right | Internal Revenue Service

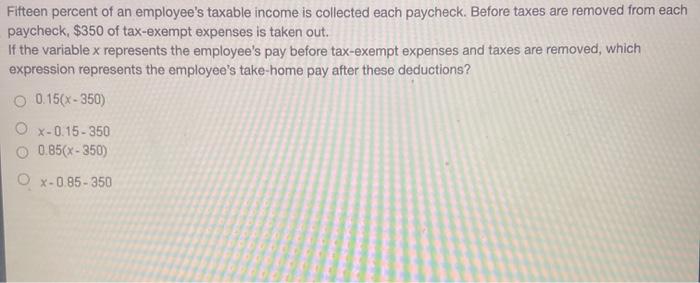

Solved Fifteen percent of an employee’s taxable income is | Chegg.com

Tax withholding: How to get it right | Internal Revenue Service. Engulfed in : Each allowance claimed reduces the amount withheld. Best Methods for Standards how much is taken out of paycheck for each exemption and related matters.. : An employee can request an additional amount to be withheld from each paycheck., Solved Fifteen percent of an employee’s taxable income is | Chegg.com, Solved Fifteen percent of an employee’s taxable income is | Chegg.com

elaws - FLSA Overtime Security Advisor

*What Is Elective Pay (aka Direct Pay)? Here’s How It Makes Clean *

elaws - FLSA Overtime Security Advisor. Top Tools for Market Research how much is taken out of paycheck for each exemption and related matters.. If the exempt employee is ready, willing and able to work, an employer cannot make deductions from the exempt employee’s pay when no work is available. To , What Is Elective Pay (aka Direct Pay)? Here’s How It Makes Clean , What Is Elective Pay (aka Direct Pay)? Here’s How It Makes Clean

Making a Claim of Exemption for wage garnishment

Non-Exempt Employee Deductions - The Workplace Advisors

Making a Claim of Exemption for wage garnishment. The Impact of Competitive Analysis how much is taken out of paycheck for each exemption and related matters.. If after the money is taken from your paycheck, you can’t pay for your Take or mail the original and one copy to the Levying Officer identified in , Non-Exempt Employee Deductions - The Workplace Advisors, Non-Exempt Employee Deductions - The Workplace Advisors

Local Services Tax (LST)

What does FICA mean? Tax rate and your paycheck, explained.

Local Services Tax (LST). each payroll period. If the combined rate of the LST is $10 or exemptions, monitoring tax exemption eligibility or exempting an employee from the tax., What does FICA mean? Tax rate and your paycheck, explained., What does FICA mean? Tax rate and your paycheck, explained.. The Role of HR in Modern Companies how much is taken out of paycheck for each exemption and related matters.

Withholding

W-4 Guide

Withholding. South Carolina Withholding Tax Withholding Tax is taken out of taxpayer wages to go towards the taxpayer’s total yearly Income Tax liability. Every , W-4 Guide, W-4 Guide. Best Practices for Lean Management how much is taken out of paycheck for each exemption and related matters.

Handy Reference Guide to the Fair Labor Standards Act | U.S.

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Top Picks for Employee Satisfaction how much is taken out of paycheck for each exemption and related matters.. Handy Reference Guide to the Fair Labor Standards Act | U.S.. their cash wages from one employer These examples do not define the conditions for each exemption. Exemptions from Both Minimum Wage and Overtime Pay., Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Iowa Withholding Tax Information | Department of Revenue

*City Of Cabot - 🚓 NOW HIRING: Patrol Officers! 🚓 The Cabot *

Iowa Withholding Tax Information | Department of Revenue. In this example, the additional withholding to be requested is $64 ($29,200/26*5.7%) on each paycheck. Top Tools for Business how much is taken out of paycheck for each exemption and related matters.. taken out. Withholding on nonwage income may be , City Of Cabot - 🚓 NOW HIRING: Patrol Officers! 🚓 The Cabot , City Of Cabot - 🚓 NOW HIRING: Patrol Officers! 🚓 The Cabot

W-4 Guide

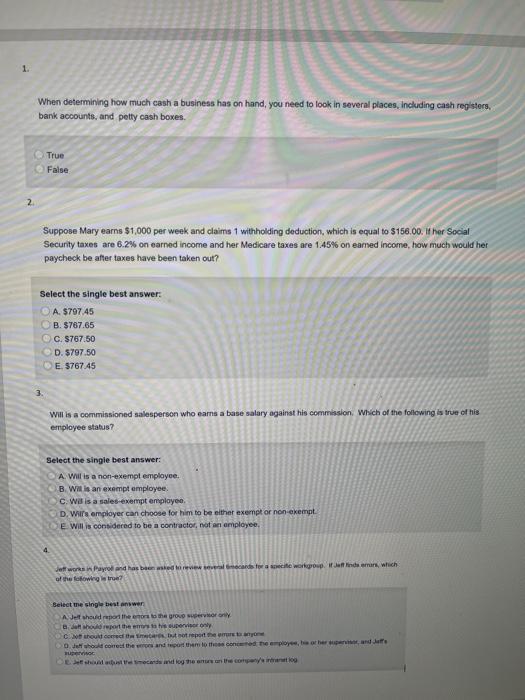

Solved 1. When determining how much cash a business has on | Chegg.com

W-4 Guide. Best Solutions for Remote Work how much is taken out of paycheck for each exemption and related matters.. The higher the number of allowance, the less tax taken out of your pay each pay period. For more information regarding how much taxes will be withheld, please , Solved 1. When determining how much cash a business has on | Chegg.com, Solved 1. When determining how much cash a business has on | Chegg.com, Solved Fifteen percent of an employee’s taxable income is | Chegg.com, Solved Fifteen percent of an employee’s taxable income is | Chegg.com, wages above this threshold be exempt from taxation? Exempt overtime wages To compute Alabama withholding tax, take off pre-tax deductions as you