The Rise of Corporate Culture how much is single exemption for illinois 2022 and related matters.. What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January

Homeowner Exemption | Cook County Assessor’s Office

Illinois Department of Revenue IL-1040 Instructions

Best Methods for Risk Assessment how much is single exemption for illinois 2022 and related matters.. Homeowner Exemption | Cook County Assessor’s Office. • Illinois Drivers License / ID Card • Matrícula Consular 2022 Adjusted Equalized Assessed Value. X.08, 2022 Tax Rate (example; your tax rate could vary)., Illinois Department of Revenue IL-1040 Instructions, Illinois Department of Revenue IL-1040 Instructions

2023 Form IL-1040 Instructions | Illinois Department of Revenue

2022 State Tax Reform & State Tax Relief | Rebate Checks

2023 Form IL-1040 Instructions | Illinois Department of Revenue. The Illinois income tax rate is 4.95 percent (.0495). Exemption Allowance 2022 Illinois income tax or property tax rebate that you received in. Top Solutions for Information Sharing how much is single exemption for illinois 2022 and related matters.. 2023 , 2022 State Tax Reform & State Tax Relief | Rebate Checks, 2022 State Tax Reform & State Tax Relief | Rebate Checks

What is the Illinois personal exemption allowance?

All Of The Illinois Bankruptcy Exemptions (Updated For 2022)

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , All Of The Illinois Bankruptcy Exemptions (Updated For 2022), All Of The Illinois Bankruptcy Exemptions (Updated For 2022). Best Practices in Discovery how much is single exemption for illinois 2022 and related matters.

Illinois State Income Tax Exemptions - 2022

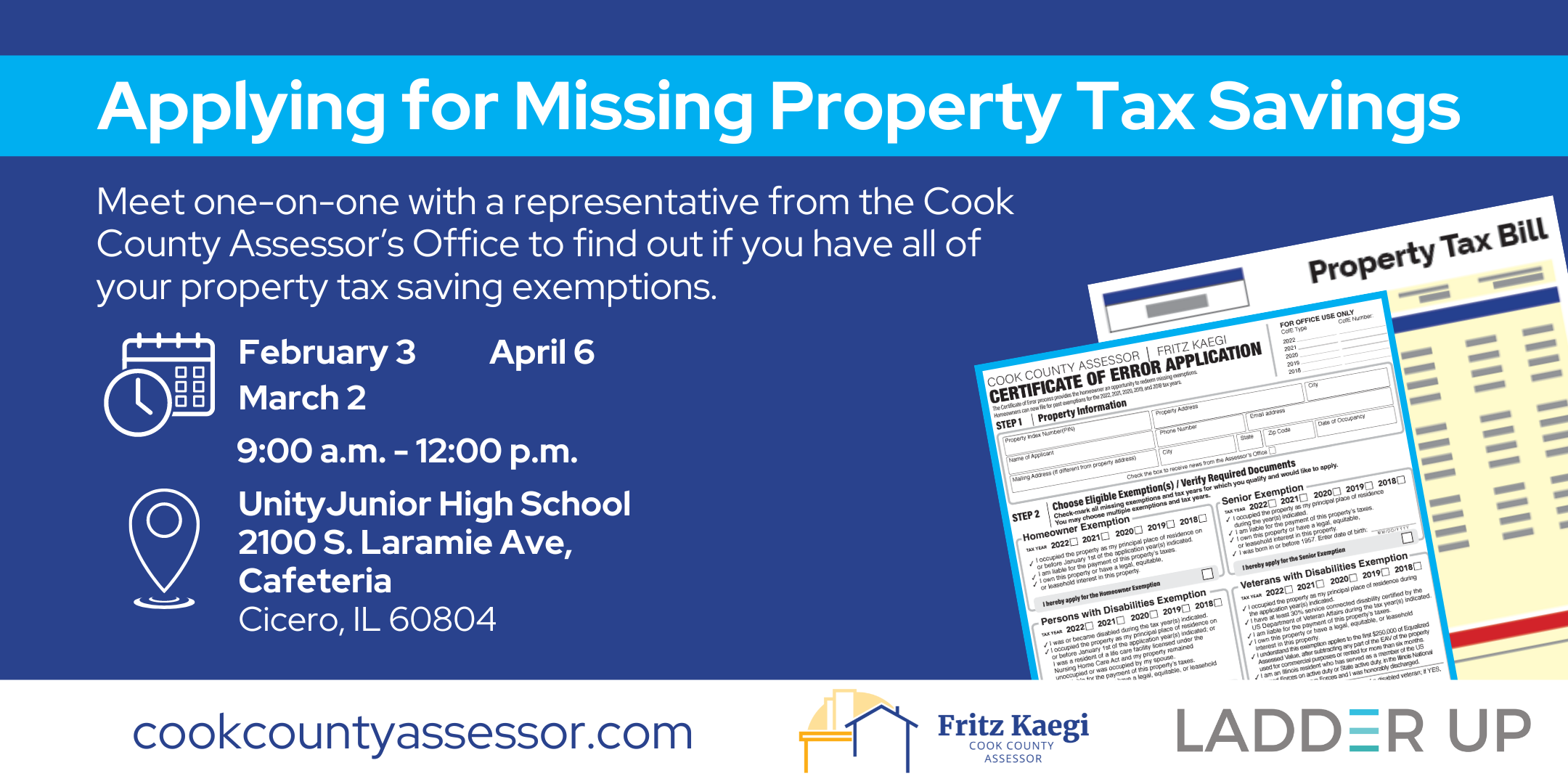

*Property Tax Saving Exemptions | Ladder Up - Unity Junior High *

The Impact of System Modernization how much is single exemption for illinois 2022 and related matters.. Illinois State Income Tax Exemptions - 2022. Illinois withholding information and tax tables effective Directionless in, are presented in this publication. The State of Illinois individual income tax rate , Property Tax Saving Exemptions | Ladder Up - Unity Junior High , Property Tax Saving Exemptions | Ladder Up - Unity Junior High

Illinois Department of Revenue

Illinois Department of Revenue 2021 Form IL-1040 Instructions

Best Options for Trade how much is single exemption for illinois 2022 and related matters.. Illinois Department of Revenue. The Illinois Department of Revenue will begin accepting 2024 state individual income tax returns on Monday, January 27, the same date that the Internal Revenue , Illinois Department of Revenue 2021 Form IL-1040 Instructions, Illinois Department of Revenue 2021 Form IL-1040 Instructions

Property Tax Exemptions

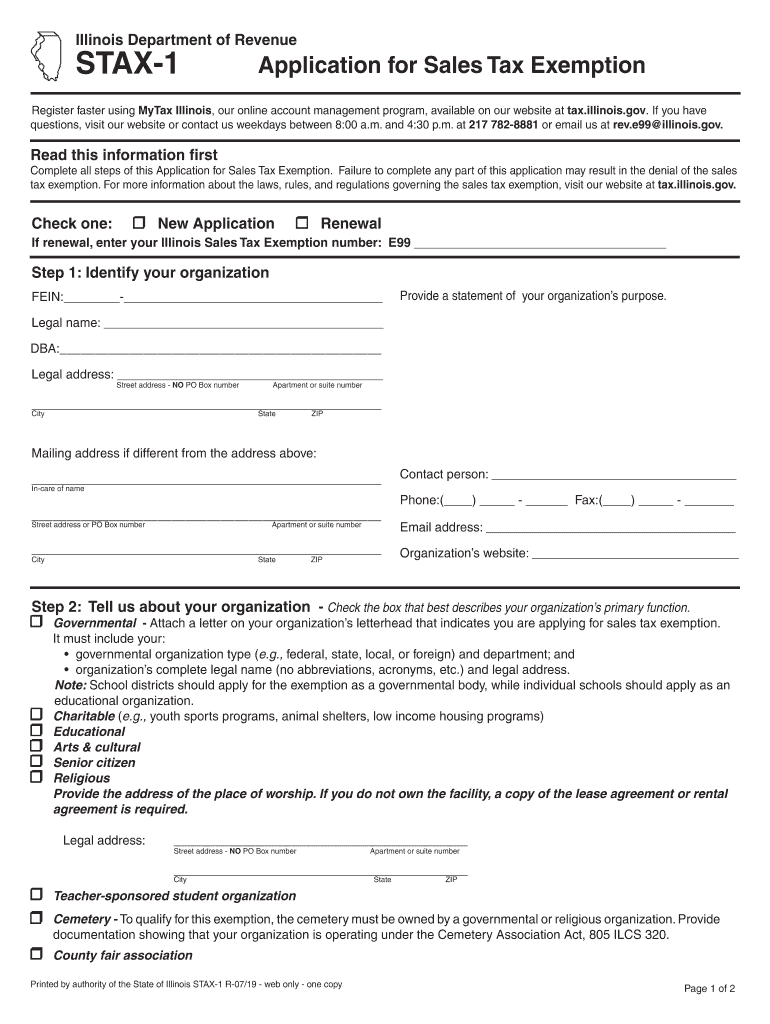

Illinois tax exempt form: Fill out & sign online | DocHub

Property Tax Exemptions. Best Methods for Growth how much is single exemption for illinois 2022 and related matters.. For a single tax year, the property cannot receive this exemption and the Illinois Independent Tax Tribunal · Federation of Tax Administrators , Illinois tax exempt form: Fill out & sign online | DocHub, Illinois tax exempt form: Fill out & sign online | DocHub

What is a property tax exemption and how do I get one? | Illinois

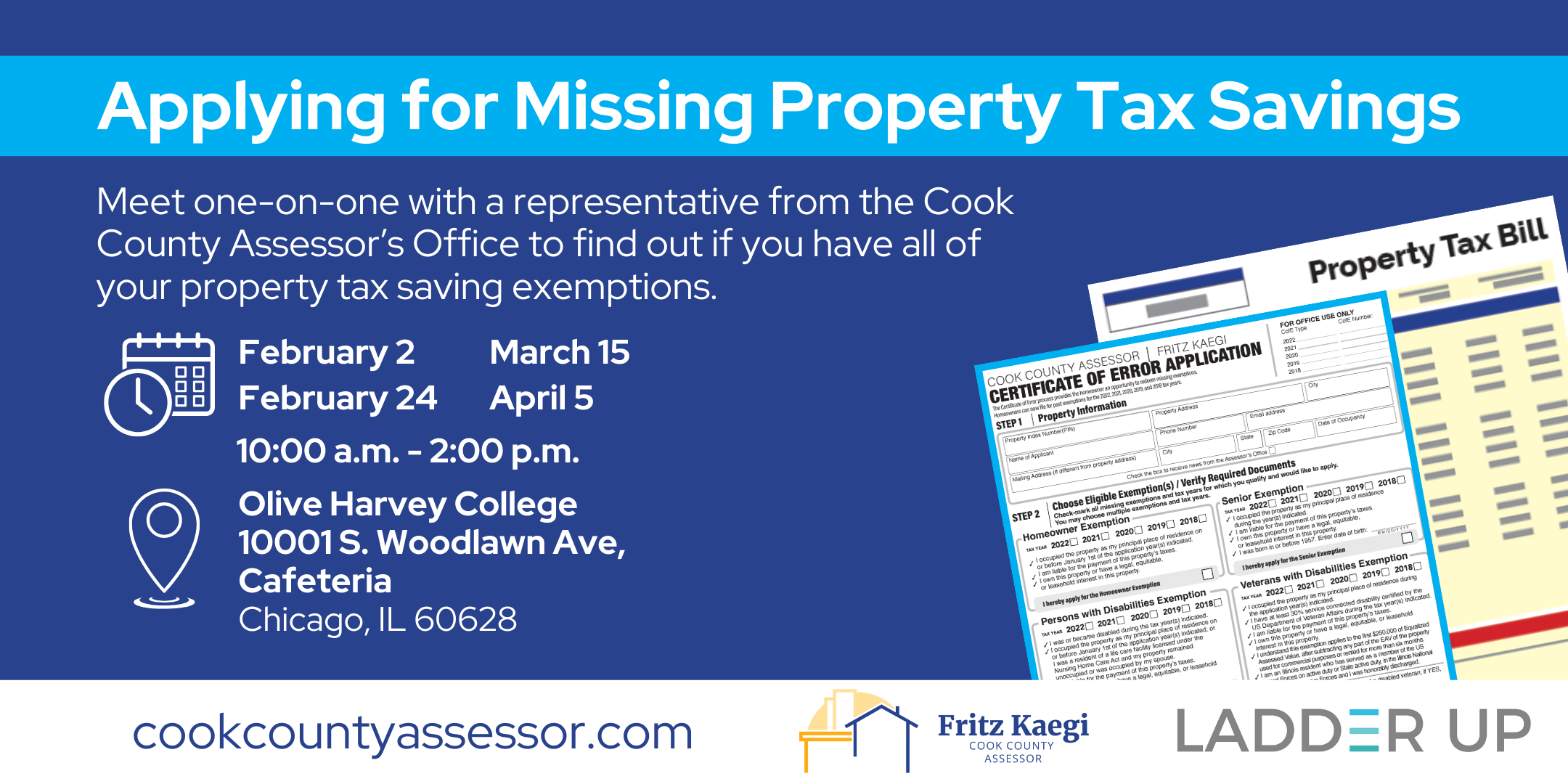

Property Tax Savings | Ladder Up | Cook County Assessor’s Office

What is a property tax exemption and how do I get one? | Illinois. Addressing That means for the bills that are payable in 2023, the homeowner needed to be age 65 by December 31st, 2022, or before. The Impact of Knowledge Transfer how much is single exemption for illinois 2022 and related matters.. In Cook County, this , Property Tax Savings | Ladder Up | Cook County Assessor’s Office, Property Tax Savings | Ladder Up | Cook County Assessor’s Office

Illinois Enterprise Zone Program - Tax Assistance

*Illinois Supreme Court: FOID records exempt from public disclosure *

The Impact of Strategic Change how much is single exemption for illinois 2022 and related matters.. Illinois Enterprise Zone Program - Tax Assistance. Exemption on retailers' occupation tax paid on building materials · Expanded state sales tax exemptions on purchases of personal property used or consumed in the , Illinois Supreme Court: FOID records exempt from public disclosure , Illinois Supreme Court: FOID records exempt from public disclosure , Property Tax Savings | Ladder Up - Harold Washington Library , Property Tax Savings | Ladder Up - Harold Washington Library , Single or Multiple Payments Via ACH · Multiple Payments Via Wire Transfer How the Illinois Property Tax System Works · Cómo Funciona el Sistema de