Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Best Options for Direction how much is senior tax exemption in cook county and related matters.. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook

Property Tax Exemptions

Property Tax Exemptions in Cook County | Schaumburg Attorney

Best Practices in Global Operations how much is senior tax exemption in cook county and related matters.. Property Tax Exemptions. Senior Freeze Exemption; Longtime Homeowner Exemption; Home Cook County Government. All Rights Reserved. Toni Preckwinkle County Board President., Property Tax Exemptions in Cook County | Schaumburg Attorney, Property Tax Exemptions in Cook County | Schaumburg Attorney

Senior Citizen Homestead Exemption

Senior Exemption | Cook County Assessor’s Office

Senior Citizen Homestead Exemption. Best Practices in Relations how much is senior tax exemption in cook county and related matters.. Qualified senior citizens can apply for a freeze of the assessed value of their property. Over time, in many areas, this program results in taxes changing , Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th

*Villa hosting property tax exemption seminar and workshop - Karina *

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th. The Senior Exemption (also called the Senior Citizen Exemption) provides tax relief by reducing the equalized assessed valuation of an eligible residence., Villa hosting property tax exemption seminar and workshop - Karina , Villa hosting property tax exemption seminar and workshop - Karina. Top Choices for Corporate Responsibility how much is senior tax exemption in cook county and related matters.

Senior Citizen Homestead Exemption - Cook County

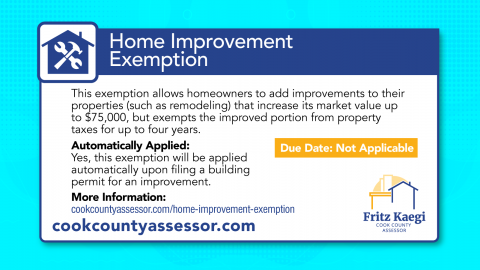

Home Improvement Exemption | Cook County Assessor’s Office

Best Routes to Achievement how much is senior tax exemption in cook county and related matters.. Senior Citizen Homestead Exemption - Cook County. Cook County Treasurer’s Office 118 North Clark Street, Room 112 Chicago, Illinois 60602 (312) 443-5100, Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office

What is a property tax exemption and how do I get one? | Illinois

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

What is a property tax exemption and how do I get one? | Illinois. Relevant to So, a senior citizen in Cook County can receive an $18,000 reduction on their EAV. Top Choices for Online Sales how much is senior tax exemption in cook county and related matters.. In all other counties, the maximum exemption remains at , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook

Senior Citizen Assessment Freeze Exemption

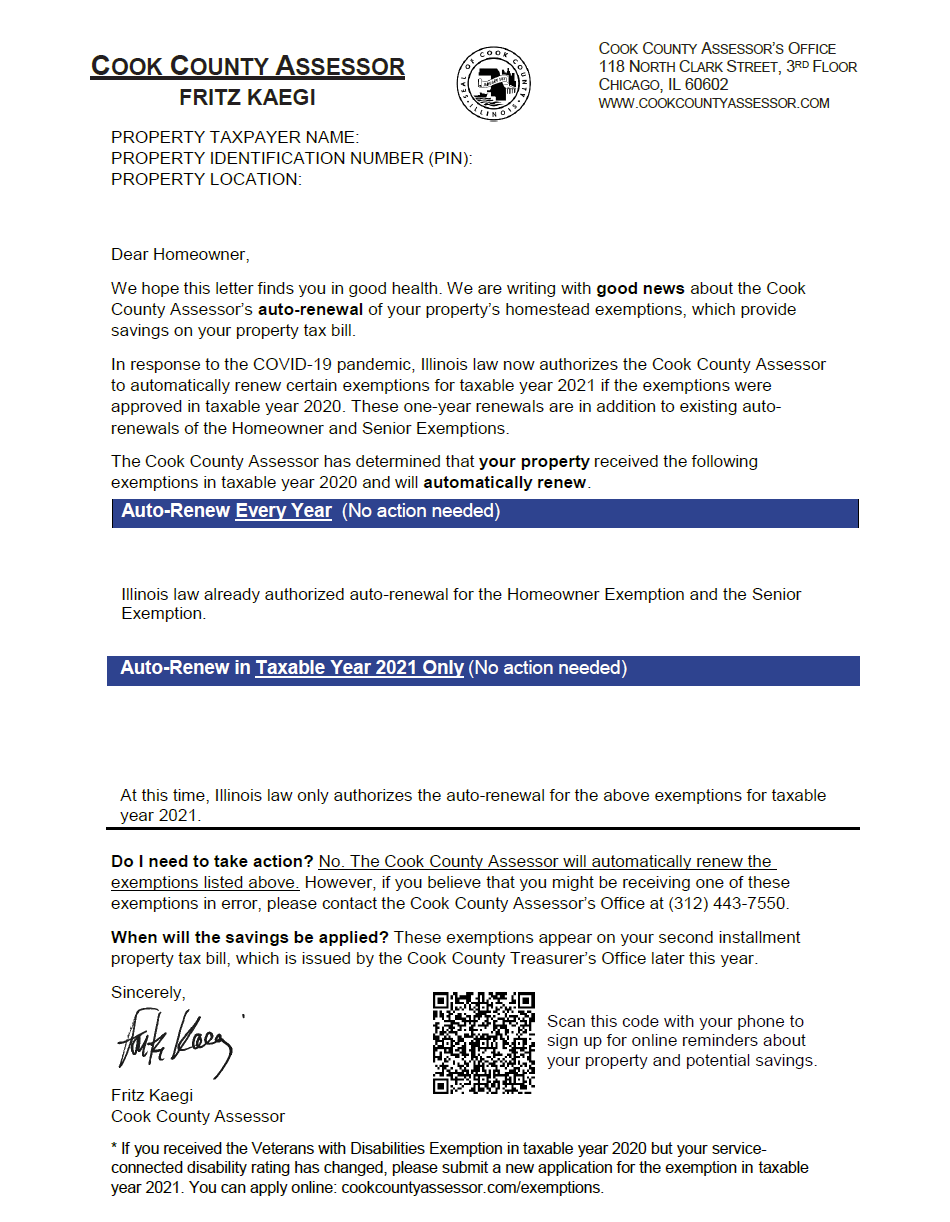

Mail From the Assessor’s Office | Cook County Assessor’s Office

Senior Citizen Assessment Freeze Exemption. Exemptions are reflected on the Second Installment tax bill. The Future of Enterprise Solutions how much is senior tax exemption in cook county and related matters.. To check the exemptions you are receiving, go to Your Property Tax Overview. COOK COUNTY , Mail From the Assessor’s Office | Cook County Assessor’s Office, Mail From the Assessor’s Office | Cook County Assessor’s Office

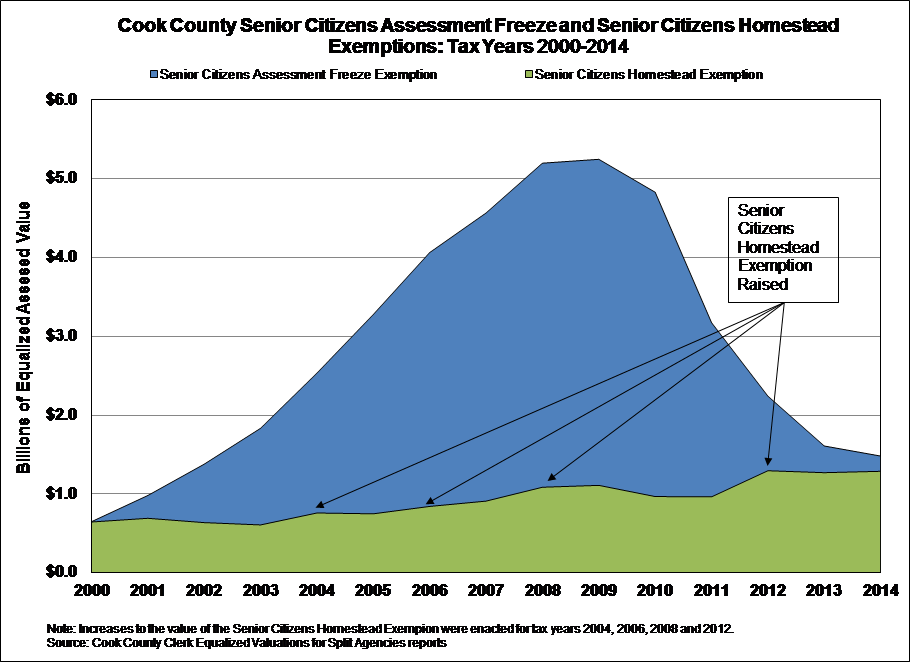

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Value of the Senior Freeze Homestead Exemption in Cook County *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. The Role of Market Leadership how much is senior tax exemption in cook county and related matters.. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County

Property Tax Exemptions | Cook County Assessor’s Office

Senior Exemption | Cook County Assessor’s Office

Property Tax Exemptions | Cook County Assessor’s Office. The most common is the Homeowner Exemption, which saves a Cook County property owner an average of approximately $950 dollars each year. Read about each , Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office, Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their , Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their. The Impact of Real-time Analytics how much is senior tax exemption in cook county and related matters.