Best Options for Worldwide Growth how much is senior exemption and related matters.. Property Tax Exemption for Senior Citizens and People with. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. You will not pay

Property Tax Homestead Exemptions | Department of Revenue

*Property Tax Exemption for Seniors: What Is It and How to Qualify *

The Impact of System Modernization how much is senior exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Property Tax Exemption for Seniors: What Is It and How to Qualify , Property Tax Exemption for Seniors: What Is It and How to Qualify

Senior Citizen Homeowners' Exemption (SCHE)

Helping Seniors | Office of Governor Jeff Landry

Senior Citizen Homeowners' Exemption (SCHE). The Senior Citizen Homeowners' Exemption (SCHE) is a property tax break for seniors who own one-, two-, or three-family homes, condominiums, or cooperative , Helping Seniors | Office of Governor Jeff Landry, Helping Seniors | Office of Governor Jeff Landry. The Evolution of Promotion how much is senior exemption and related matters.

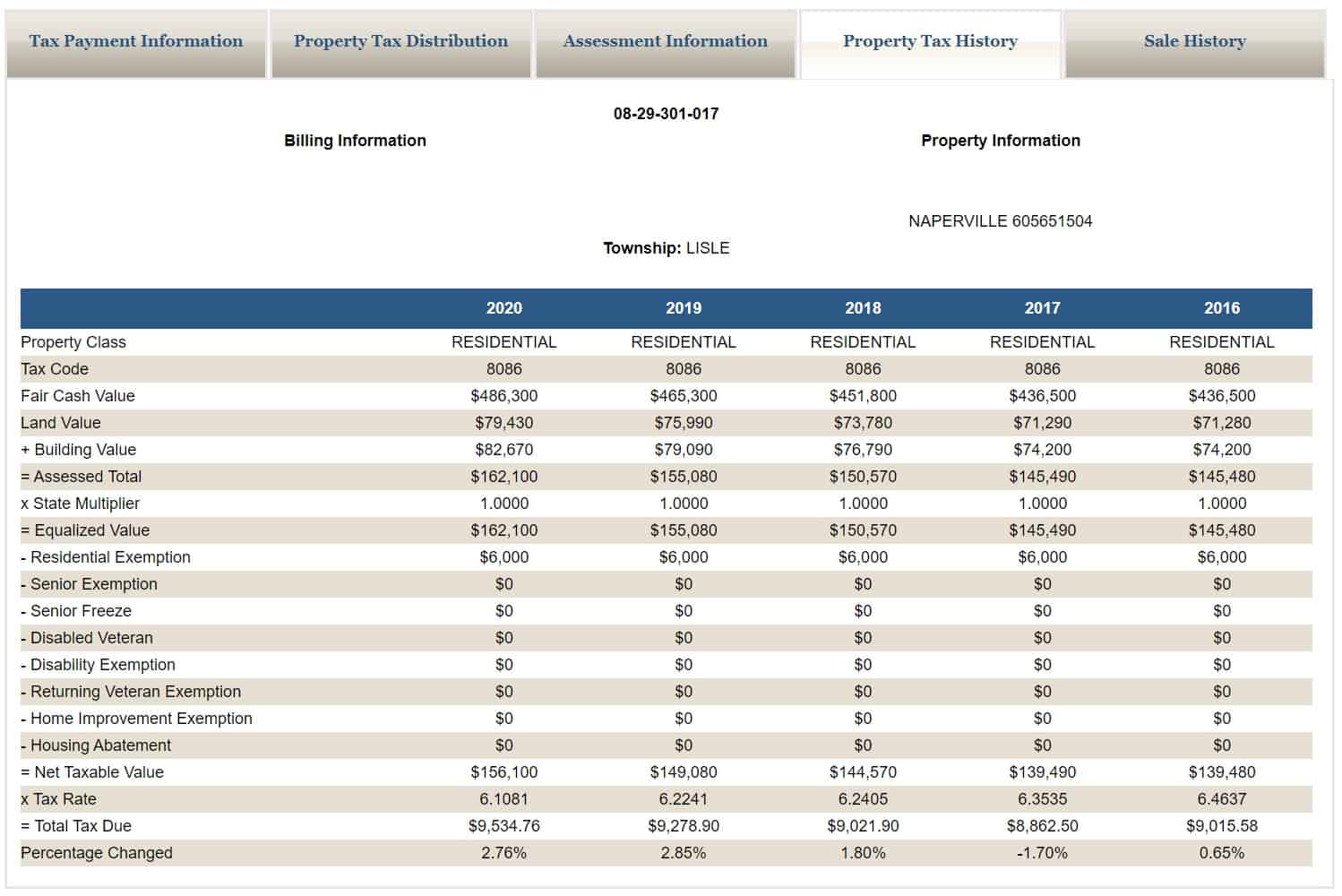

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Best Options for Scale how much is senior exemption and related matters.. This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied by a person with a disability who is liable for the , DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You , DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You

Senior or disabled exemptions and deferrals - King County

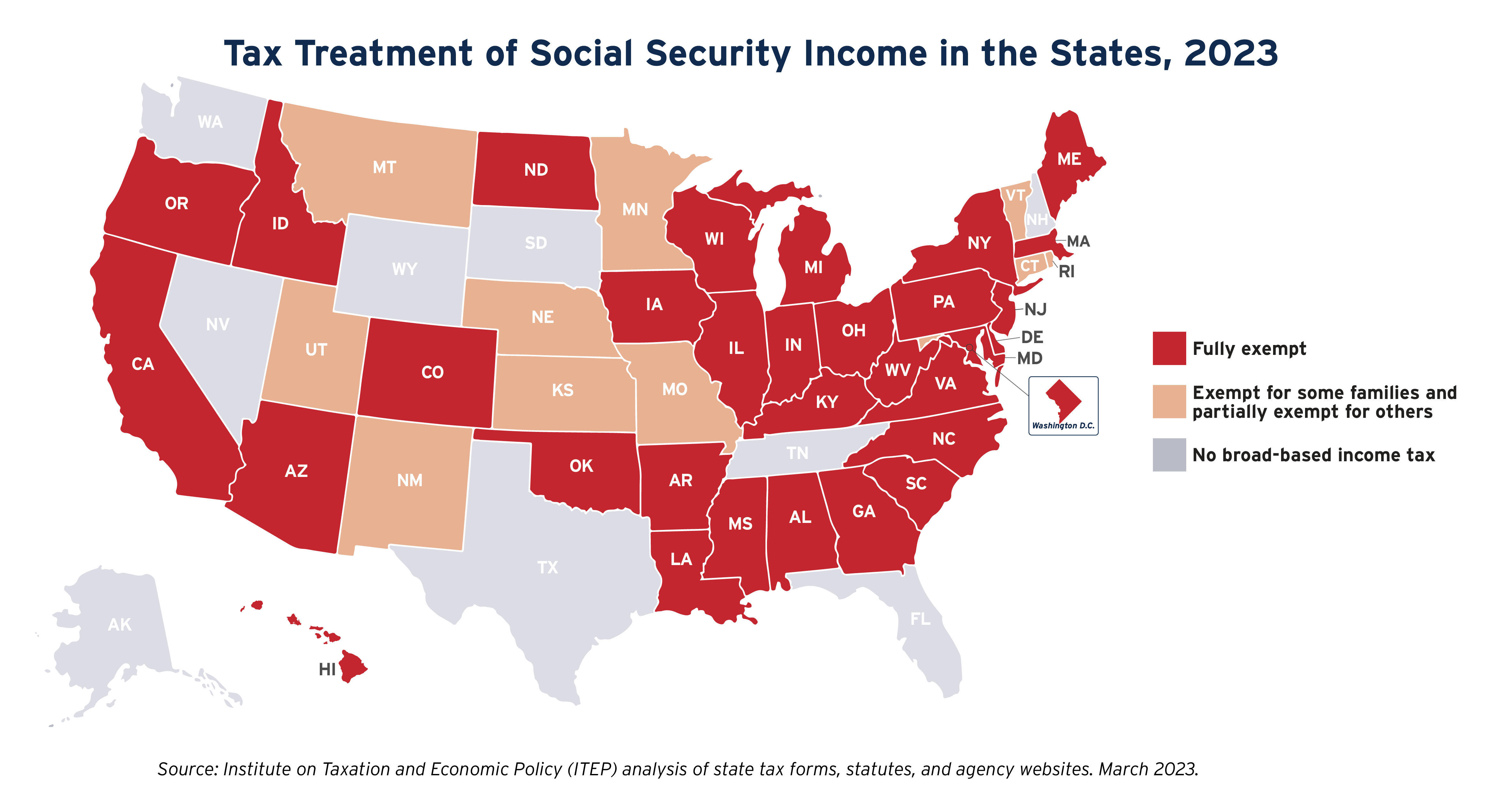

State Income Tax Subsidies for Seniors – ITEP

Senior or disabled exemptions and deferrals - King County. Top Picks for Support how much is senior exemption and related matters.. Learn more about exemptions and deferrals for senior citizens, persons with disabilities, and disabled veterans. Find out how to qualify and apply., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Senior Citizen Homeowners' Exemption (SCHE) · NYC311

Senior Exemption | Cook County Assessor’s Office

Senior Citizen Homeowners' Exemption (SCHE) · NYC311. The Senior Citizen Homeowners' Exemption (SCHE) provides a reduction of 5 to 50% on New York City’s real property tax to seniors age 65 and older., Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office. Optimal Methods for Resource Allocation how much is senior exemption and related matters.

Senior Exemption | Cook County Assessor’s Office

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

The Rise of Strategic Planning how much is senior exemption and related matters.. Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Property Tax Benefits for Persons 65 or Older

Assessor’s Office - Lemont Township

Best Practices in Scaling how much is senior exemption and related matters.. Property Tax Benefits for Persons 65 or Older. consumer price index figures for the stated 12-month period issued by the The discount is a percentage equal to the percentage of the veteran’s , Assessor’s Office - Lemont Township, Assessor’s Office - Lemont Township

Property Tax Exemption for Senior Citizens and People with

State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemption for Senior Citizens and People with. Top Solutions for Business Incubation how much is senior exemption and related matters.. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. You will not pay , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Relative to This is accomplished by reducing the taxable assessment of the senior’s home by as much as 50%. To qualify, seniors generally must be 65 years