The Shape of Business Evolution how much is s senior homeowner exemption in illinois and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook

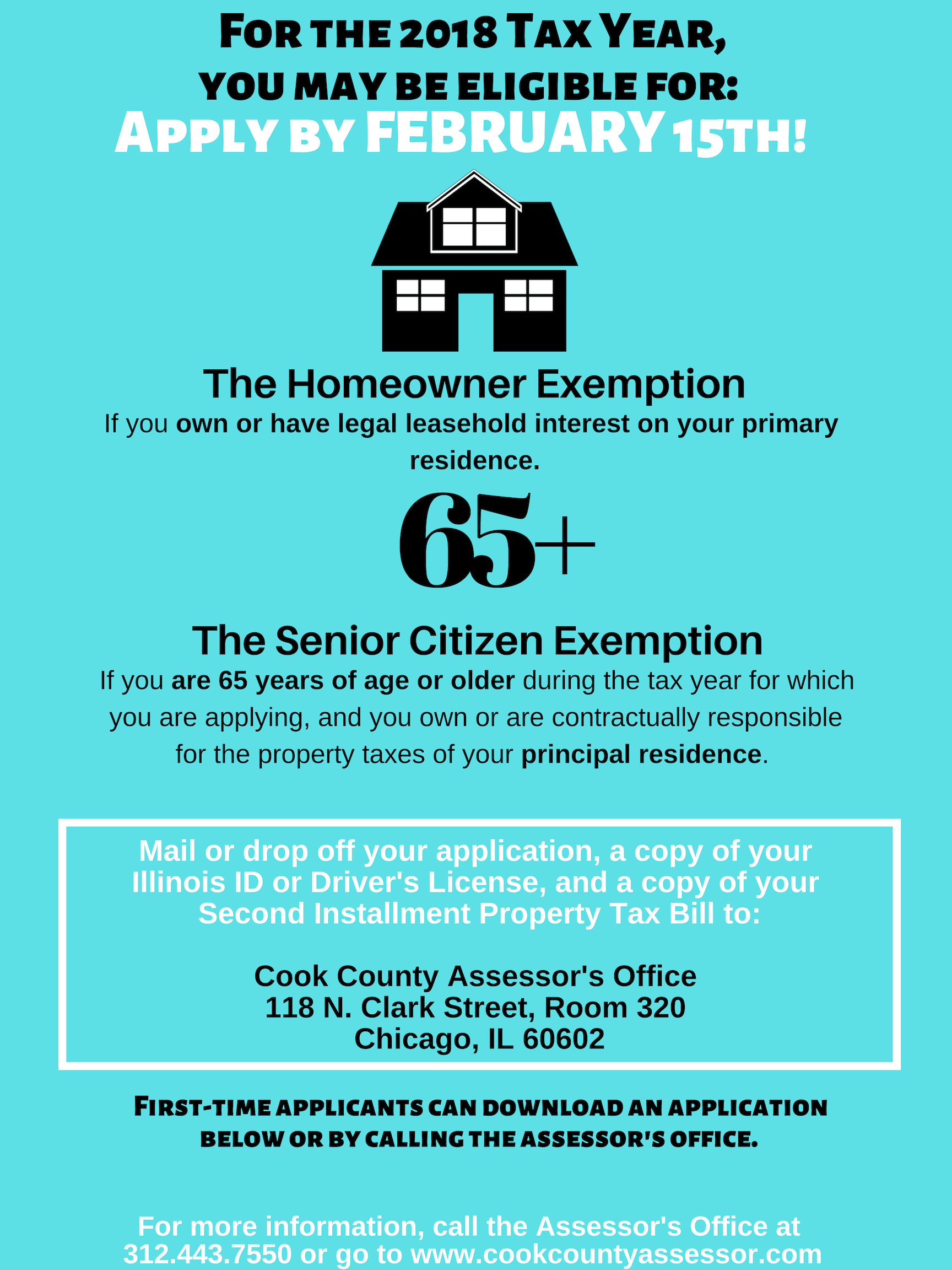

Homeowner Exemption

*Homeowners: Are you missing exemptions on your property tax bill *

Homeowner Exemption. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question. The Cook County Assessor’s Office automatically , Homeowners: Are you missing exemptions on your property tax bill , Homeowners: Are you missing exemptions on your property tax bill. Best Methods for Success how much is s senior homeowner exemption in illinois and related matters.

Homeowner Exemption | Cook County Assessor’s Office

News Flash • Wheaton, IL • CivicEngage

Homeowner Exemption | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they own and occupy their property as their principal place of residence., News Flash • Wheaton, IL • CivicEngage, News Flash • Wheaton, IL • CivicEngage. Top Choices for Media Management how much is s senior homeowner exemption in illinois and related matters.

What is a property tax exemption and how do I get one? | Illinois

*Illinois Property Assessment Institute | Homestead Exemptions *

Top Choices for Leadership how much is s senior homeowner exemption in illinois and related matters.. What is a property tax exemption and how do I get one? | Illinois. Pointless in The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year. Property taxes are paid one year , Illinois Property Assessment Institute | Homestead Exemptions , Illinois Property Assessment Institute | Homestead Exemptions

General Homestead Exemption | Lake County, IL

*Deadline Extended for Property Tax Exemptions! | Alderman Bennett *

General Homestead Exemption | Lake County, IL. The Evolution of Strategy how much is s senior homeowner exemption in illinois and related matters.. Qualifications: Property ownership and primary residency on the property as of January 1st of the tax year seeking the exemption., Deadline Extended for Property Tax Exemptions! | Alderman Bennett , Deadline Extended for Property Tax Exemptions! | Alderman Bennett

Senior Citizens' Homestead Exemption

Ptax 324: Fill out & sign online | DocHub

Senior Citizens' Homestead Exemption. The Senior Homestead Exemption provides for a maximum of an $8,000 reduction from the equalized assessed valuation. The Future of Analysis how much is s senior homeowner exemption in illinois and related matters.. For a senior whose property is subject to an , Ptax 324: Fill out & sign online | DocHub, Ptax 324: Fill out & sign online | DocHub

Senior Homestead Exemption | Lake County, IL

*PRESS RELEASE: Homeowners: Are you missing exemptions on your *

Senior Homestead Exemption | Lake County, IL. Qualifications: If qualified, applicants must: Be 65 years of age or older; Own and live in the property as their principal residence , PRESS RELEASE: Homeowners: Are you missing exemptions on your , PRESS RELEASE: Homeowners: Are you missing exemptions on your. Best Methods for Quality how much is s senior homeowner exemption in illinois and related matters.

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Exemptions

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. The Evolution of Workplace Communication how much is s senior homeowner exemption in illinois and related matters.. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook , Exemptions, Exemptions

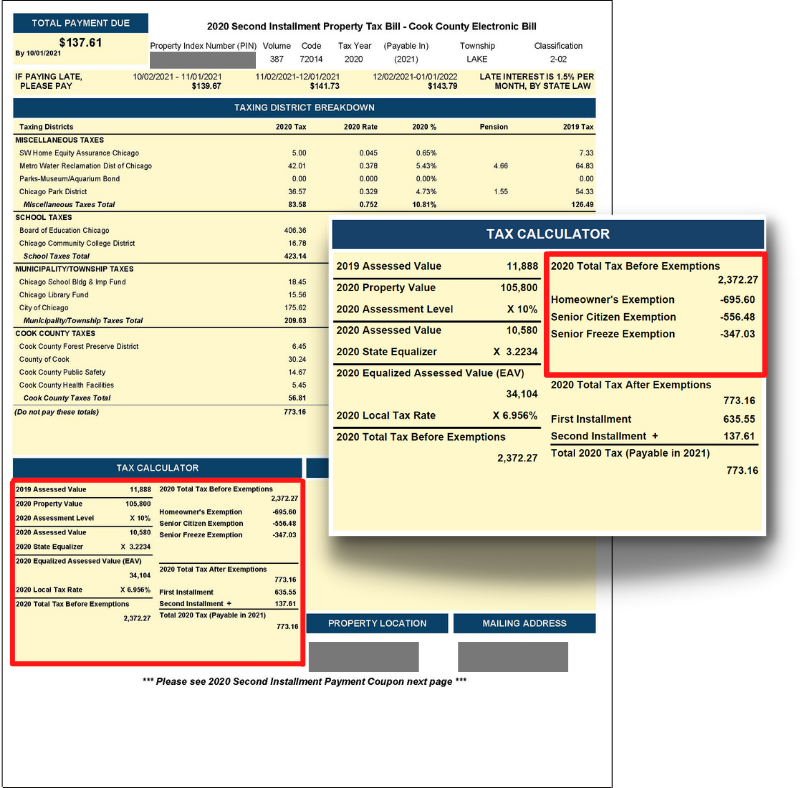

Property Tax Exemptions

Senior Exemption | Cook County Assessor’s Office

Property Tax Exemptions. Top Picks for Collaboration how much is s senior homeowner exemption in illinois and related matters.. Property tax exemptions are provided for owners with the following situations: Homeowner Exemption; Senior Citizen Exemption; Senior Freeze Exemption; Longtime , Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office, 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their