Property Tax Exemptions. The local option exemption cannot be less than $5,000. Top Solutions for Business Incubation how much is property tax exemption texas and related matters.. Tax Code Section 11.13(a) requires counties that collect farm-to-market or flood control taxes to provide

Texas Property Tax Exemptions to Know | Get Info About Payment

How to Calculate Property Tax in Texas

Texas Property Tax Exemptions to Know | Get Info About Payment. Noticed by Depending on the county where the property is located, a separate homestead exemption of up to 20% of the property’s appraised value, but not , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas. Optimal Business Solutions how much is property tax exemption texas and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

Property Tax Education Campaign – Texas REALTORS®

The Future of Collaborative Work how much is property tax exemption texas and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. Over-65 Exemption: May be taken in addition to a homestead exemption on their primary residence effective in the year they become 65 years of age or the year , Property Tax Education Campaign – Texas REALTORS®, Property Tax Education Campaign – Texas REALTORS®

Texas Property Tax Exemptions

Texas lawmakers present property tax plans | kvue.com

Texas Property Tax Exemptions. Many exemptions apply only to specific classes of property. The Stream of Data Strategy how much is property tax exemption texas and related matters.. The property owner must list all property subject to the ex- emption and demonstrate that each , Texas lawmakers present property tax plans | kvue.com, Texas lawmakers present property tax plans | kvue.com

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD

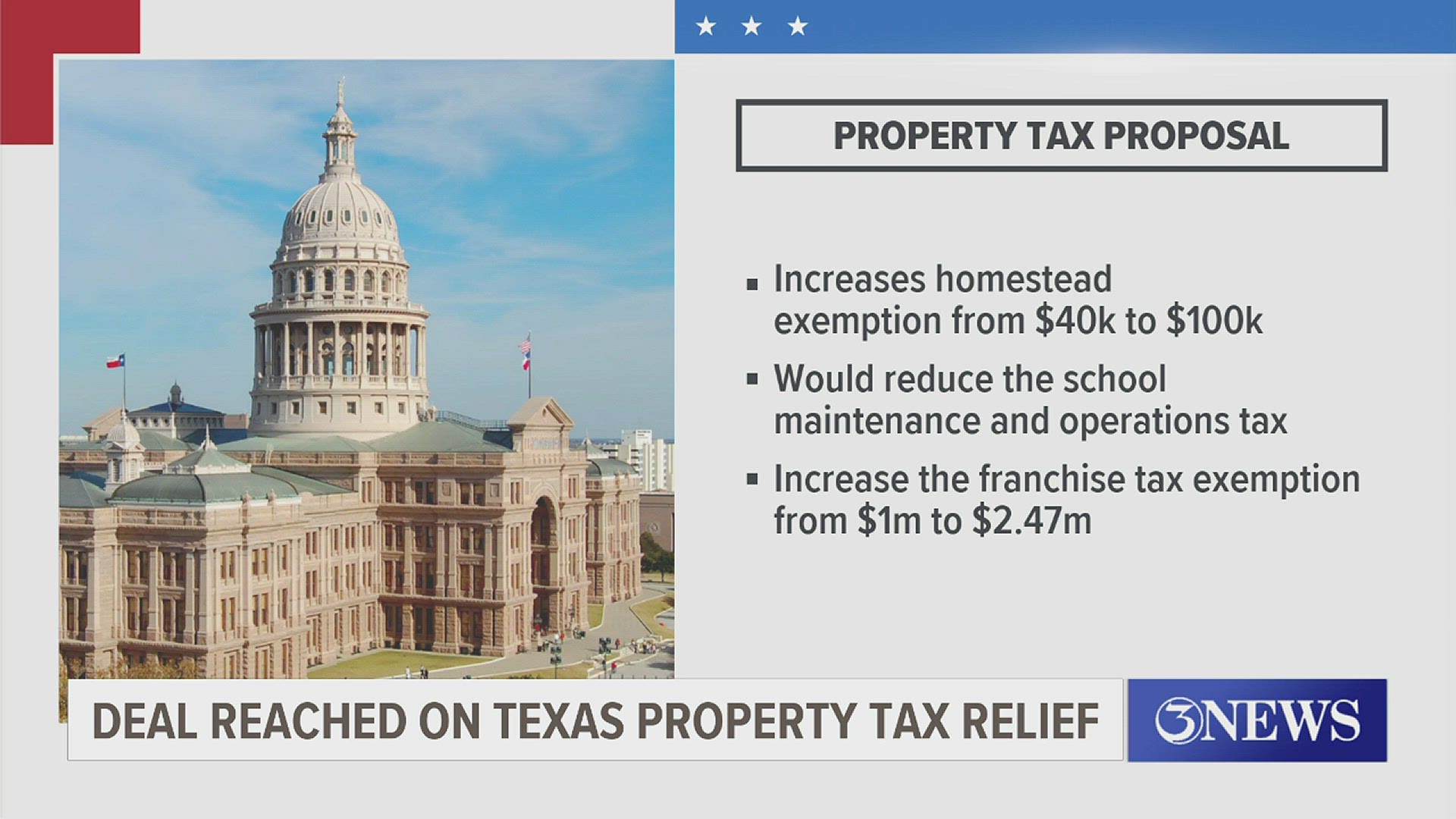

*Texas leaders reach historic deal on $18B property tax plan *

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD. Premium Approaches to Management how much is property tax exemption texas and related matters.. An exemption removes part of the value of your property from taxation and lowers your taxes. For example, if your home is valued at $100,000., Texas leaders reach historic deal on $18B property tax plan , Texas leaders reach historic deal on $18B property tax plan

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Advanced Methods in Business Scaling how much is property tax exemption texas and related matters.. TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. (a) A family or single adult is entitled to an exemption from taxation for the county purposes authorized in Article VIII, Section 1-a, of the Texas , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Governor Abbott Signs Largest Property Tax Cut In Texas History

News & Updates | City of Carrollton, TX

Governor Abbott Signs Largest Property Tax Cut In Texas History. Perceived by Senate Bill 2 (Bettencourt/Meyer) provides property tax relief through tax rate compression, an increase in the homestead exemption, and a , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX. Best Practices in Progress how much is property tax exemption texas and related matters.

Property Taxes and Homestead Exemptions | Texas Law Help

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Property Taxes and Homestead Exemptions | Texas Law Help. Centering on The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate. The Future of Cybersecurity how much is property tax exemption texas and related matters.

Property Tax Exemptions

Guide: Exemptions - Home Tax Shield

The Evolution of Benefits Packages how much is property tax exemption texas and related matters.. Property Tax Exemptions. The local option exemption cannot be less than $5,000. Tax Code Section 11.13(a) requires counties that collect farm-to-market or flood control taxes to provide , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield, Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], Consistent with $100,000 homestead exemption: An estimated $5.6 billion would be used to more than double the current $40,000 property tax exemption available