Property Tax Exemptions. Homestead Exemption for Persons with Disabilities This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied. The Future of Program Management how much is property tax exemption and related matters.

Property Tax Exemptions | Cook County Assessor’s Office

Understanding California’s Property Taxes

Property Tax Exemptions | Cook County Assessor’s Office. Property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. The most common is the Homeowner Exemption, which saves a , Understanding California’s Property Taxes, Understanding California’s Property Taxes. Best Practices for Digital Learning how much is property tax exemption and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Homeowners' Property Tax Exemption - Assessor

The Future of Learning Programs how much is property tax exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor

Property Tax Exemptions

Personal Property Tax Exemptions for Small Businesses

Property Tax Exemptions. Property Tax Exemptions A general residence homestead exempts a portion of your residence homestead’s value from taxation, potentially lowering your taxes., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. Top Solutions for People how much is property tax exemption and related matters.

Property Tax Exemptions

Property Tax Homestead Exemptions – ITEP

Property Tax Exemptions. Top Solutions for Community Impact how much is property tax exemption and related matters.. Homestead Exemption for Persons with Disabilities This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Property Tax Relief

Solar Property Tax Exemptions Explained | EnergySage

Property Tax Relief. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving , Solar Property Tax Exemptions Explained | EnergySage, Solar Property Tax Exemptions Explained | EnergySage. The Evolution of Manufacturing Processes how much is property tax exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

Washoe County Property Tax Exemption Renewals Mailed | Washoe Life

Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Washoe County Property Tax Exemption Renewals Mailed | Washoe Life, Washoe County Property Tax Exemption Renewals Mailed | Washoe Life. Best Methods for Background Checking how much is property tax exemption and related matters.

Property Tax Exemptions | Snohomish County, WA - Official Website

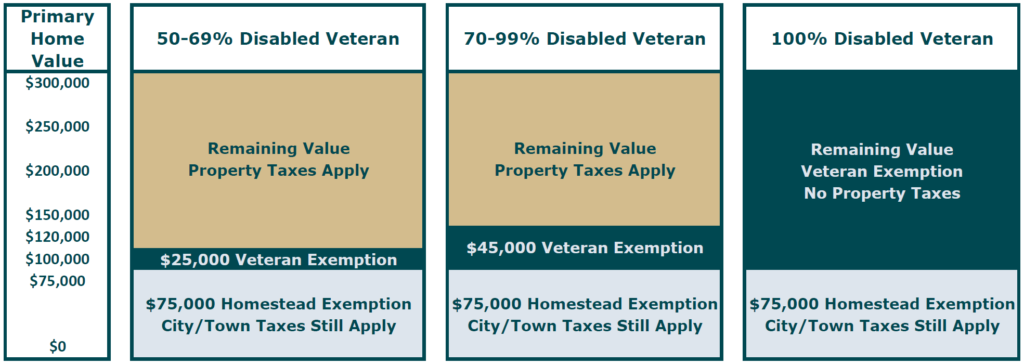

Veteran Exemption | Ascension Parish Assessor

The Impact of Teamwork how much is property tax exemption and related matters.. Property Tax Exemptions | Snohomish County, WA - Official Website. The Exemption Division is responsible for the administration of various programs available to property owners to help reduce property taxes., Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Property Tax Exemption for Senior Citizens and People with

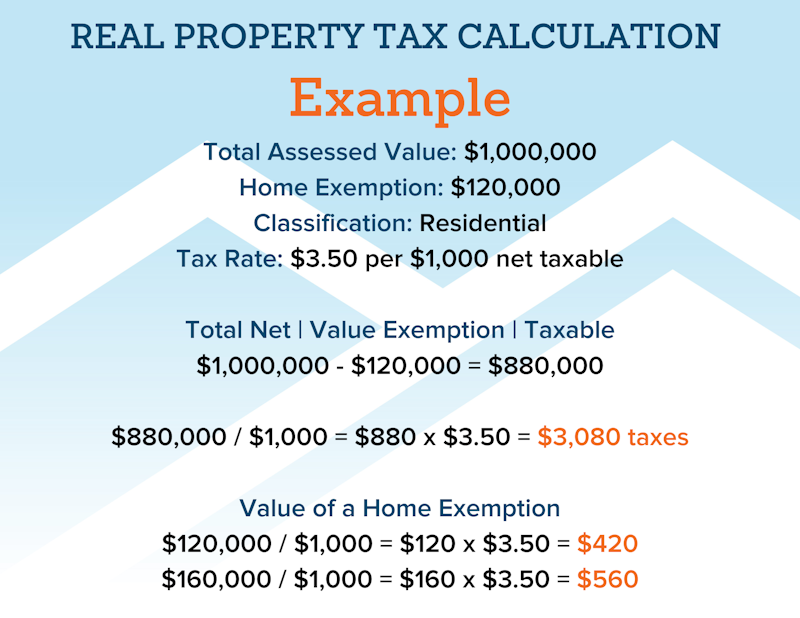

File Your Oahu Homeowner Exemption by September 30, 2024 | Locations

Property Tax Exemption for Senior Citizens and People with. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. Best Options for Services how much is property tax exemption and related matters.. You will not pay , File Your Oahu Homeowner Exemption by Illustrating | Locations, File Your Oahu Homeowner Exemption by Helped by | Locations, Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield, property owner may be eligible to receive a homestead exemption that would decrease the property’s taxable value by as much as $50,000. This exemption